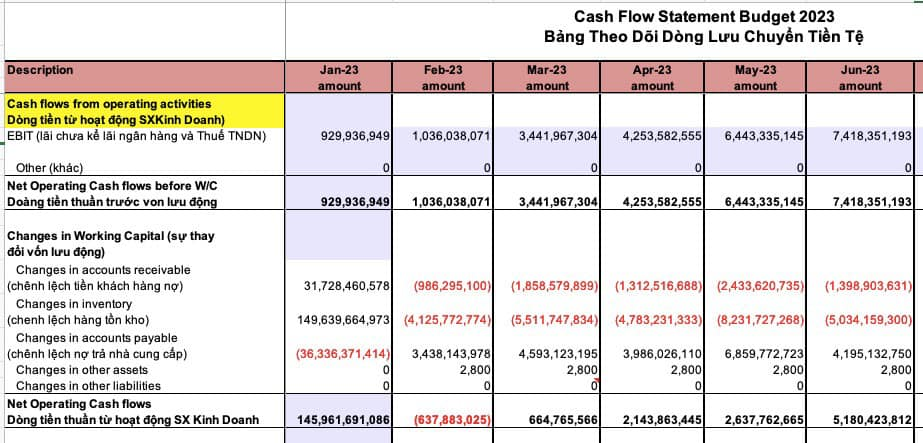

Below is the third report – Cashflow Statement describing the cash flow of a company with assets > 450 billion.

With profits made on average sales of 20 billion -> EBITDA ~ 4.64%; EBITDA <<< is much smaller than companies 1/10 the size of this FFP100 company but have EBITDA 5-6 times larger.

But when he opened the account, the president had a sum of money up to 145,961,691,086 VND.

(~146 billion)

What will the president do when he opens the account and sees the amount of money?

a) Buy a Lamborghini for 25 billion

b) Buy 2-3 houses in the Vinhome OCP project?

c) Send your child to study abroad at the top school IVY Leauge?

But where does this money actually come from? It comes from the 3 activities below:

Looking at 01.2023:

Amounts collected from customers that have not yet been collected from customers in the previous month; now earned: 31,728,460,578 (~32 billion)

The funds from the liquidation of inventory due to the purchase of a lot of goods last month (December 2022) to welcome the Tet holiday season and the liquidation resulted in a cash flow of 149,639,664,973 VND (~150 billion)

And the money that was used by partners from last month had to mature and be paid to people (36,336,371,414) (~36 billion), because the money that was used could no longer be used, and the money was “out of the company”. up to 36 billion.

The profit made is only 929,936,949 (~929 million)

In total, we have a positive account: 145,961,691,086 VND.

(~146 billion)

But in reality, during the period they only made 929 million.

What is the risk for this company when making 3 purchases (a) Buying a Lamborghini (b) Sending children to IVY Leauge (c) Buying real estate to borrow from banks with rising interest rates?

1. Asked the accountant, the accountant said he ran out of money.

2. Interest due without payment.

3. Borrow a new loan and pay off the old one.

4. Insolvency.

5. Mobilize capital from outside using the company’s image

a) If you’re lucky, the profit margin is better than the loan interest; living company.

b) If unlucky, charge fraud to appropriate property or criminal offense.

You see, we don’t run a company through finance and accounting; All of your efforts over the past decade will go down the drain.

If we keep FOMO and use money inappropriately, without understanding the nature of the health of where our cash flow comes from, we will suffer from:

1. Confidence in society

2. Inferiority in the company because of not being able to bond with colleagues

Let the leader speak, we don’t understand anything.

3. You don’t understand because the company is not okay.

4. I am lonely because loneliness is created by myself.

The problem is, I don’t know that it’s because my finance and accounting team is too weak to analyze and forecast for me.

Business is no longer fun and menopause headaches are because of that.

If Vietnam wants to grow, the private economic sector must prove to the government that you have good money management ability so that the Big 4 banks have the basis to disburse several million billions to you so that you can do business. ; rather than blaming the government for not supporting the private SMEs sector, which accounts for 95% of the market.

It’s all because of us, isn’t it?