How is a company with over USD20mn in assets (> VND502bn) managed?

I often tell my founder friends: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is not Cashflow that you can… hold in your hand to spend.

EBITDA is not Cashflow.

When opening the third financial statement – Cashflow Statement of a company with assets of VND500bn or more, we will clearly see the financial structure according to their industry.

EBITDA/EBT (Net profit) is not as important as the cash flow they can generate – cash flow.

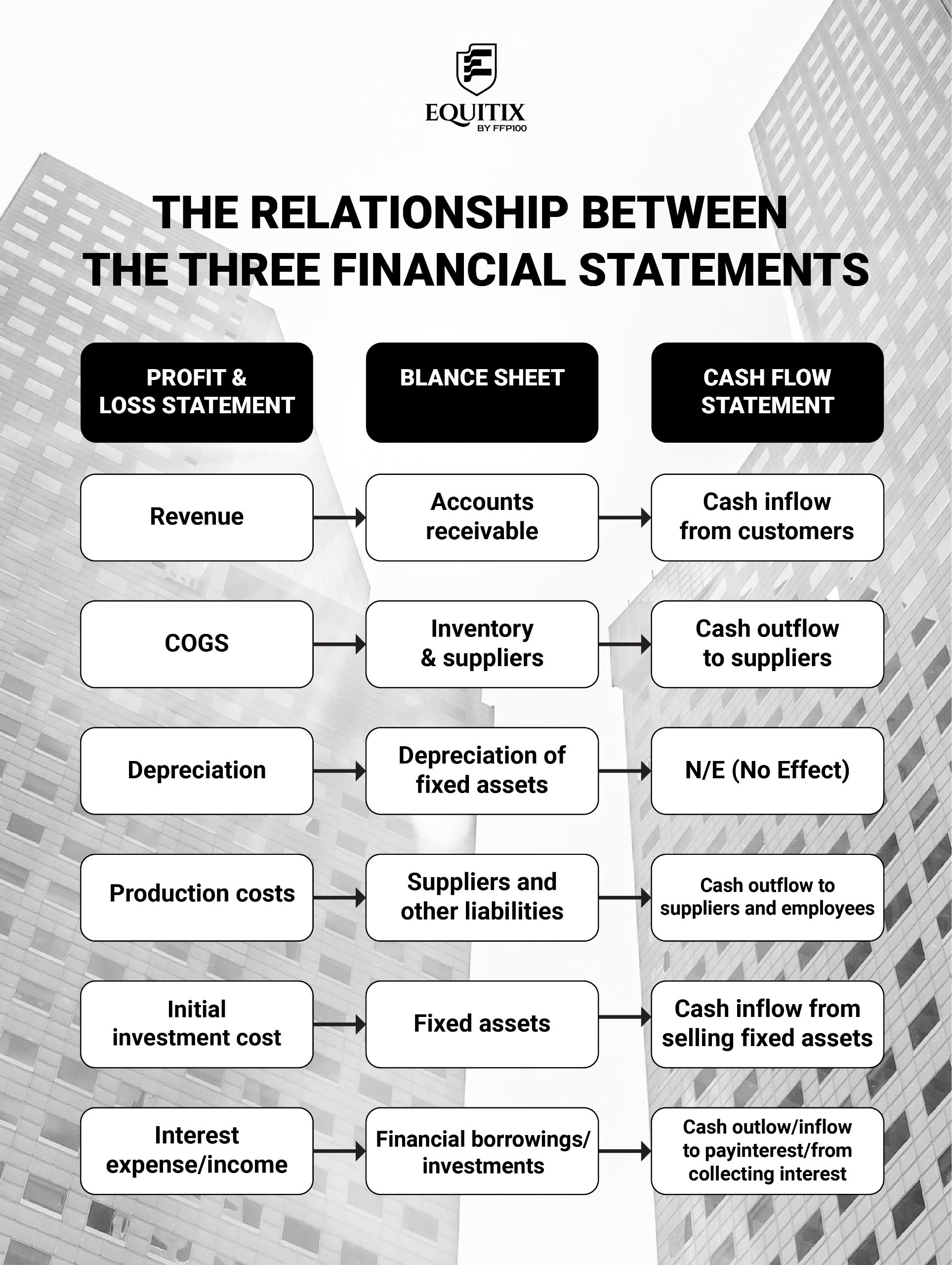

The meaning of the 3 financial statements

- Income statement: The bottom line shows the company’s ability to generate profit as well as the risk trend of the industry that the company is pursuing and competing in, gaining market share and developing business.

- Balance sheet: To assess liquidity and the ability to convert into cash as well as the ability to pay current liabilities of the company, as well as assess the asset management ability of the CEO/BOD for the Board of Directors and shareholders.

- The cash flow statement is meaningful at the time of closing the financial statements (for example, on September 30), you have how much money to spend on hand compared to the planned expenditure in the next 30-45 days.

In the startup phase, most startup founders are often:

- a) CCO: Chief Commercial Officer

- b) CGO: Chief Growth Officer (Sales + Marketing)

- c) CPO: A jack-of-all-trades production director, handling both sales and marketing on a part-time basis.

More than CEO

Professional company CEOs are not only concerned with functional issues, but they are also concerned about when the cash flow comes in to spend according to the company’s appropriate plan. (Called – Cash flow management).

In the position of CEO at a professional scale (VND70bn/year or more), most of the time must be 70% for communication and 30% for solving financial problems, cash flow and accounting as a basic foundation (Fundamental).

The rest uses leadership (communication + leadership ability) to influence and support other colleagues (CCO, CMO, COO, CPO…) to do other CVs to achieve business goals.

We often have headaches in business because… we run out of money.

Therefore, in the position of a startup/CEO, don’t let the company be in short supply of money because you don’t have many financial management skills or make decisions to manage cash flow suitable for the company.

There are companies that have financial statements on the 5th of the month, some on the 10th, some on the 15th, and some companies have them 3-6 months later.

Financial statements are only for tax reporting, not for management.

When receiving financial statements late, they no longer reflect the timeliness and the company’s situation corresponding to the time we receive the report, so that we can make accurate decisions.

The ultimate consequence is – Lack of money, emotional management.

Mental Health: Doing anything is not focused, worried, struggling, suffering, easily irritable or easily suppressing emotions causing an explosion when communicating with the surrounding stakeholders, in fact, it is caused by the lack of money in the business.

As long as your company is in the transition phase of VND70-100bn/year or more and has not successfully transitioned to a company led by the finance and accounting department, you will still have a headache.

After passing my filter, you may have enough vision and build a team that can work with professional institutional investors with sales of hundreds of millions – billions of USD (budget of USD1-50mn) when conducting fundraising.