FOUNDERS BACKING FOUNDERS

Founders support founders.

Since founders come from a moderate starting point, they have nothing but motivation and desire to grow.

These founders have a lot of experience and combat, so they tend to be deeper, more personal, stronger and better than the average person in the same development period.

These founders tend to be highly defensive, do a lot of practical work, so it’s easy to see who is suitable and capable to help them.

– Due to the loss of money more than the average person.

In general, in order to make the first million dollars, it used to be several hundred thousand dollars.

– Experience more pioneering in the market, then they will survive.

– They can maintain the company, maybe they are not good at all, but they have a superior ability: Good at financial calculations, good at growth, good at energy management, so they attract people who are better than themselves or good at coaching. /training…

But of course, it’s in the 0 – 1 existence period.

In the 1 to 10 or up to 100 periods. The founders’ businesses should be supported and developed by the founder’s team.

Founders backing founders – That is, founders are able to help founders.

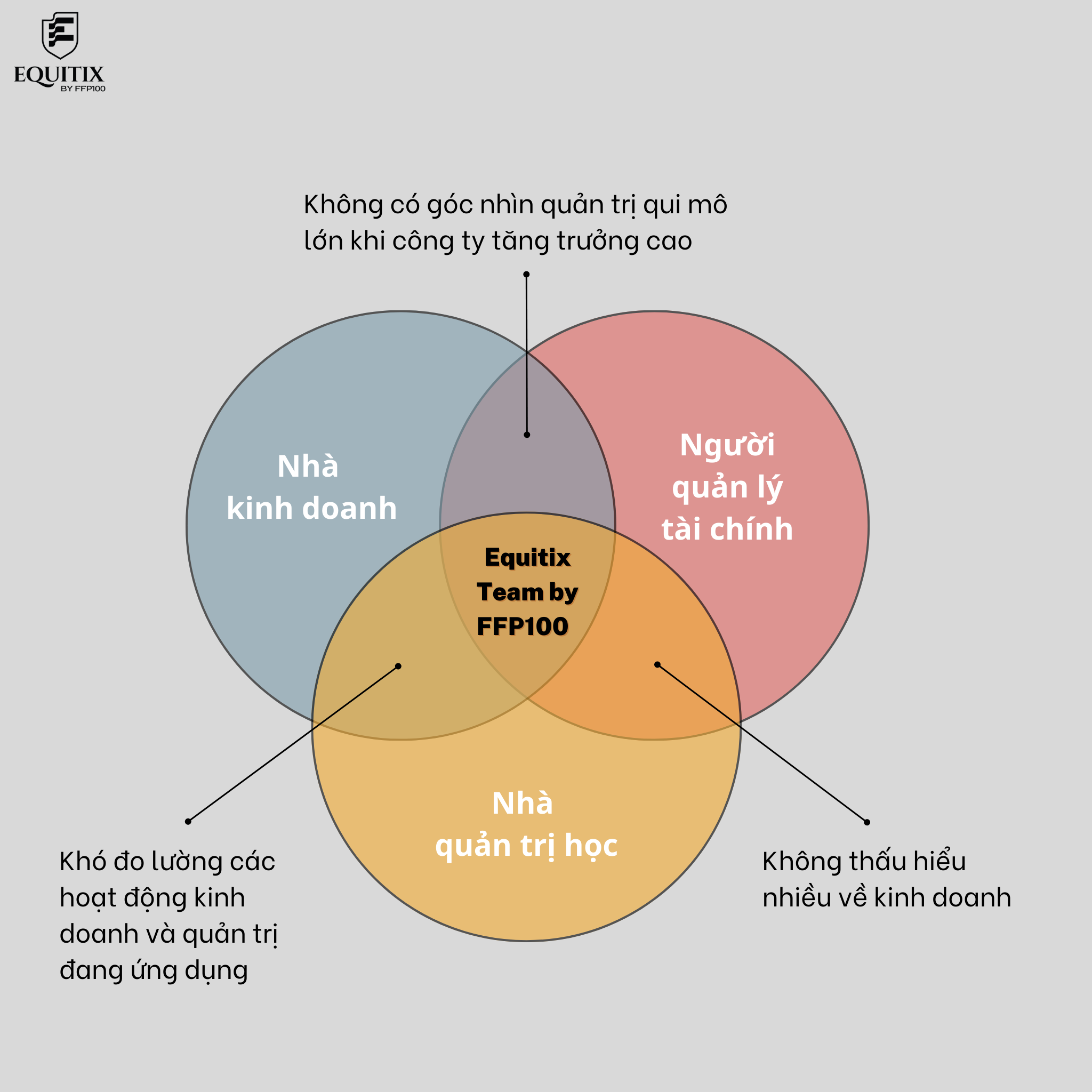

Take a look at this chart.

Circle 1: Entrepreneurs

Circle 2: Financial Managers

Circle 3: Administrators

Crossing all 3 circles: Equitix Team by FFP100 – Founders backing founders.

Value investors / Asset managers, help founders make decisions into action, they are all founders who have experienced similar business models and decisions.

The intersection between business people + financial managers but lack of management perspective:

There is no management perspective, so when the company moves to a large scale, it is necessary to have a methodical and systematic methodology (ie. not a hoarding experience) has been tested to meet the ability to increase assets for the Board of Directors or the General Meeting of Shareholders.

People who understand good governance and business but lack a financial perspective:

It is difficult to measure whether the business and management activities being applied will bring efficiency and benefits to real shareholders. Quantify better than a thousand sentimental words.

Therefore, the basic foundation of Portfolio Manager going on-site must be financial to support other founders.

People who understand finance, draw logical numbers + understand management but do not understand much about business.

Not understanding much about business, we easily create conflicts with the executive team because the advice is not suitable with the current state of the business, sometimes in line with financial and administrative goals, but restricts growth. and develop the market, miss the opportunity to increase market share and coverage, an important factor in increasing your position, competitive advantage, brand that no other party can buy if you are strong in the segment and your competitive positioning, of course we can’t buy the way customers think of us, right?

Link to register for Accelerator SG, HN classes: Training + Accelerator (Acceleration) + Investment + Fundraising for the next rounds + Become an icon.

Link 05 VHDN_HN_10

https://forms.gle/8ZGLQQkHeLe3eJne9

Link 01_TC_HN1

https://bom.so/uLNiGA

Link 05_VHDN_SG09

https://bom.so/6vtijx