Financial models are an effort to present a “big picture” view of future financial performance.

Many simplifying assumptions are made and the model doesn’t try to capture all the financial details and nuances, or the accounting accounts that show the connection to recorded data.

Most simplified assumptions won’t significantly impact the big picture – for example, the difference in cash flow between leasing or buying one car probably wouldn’t affect the big picture unless the company runs a large fleet of vehicles.

The model can also simplify things like costs and depreciation of initial expenses.

The quality of any forecast depends on the quality of the assumptions and the quality of the cause-and-effect relationships included in the model.

The focus should be on the quality of the assumptions made and their cause-and-effect relationships.

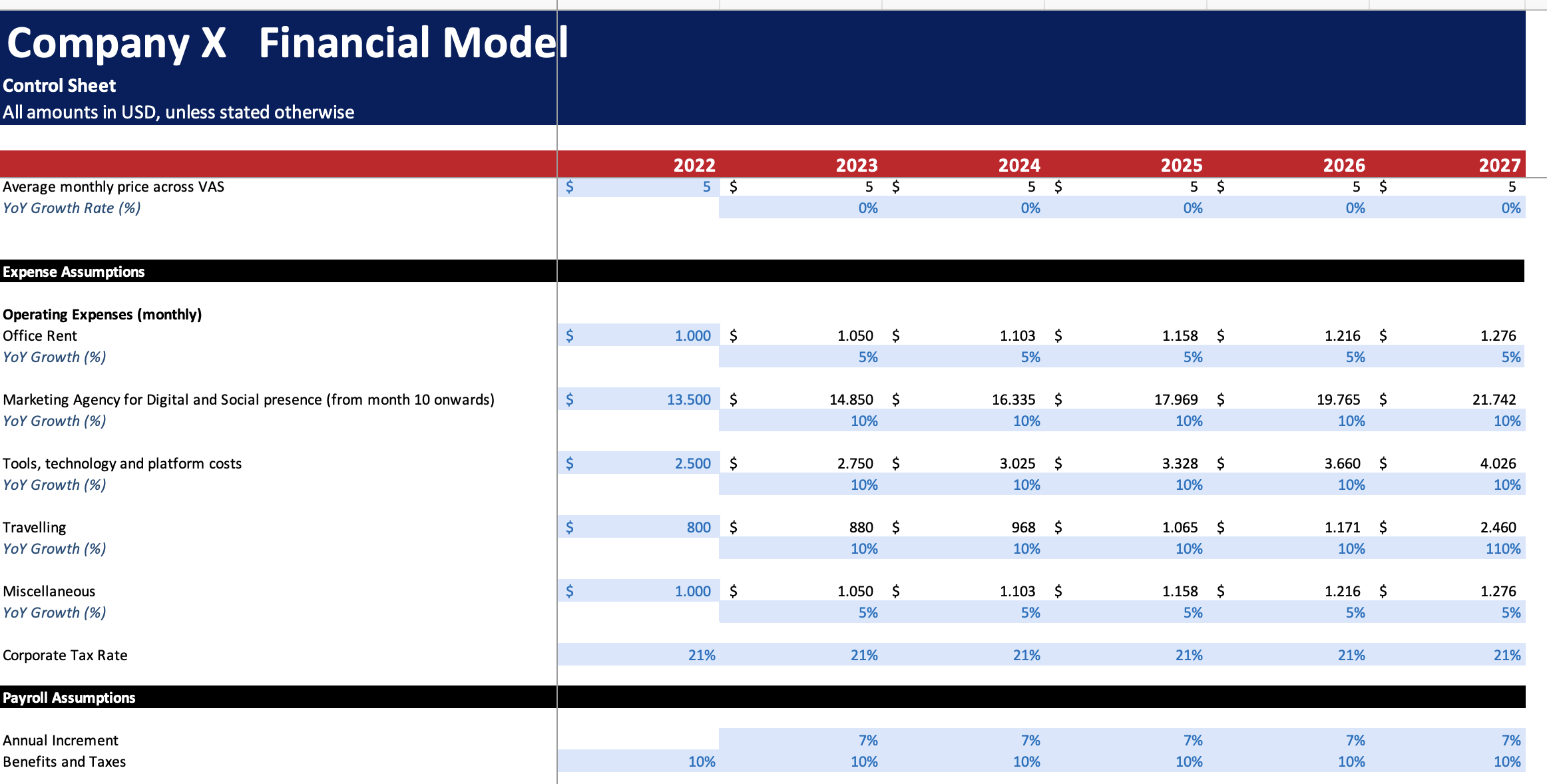

- Assumptions about starting data

- Assumptions about actual revenue streams generated from the model

- Assumptions about year-over-year growth rate (%)

- Assumptions about costs and cost structure

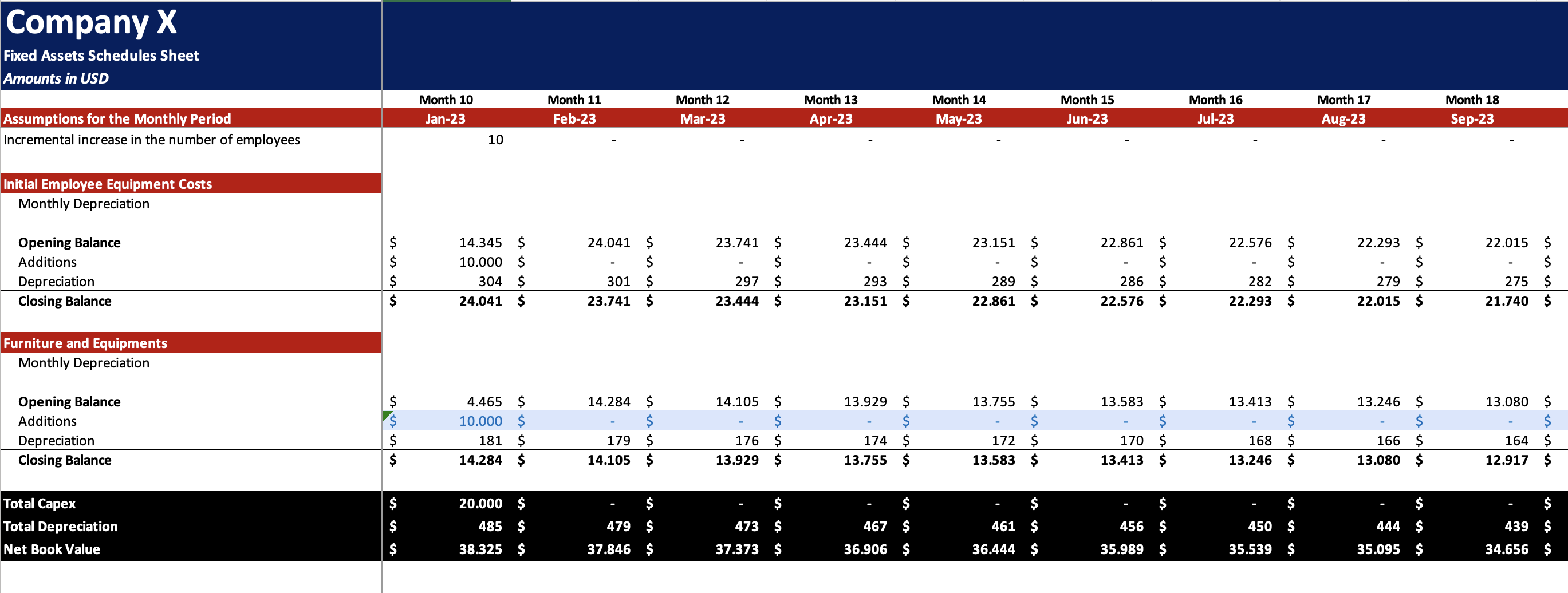

- Assumptions about initial investment in property, plant, and equipment

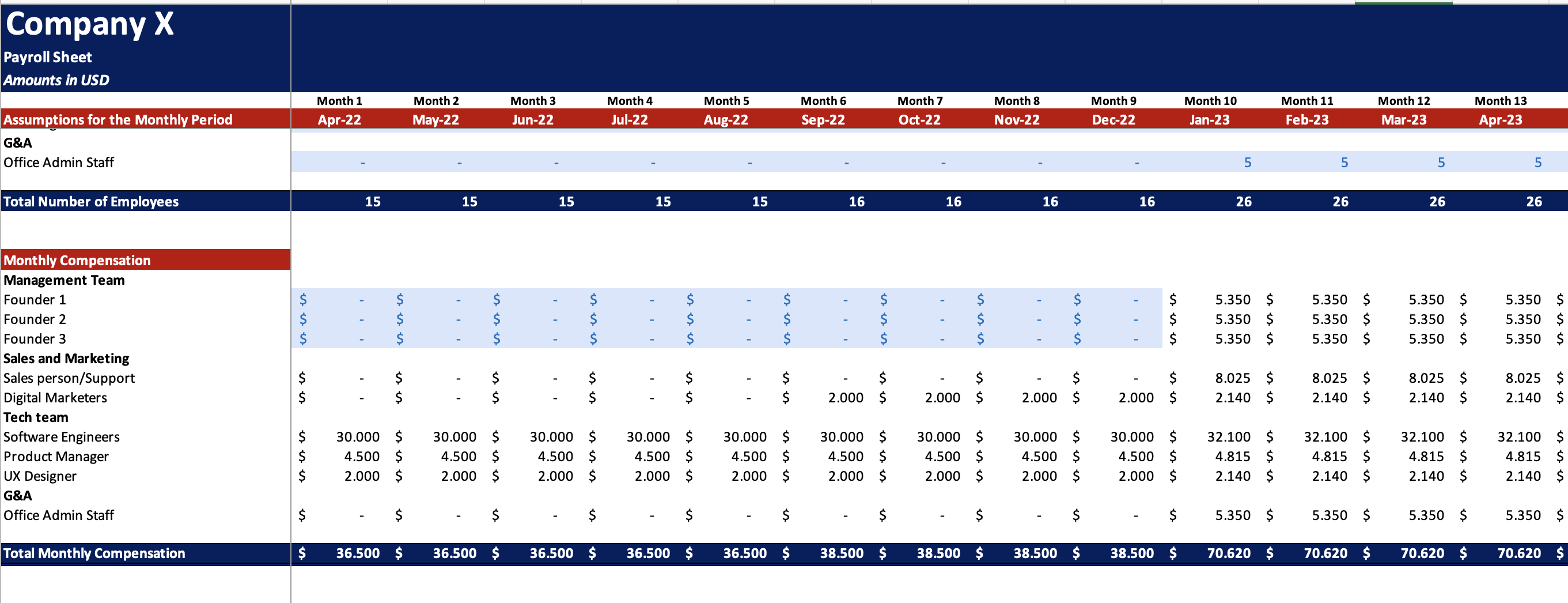

- Assumptions about headcount and salary forecasts and how they change over time

- Assumptions about break-even time and the corresponding changes in assets or cash flow reflected in the income statement

This is then used to develop plans for using capital, value the company using different methods, and explore different break-even scenarios.

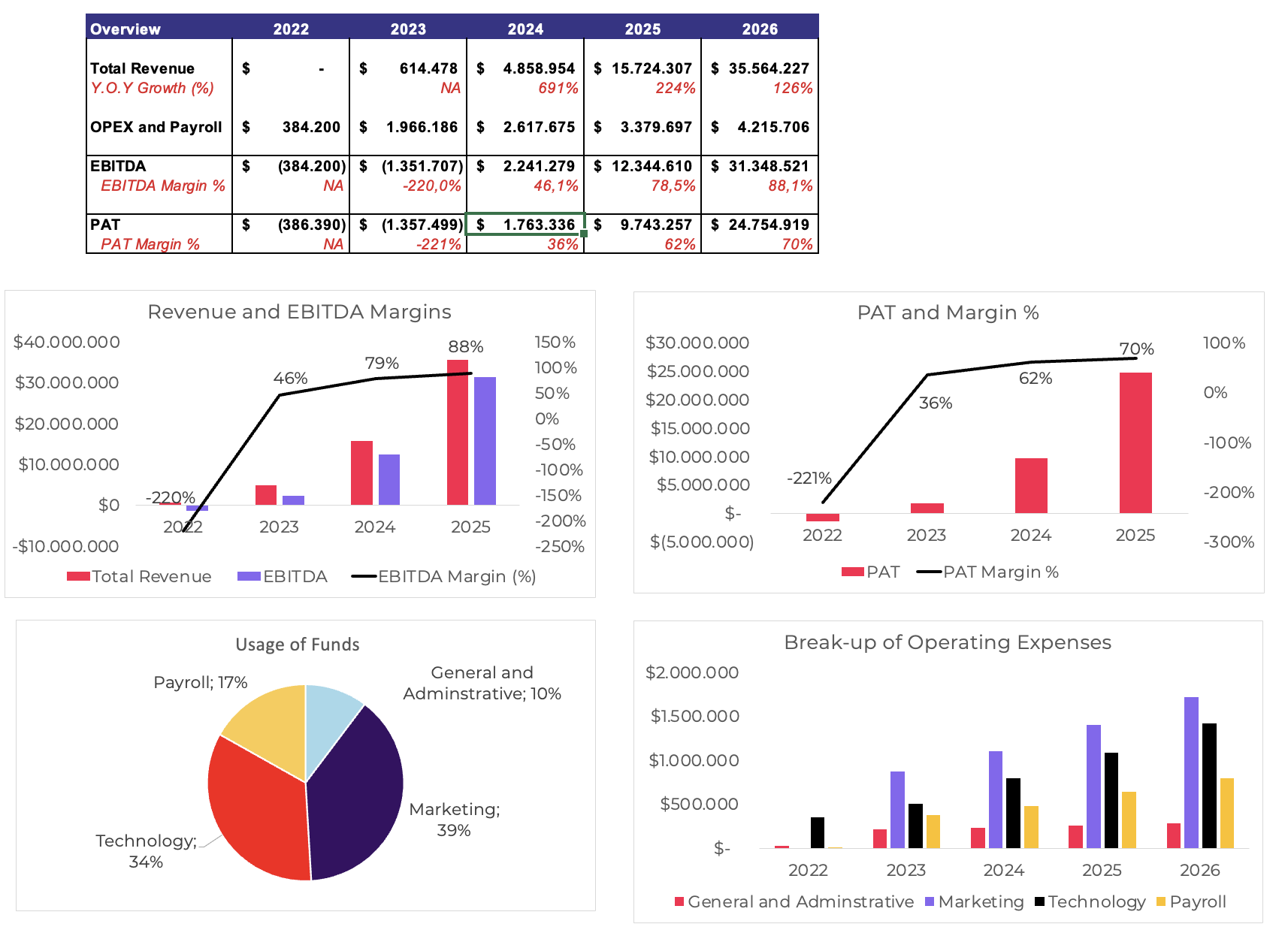

1. Dashboard

2. Revenue, expenses, payroll, and CAPEX (capital expenditures) are assumed:

3. Assumed revenue details are presented on a cumulative monthly basis:

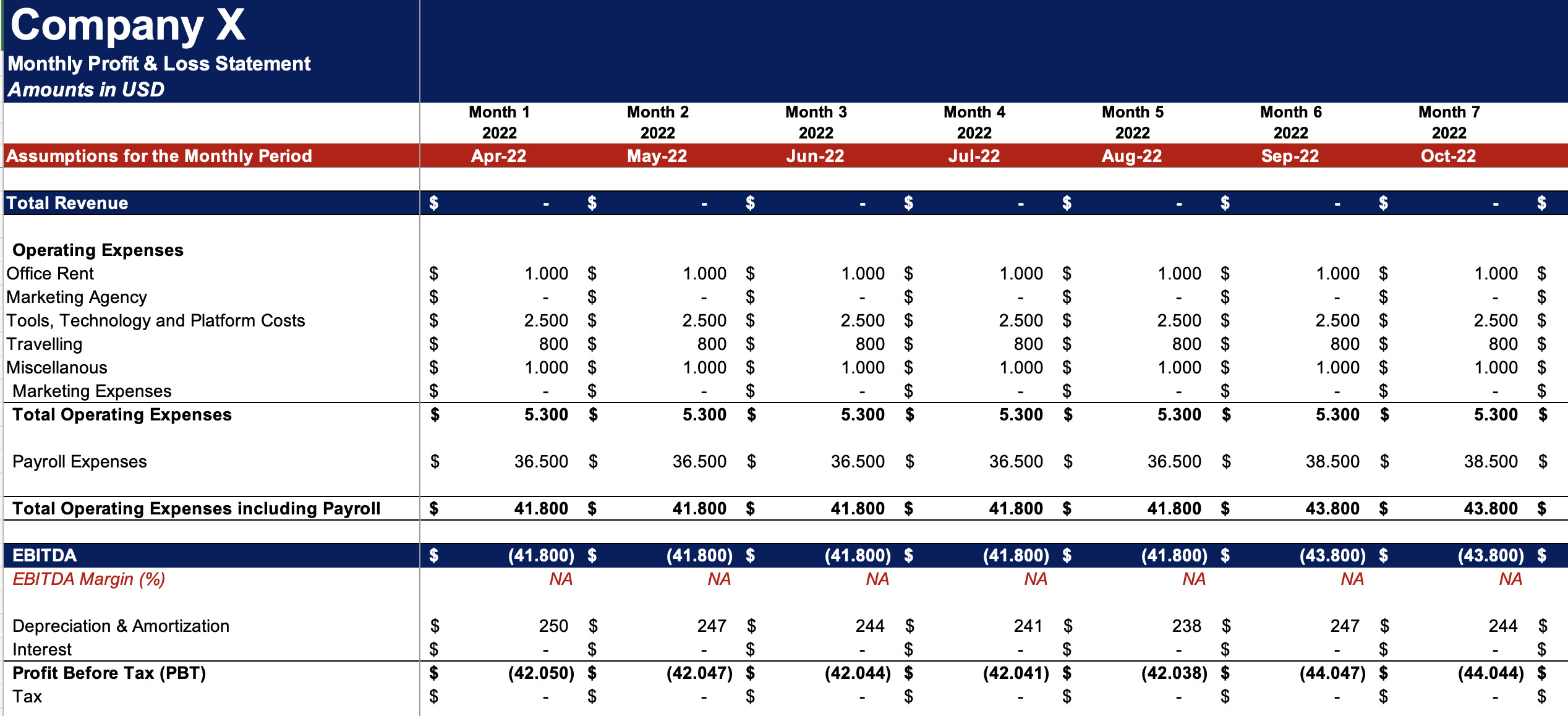

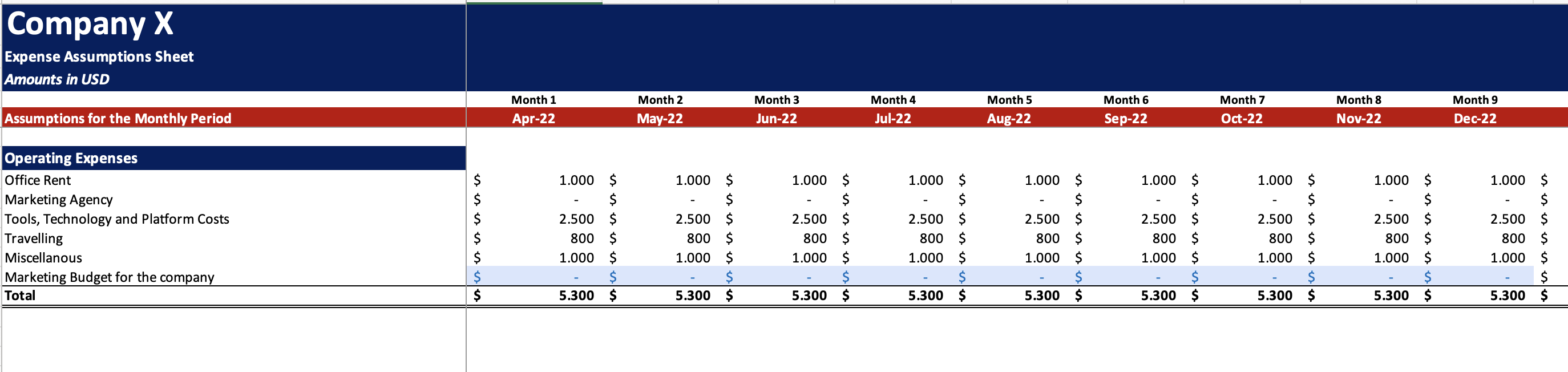

4. Assumed expenses are presented on a cumulative monthly basis:

5. Payroll details and monthly recruitment schedule forecast:

6. Capex forecast:

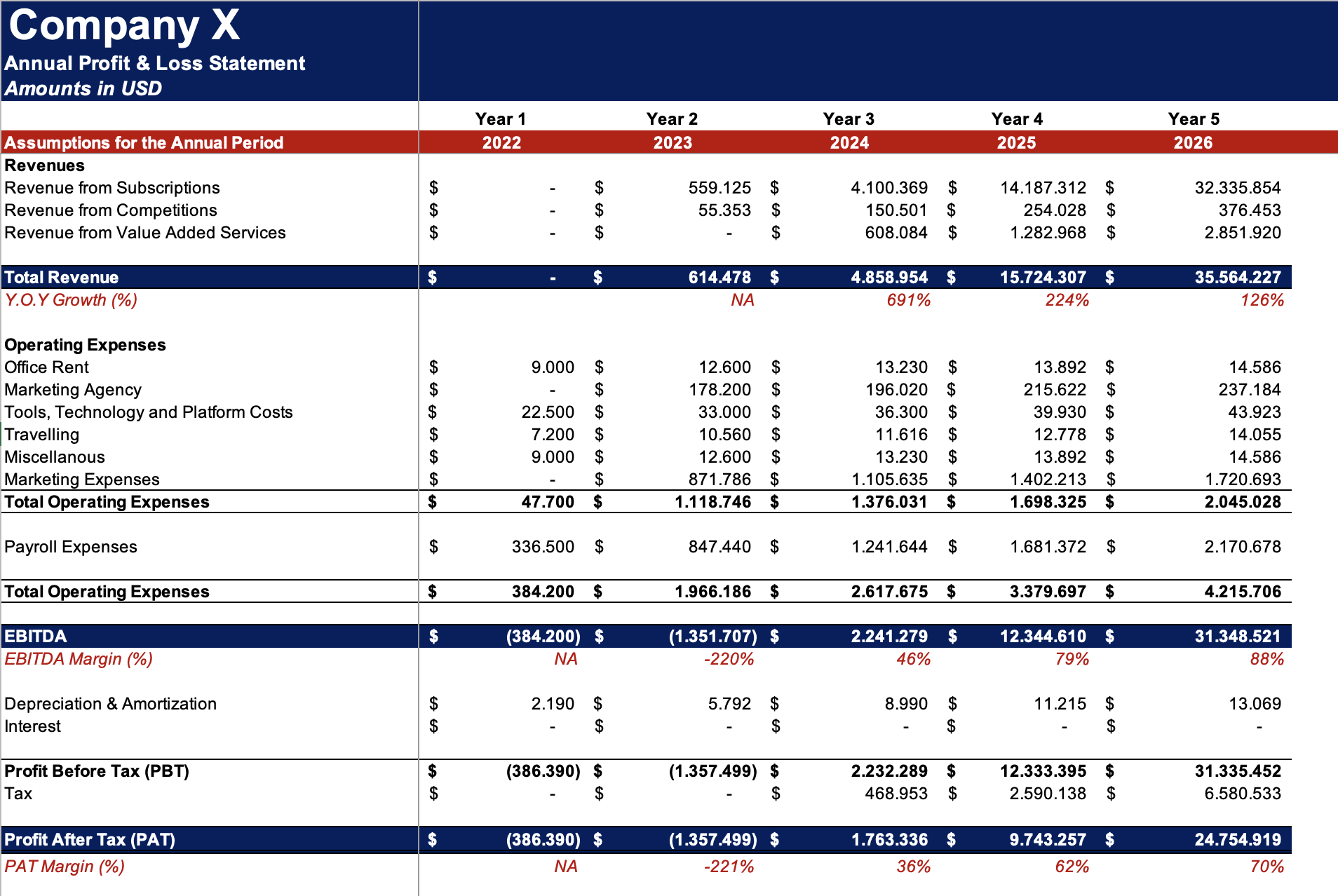

7. Monthly/Yearly Income Statement:

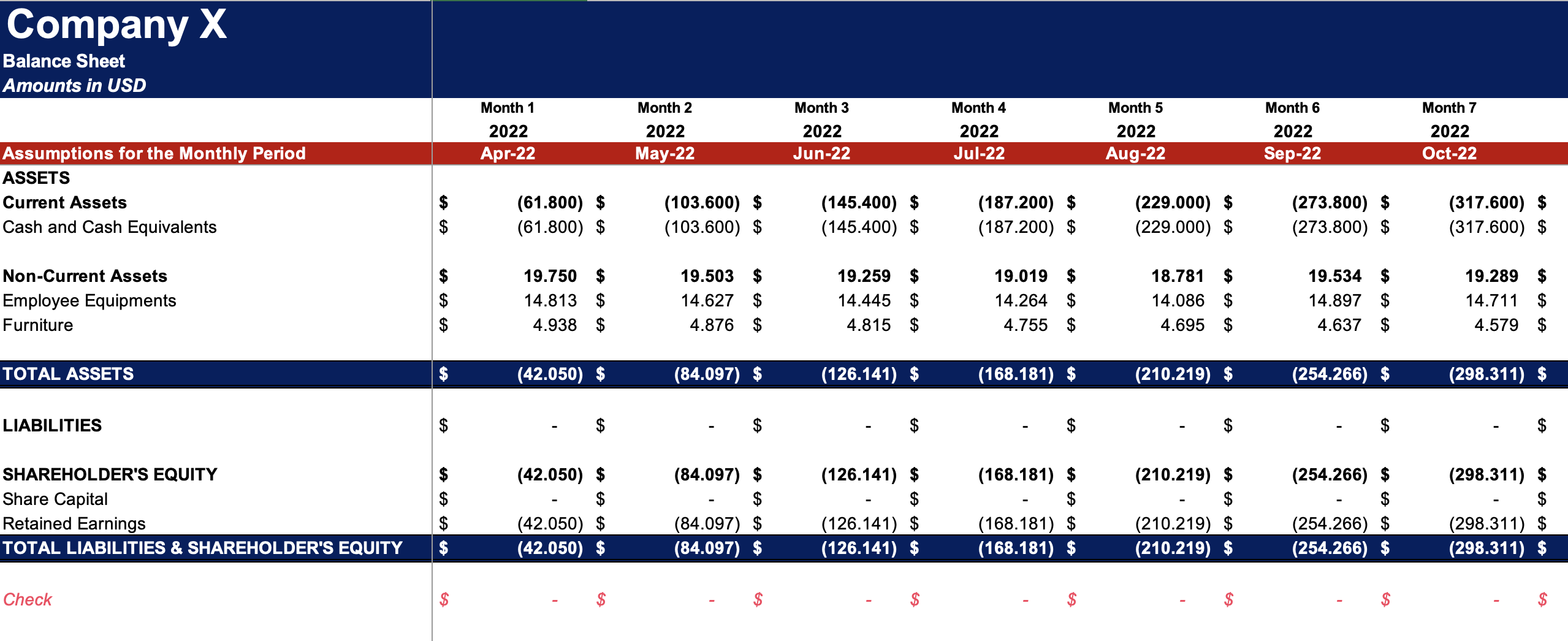

8. Monthly/Yearly Balance Sheet:

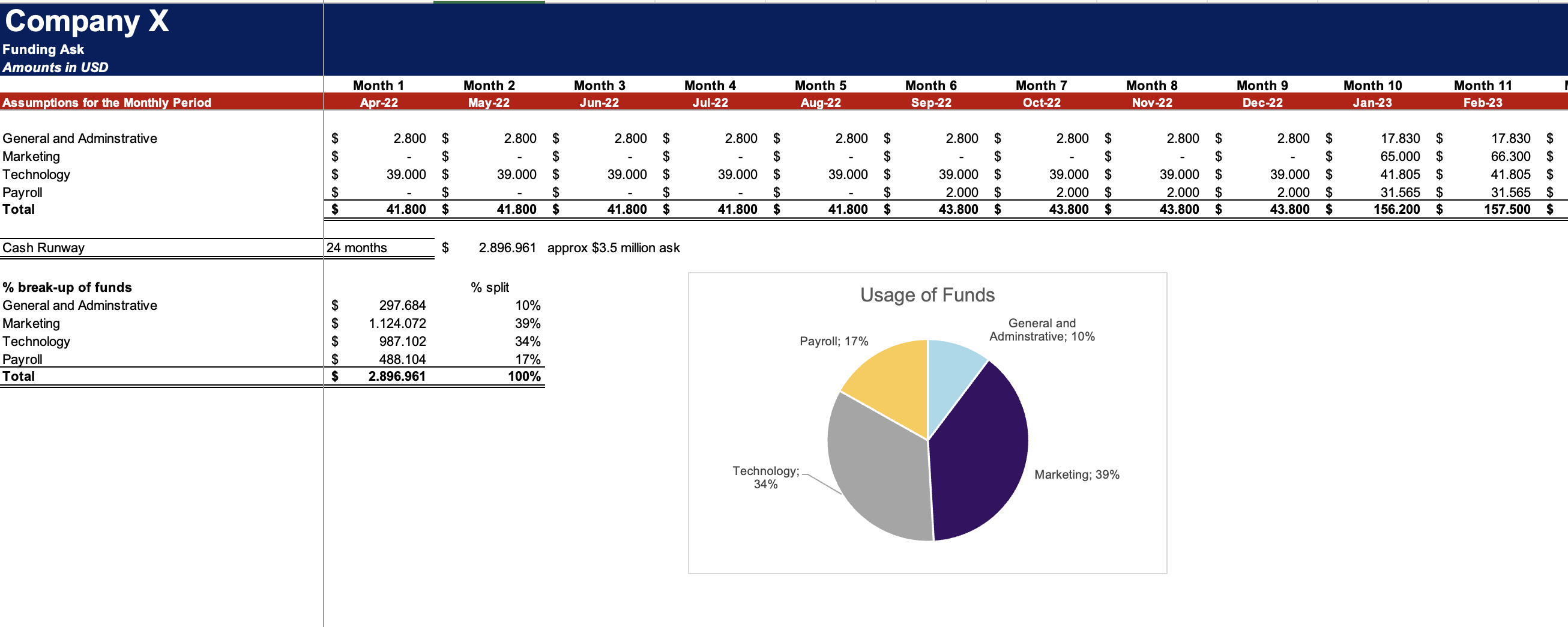

9. Capital needs

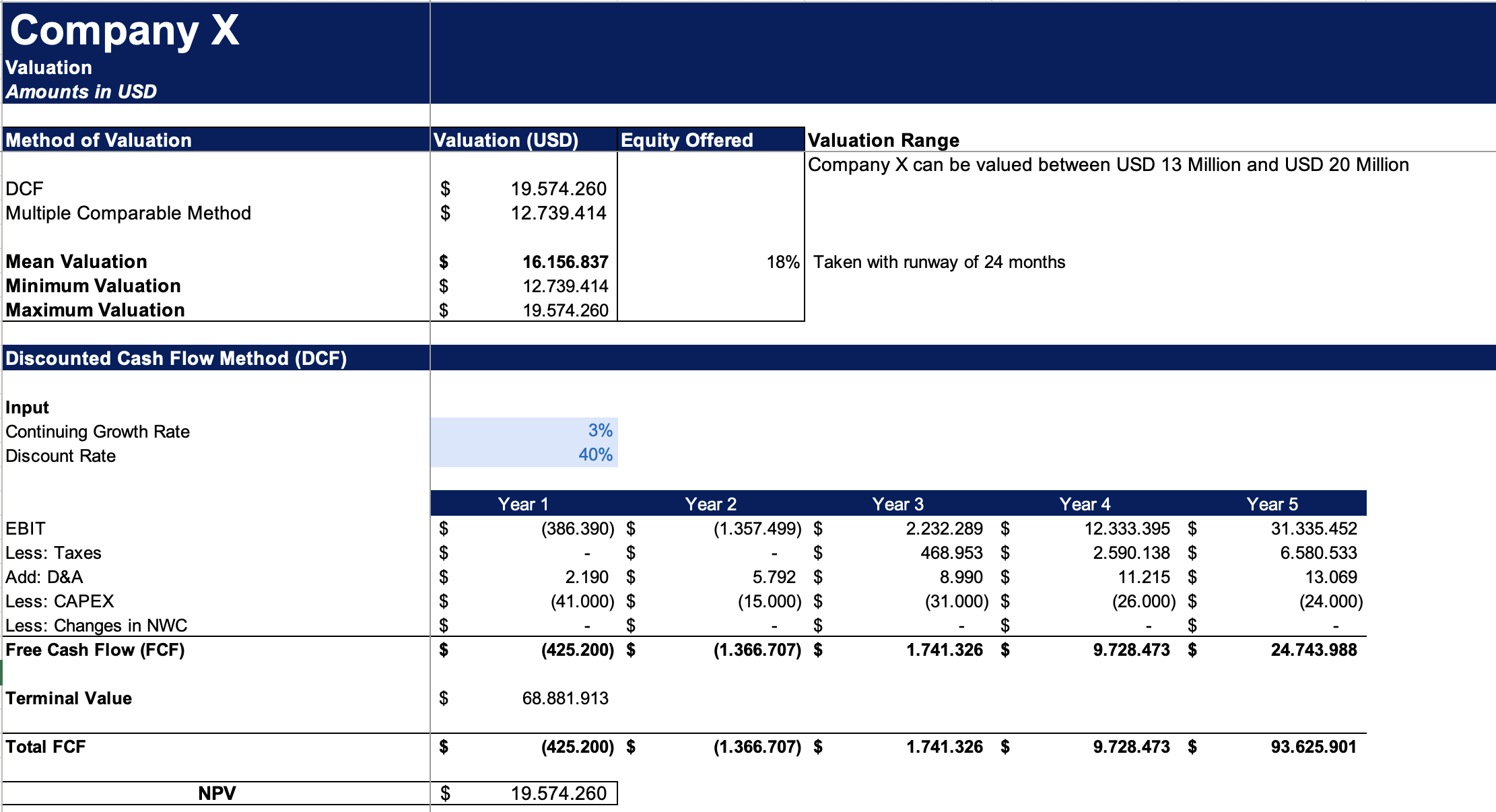

10. Valuation methodologies

a. DCF: Discounted Cash Flow

b. Minimum and maximum valuation range

c. Comparable company analysis (CCA)

d. Average valuation method

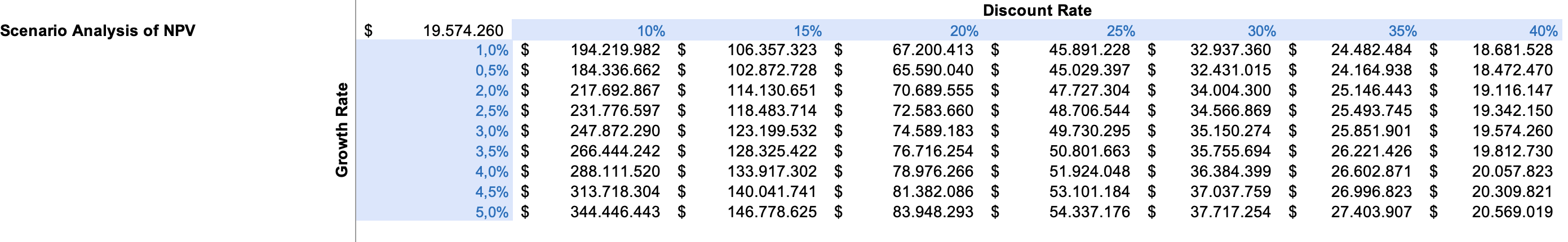

e. Impact of growth rate and discount rate on valuation

11. Sensitivity analysis