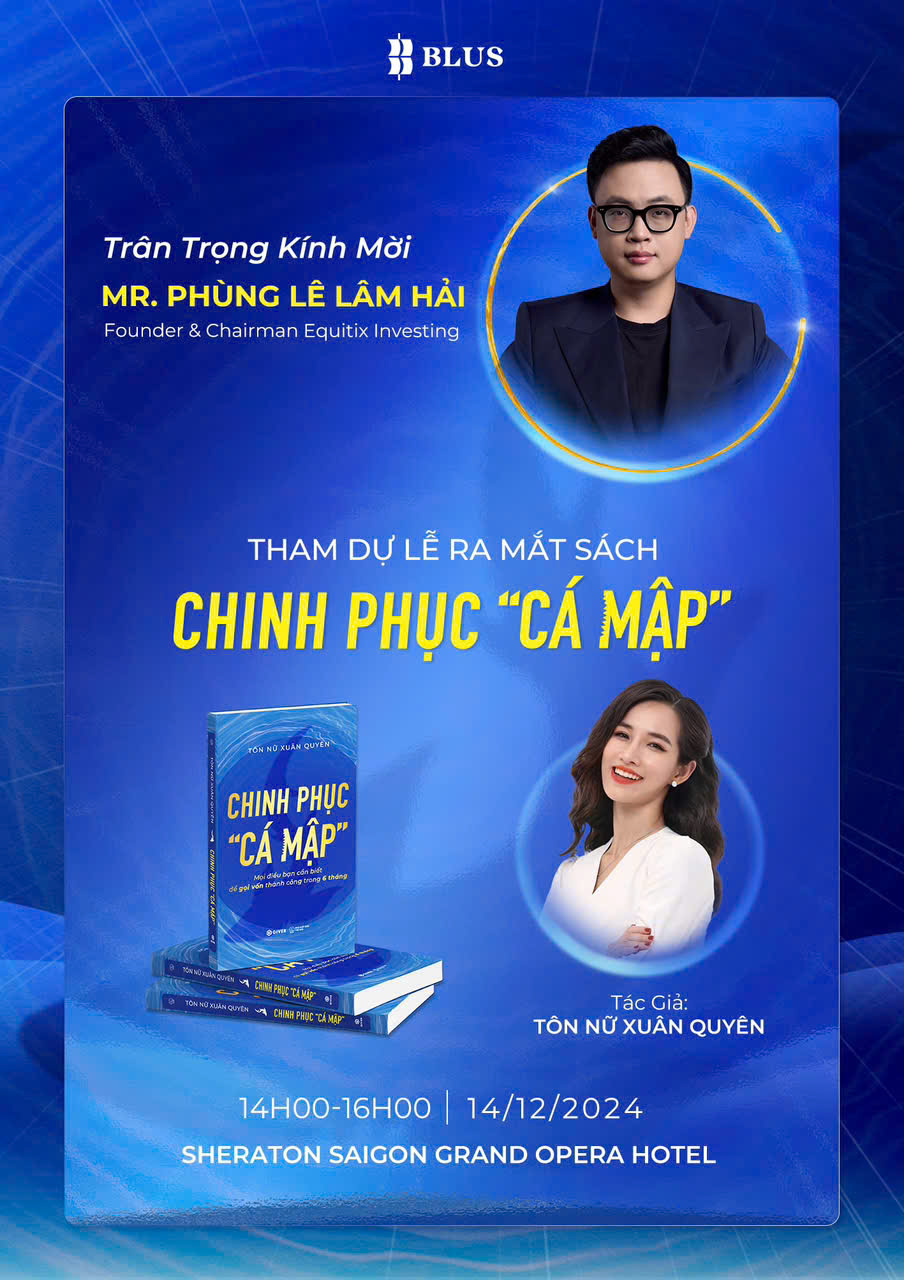

BOOK LAUNCH EVENT: ‘CONQUERING THE SHARKS’ WITH TÔN NỮ XUÂN QUYÊN

This book is designed to introduce Private Equity to founders who are excellent at business operations but lack sufficient knowledge about the capital market and the perspectives of capital managers.

Mr. Phùng Lê Lâm Hải – Founder of Equitix Investing, and Mrs. Tôn Nữ Xuân Quyên – Chairwoman of BLUS Saigon, met 6-7 months ago. This meeting is one of the 40 interviews/perspectives included in the book, alongside insights and information from various experts: policymakers, entrepreneurs, fund managers, individuals who have successfully raised capital, founders who have successfully exited, banks, investment banking professionals, private equity fund managers, and other resources. These inputs collectively make the book a suitable resource for new founders and those just starting to explore the financial market.

For founders and business owners, reading this book to build a foundation before learning about Governance with Equitix is promised to be an effective approach.

Equitix is delighted to contribute efforts to help founders better recognize their opportunities and challenges during the process of raising equity capital and preparing for an initial public offering (IPO).

Shark Tank Vietnam

Shark Tank Vietnam is a reality television program produced by Vietnam Television (VTV) and TV Hub (formerly TV Plus), broadcast on VTV3 since 2017.

This is the Vietnamese version of the famous Shark Tank program by Sony Pictures, which has won the Primetime Emmy Award twice for Outstanding Reality Program.

The program inspires contestants, who are startup entrepreneurs, to present their unique products to a panel of investors, showcasing the negotiation process as they try to convince the investors to invest in their business projects.

The Equitix Investing team has produced more than 24+ series analyzing Shark Tank Vietnam Season 7 deals and has received numerous positive messages and support from the community as well as the program’s organizers.

We hope that together we can foster the development of the entrepreneurial community through high-quality content, insightful analyses, and inspirational messages that encourage founders and promote Vietnam’s private economy. This contributes to advocating for privatization and welcoming more positive resources in the market in terms of media, marketing, branding, financial resources, and industry-specific know-how.

Equitix Investing Team

CTO FOUNDER STARTUP HUB – AN OPPORTUNITY FOR STARTUPS TO CONNECT WITH EQUITIX INVESTING AND A NETWORK OF 300+ INVESTOR GROUPS

03 key takeaways from Lucas Phung for founders at different stages of their business development:

-

Choose investors with the philosophy of “Founders backing Founders”: According to Mr. Hải, an ideal investor is one who has the perspective of a founder, fully understanding the difficulties and challenges startups face. They will not only provide funding but also managerial capabilities, helping startups achieve their vision and aspirations.

-

Seek investors with an extensive network: The network of an investor can provide startups with access to valuable resources such as potential customers, partners, and other investors.

-

Prepare thoroughly before engaging with investors: Startups need to have a clear understanding of their business model, target market, and development strategy. At the same time, they must meticulously prepare documents such as business plans, capital structures, exit strategies, financial models, valuations, etc., so that both parties can clearly understand each other’s objectives and move closer to a successful deal.

Equitix Investing is an investor that collaborates with and connects more than 300+ institutional investors, with average funding experience ranging from 30 to 100 years, specializing in investing in potential seed-stage startups in five sectors:

- FnB

- Healthcare and beauty

- Logistics

- Tourism

- Technology & finance

Additionally, Vietnamese brands with growth potential (such as education, household products, etc.) are also a focus.

With this network, Equitix is committed to supporting startups/SMEs not only with capital but also with management capabilities.

FNB VIETNAM – OPPORTUNITY FOR VIETNAM TO GO GLOBAL

Topic: How to Scale from 1 to 10

The second event in the series, organized by the bCTO team, is dedicated to founders and professionals in the FnB (Food and Beverage) industry.

Four key highlights will be shared:

-

Entrepreneurial Mindset and Spirit in FnB

- This goes beyond the mindset of production, product creation, or merely running a single restaurant or café.

- In the FnB business, we encourage founders to think about growth or aspire to build chains. If you’re this kind of founder, this event is for you.

- The speaker is a founder with a proven track record of multiple successful exits.

-

Operational Mindset Based on Four Fundamental Pillars

- The speaker has led successful chains such as Coffee Bean & Tea Leaf, Subway, PJ’s Coffee, Bonchon Chicken, and more.

-

Fundraising and Working with Professional Investors

- Insights on valuation and key considerations for founders before engaging with investors.

- Guidance on how deals with investors are structured, what stages to approach specific types of investors, and selecting the right investors for your goals and vision.

- Our team and partners are currently handling 15–20 deals, with capital sizes ranging from $1M to $20M.

-

Digital Transformation for FnB Founders and Owners

- Sharing by an expert responsible for Technology at McDonald’s.

- Practical information to empower and enable FnB businesses in Vietnam to reach global markets.

- Key resources and know-how will be discussed, including:

a) Management capabilities and knowledge

b) Industry expertise and insights

c) Access to valuable financial capital

Through this, founders can turn their dreams and aspirations into reality.

We hope this series brings immense value to FnB founders in Vietnam!

The FnB industry is fascinating—it demands creativity, diversity, and significant investments. With over 50 institutional investors eager to find promising businesses to invest in, the opportunities for collaboration and growth are immense.

Deal size range: $1M – $50M.

FOUNDERS BACKING FOUNDERS

Changing Perspectives to Secure Funding

Investors and asset managers are also a type of entrepreneur.

While you are in the business of products or services, they are in the business of money.

Just like you have a cost of goods sold, they too have a cost of capital.

You would never buy something unless you are confident you can sell it at a higher price. The same applies to them.

We, as investors, will never purchase shares without being assured that they can later be transferred or sold for a higher value.

Therefore, as founders, you need to present your business as a lucrative opportunity for investors to grow their wealth, rather than approaching them solely with the mindset of raising funds.

Investors and entrepreneurs are not philanthropists. While they empathize with your challenges, as they have likely faced similar struggles, sustainable fundraising relationships must be built on mutual value creation.

We make money and take responsibility for the capital we manage.

As founders, you also bear responsibility for numerous aspects of daily business operations. Similarly, investors are accountable for the cost of capital tied to the funds they oversee.

This is why a solid foundation in finance and accounting is crucial—not only to successfully raise capital but also to identify business opportunities that align with investor goals.

We cannot entrust funds to those lacking the competence to manage them, as doing so almost guarantees losses.

This is why many founders struggle to secure funding: they often lack adequate focus and understanding when it comes to finances and capital management.

In an age where overwhelming amounts of information bombard you daily, failing to filter these ideas through a financial lens can cause you to lose focus and veer off course.

This often leads to a scattered approach, resulting in financial depletion before reaching your goals.

PHU VINH PLASTIC PROJECT KICK-OFF

Ben Tre – January 11, 2024, Equitix Investing Co., Ltd. and Phu Vinh Plastic Co., Ltd. officially conducted a field visit and pre-interview for the fundraising and digital transformation project: Consulting and training process for business development, management, business strategy, financial strategy, and investment strategy.

Leveraging Equitix & Partners’ network of 300+ investors and its experience in restructuring companies from startups to multi-owner operations, this project promises to position Phu Vinh Plastic as a leading force in the industry. Post-restructuring, Phu Vinh Plastic is poised to become an icon of business and a pioneer in technology, equipment, and methods for collecting and recycling plastic, while simultaneously supplying high-quality, high-quantity recycled plastic materials to manufacturing plants. Additionally, the project will create job opportunities for vulnerable workers, especially elderly female laborers in the local area.

PISA IELTS Project Kick-off

Halong Bay, March 10, 2024 – Equitix Investing, an international investment company, and PISA IELTS, an education and media corporation, officially launched a feasibility study to restructure PISA IELTS’s governance, raise capital, and undergo digital transformation. The project will focus on consulting and coaching to develop business, management, business strategy, finance, and investment strategies.

With a network of over 300 investors through Equitix & Partners and experience in restructuring startups, we believe that PISA IELTS will take significant strides to become an icon in the English language education and professional financial management sectors.

Key focus areas:

- EdTech

- Education real estate

- Retail, services, and cafeterias

FFP100: A Vibrant Fusion of Hanoi and Ho Chi Minh City

Join us for an exclusive gathering hosted by Phung Le Lam Hai, Founder and CEO of Equitix Investing, in collaboration with Founders Forum Private 100. This June 2024 event brought together a distinguished community of 100 seasoned founders from diverse industries.

Experience a unique blend of Hanoi’s sophistication and Ho Chi Minh City’s dynamism as we connect leaders at the forefront of:

- Direct-to-consumer household goods

- Luxury and science-backed beauty brands

- On-demand fashion and accessories

- ESG-compliant plastics and socially impactful businesses

- Entertainment and cocktail culture

Network with industry pioneers, share insights, and explore new opportunities. Don’t miss this chance to be part of a dynamic community shaping the future of business.

CTO FOUNDER STARTUP HUB – OPPORTUNITY FOR STARTUPS TO CONNECT WITH EQUITIX INVESTING

Equitix Investing is an investment firm that partners with and connects over 300+ institutional investors, with an average fund age of 30-100 years. We specialize in investing in high-potential seed-stage startups across 5 key sectors: F&B; Healthcare, Beauty, and Wellness; Logistics; Tourism; and Technology & Finance. With this extensive network, Equitix is committed to supporting startups not only with capital but also with governance capabilities.

Join the CTO Founder Startup Hub to discover the insights of Mr. Phung Le Lam Hai, Founder of Equitix Investing, a seasoned investment director who is dedicated to partnering with startups and SMEs.

TALKSHOW: CAPITAL RAISING STRATEGY AND IPO ROADMAP IN THE NEW CONTEXT

Mr. Phung Le Lam Hai – Founder and CEO of Equitix Investing – is one of the 5 speakers of the seminar “Capital raising strategy and IPO roadmap in the new context” held to strengthen the global perspective. situation on capital raising of enterprises and IPO roadmap.

The Lost Bird: A Haven for Founders

In April 2024, Mr. Phung Le Lam Hai, Founder and CEO of Equitix Investing, joined us at The Lost Bird, a premier cocktail bar in Ho Chi Minh City’s Thao Dien district. This visit was part of the Founders Forum Private 100 (FFP100), a distinguished community of seasoned founders who are industry leaders in their respective fields.

The Lost Bird has become a go-to destination for founders to unwind and connect. Here, they share insights on a wide range of topics, including investment strategies, financial management, deal-making, M&A, and asset management.

Join us at The Lost Bird to experience the unique atmosphere and engage in stimulating conversations with fellow founders.

FFP100: Hanoi Capital

Mr. Phung Le Lam Hai, Founder and CEO of Equitix Investing, hosted a special gathering of the Founders Forum Private 100 community in Hanoi in March 2024.

FFP100 is a prestigious network of founders with extensive experience in leading and growing businesses across a wide range of industries, including:

- Gaming, apps, and technology in the US and internationally

- Leather goods, bags, and lifestyle

- Travel and experiences

- Gifts, consumer goods, and handmade products for mothers and babies in the US

- Direct-to-consumer (D2C) fashion for women

This gathering provided a unique opportunity for founders to share insights, knowledge, and build valuable partnerships.

ASA1YEAR WORKSHOP – DIGITAL TRANSFORMATION MANAGEMENT

Expected in August – September 2023, Thanhs and Equitix Investing will co-organize an online Workshop with the theme “Digital Transformation Management”. The lecturer is Mr. Phung Le Lam Hai – Thanhs Market Development Manager; Chairman, Investment Director of Equitix Investing.

ASA1YEAR WORKSHOP #11: FUNCTIONAL KPI MANAGEMENT INDICATORS FOR BOSSES.

“It’s all based on faith, but when it comes to money, there are so many names, guys? Investing, Starting a Business, Speculating, Gambling, Betting…!!!” – Quote the status of the elder.

I just said the fundamental difference is the ability to directly affect the portfolio to create profitability xx assets.

ASA1YEAR WORKSHOP – THINKING AND STYLE OF FINANCIAL THINKING – CORPORATE FINANCIAL MANAGEMENT AND CALLING FOR CAPITAL

Expected in April – May 2023, Thanhs and Equitix Investing will co-organize an online workshop with the theme “Thinking and financial thinking style – Corporate finance management and fundraising”. The lecturer is Mr. Phung Le Lam Hai – Thanhs Market Development Manager; Chairman, Investment Director of Equitix Investing.

KICK OFF KOKODA PROJECT

Ho Chi Minh City, August 8, 2022 – Equitix Investing International Investment Co., Ltd and Kokoda Vietnam Co., Ltd. officially signed a consulting contract and kicked off the project: The process of consulting and training for business development Business: Management, business strategy, financial strategy and investment strategy.

ASA1YEAR WORKSHOP – BUILDING TEAM CAPACITY TO MEET BUSINESS TARGET

On August 23, Thanhs and Equitix Investing will co-organize the online Workshop number 05 with the theme “Building team capacity to meet business goals”. The lecturer this time is Mr. Phung Le Lam Hai – Thanhs’s Market Development Manager; Chairman, Investment Director of Equitix Investing.

EQUITIX INVESTING OFFICIALLY ESTABLISHED AN OFFICE IN THE PHILIPPINES – A COUNTRY THAT PROMISES TO BRING MANY OPPORTUNITIES TO “SHINE”

INTERNATIONAL INVESTMENT EQUITIX INVESTING COMPANY LIMITED is an investment fund company with a design model and accompanies business owners in the process of improving valuation by optimizing business models, financial strategies, build a human resources team and evaluate the feasibility in terms of vision, offer different business plans and scenarios for the business before calling for capital.