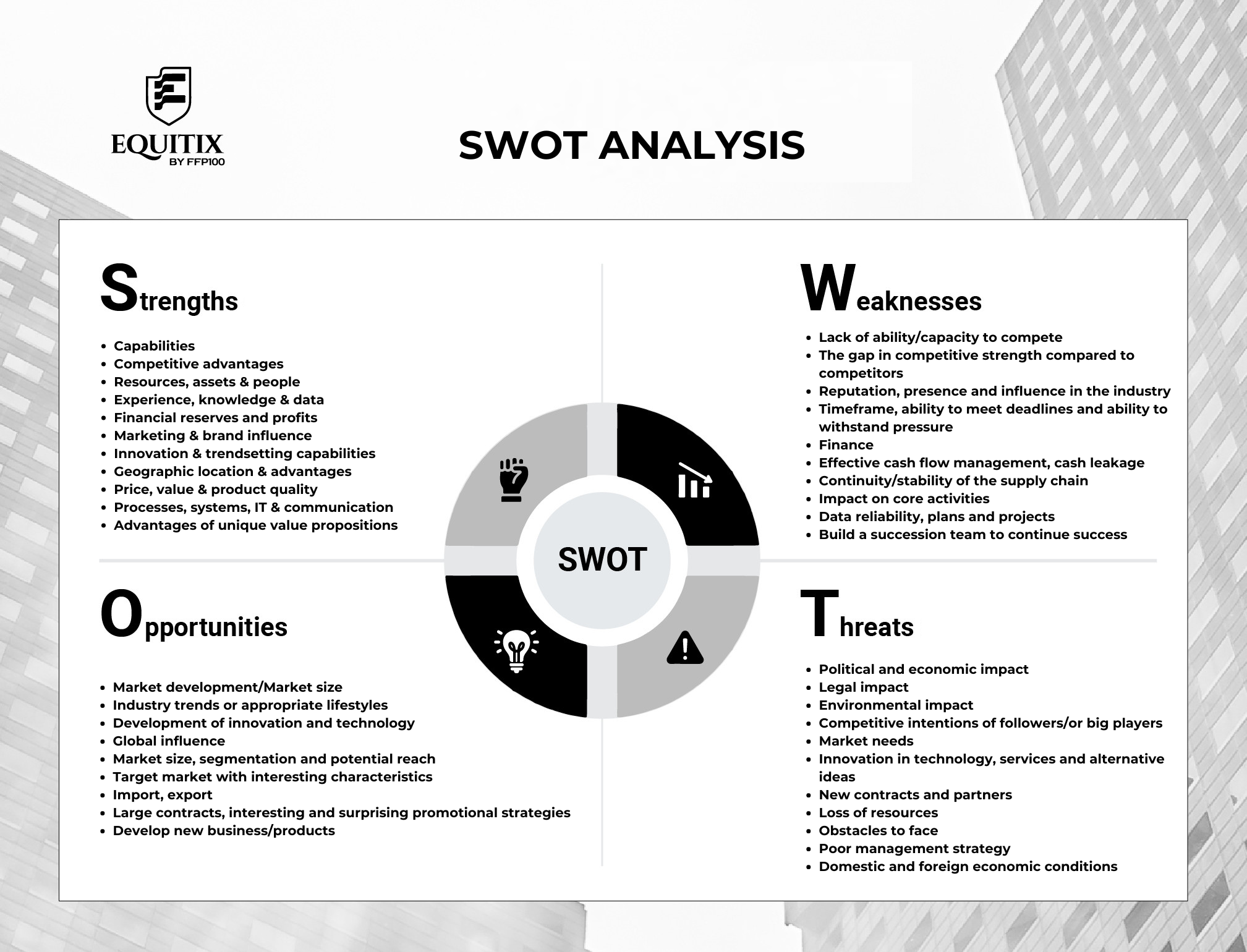

The SWOT framework by Equitix suggests bullet points that startups/SMEs need to answer and explain thoroughly to professional institutional investors – investors who have zero knowledge like ourselves but have accumulated capital for 60-100 years.

Most founders before the Series A round will find it difficult to comprehensively answer all of this content.

The only way to answer is… to do it for real and accumulate over time.

When doing it for real, this information, although not neatly organized and sequential, basically exists somewhere in the minds of the founders/BOD.

Based on this framework, Equitix also diagnoses and restructures management and governance and proposes improvement strategies to help companies maximize valuation through in-depth internal interviews.

Of course, the resources of the founders are always limited to do everything.

Therefore, restructuring must necessarily have a financial perspective to: – Focus on what needs to be focused on – Eliminate the redundant, unnecessary, or non-significant value in the short and medium term.

Suitable size: 70-100 billion/year or more or a workforce of 50-100 people or more.

Not recommended: For founders of startups, startups should only focus > 80% on target customers and sales.

However, when starting a business and passing the Seed round, this information will gradually be accumulated and form a strategic mindset for business owners because we form a habit of paying attention, observing, receiving and processing information, and choosing actions to cope with the business and at the same time, communicating to the team for execution; that is the foundation of a strategic business mindset formed with a company of many owners in the future.

That means this instinct of our founders exists somewhere, it’s not that founders don’t have it, it’s even very deep and sharp because we encounter it daily and accumulate over 8-10 years or more.

Follow my channel, and gradually you will be able to answer all the questions and bullet points below.