Acquiring a Company: Cash and Stock Offer

When a company is acquired, there are three main methods:

-

100% Cash Offer: The acquiring company pays the full value of the target company in cash.

-

100% Stock Offer: The acquiring company offers its own shares in exchange for the target company’s shares.

-

Cash and Stock Offer: The acquiring company offers a combination of cash and stock in exchange for the target company’s shares.

This post will focus on the Cash and Stock Offer method.

Case Study

Seller Information:

- Pre-transaction Stock Price: 58,000/share

- Number of Outstanding Shares: 0.25 million

- Pre-transaction Market Capitalization: 58,000 * 0.25 million = 14.5 billion

Buyer Information:

- Pre-transaction Stock Price: 78,000/share

- Number of Outstanding Shares: 0.50 million

- Pre-transaction Market Capitalization: 78,000 * 0.50 million = 39 billion

Offer Details:

The buyer is offering 68,000/share in cash and 0.5 buyer shares for each seller share.

Synergies and Valuation

In addition to the cash and stock offer, the buyer is also offering synergies of 35 billion, which have been estimated using a future cashflow model to predict the merger’s valuation.

Impact on Seller Shareholders

- Seller shareholders will receive 0.5 buyer shares for each seller share.

- This will result in the issuance of 0.125 million new buyer shares.

- Seller shareholders will also receive 68,000/share in cash for each of their 0.25 million outstanding shares.

- This will result in a total cash payment of 17 billion.

Post-Merger Valuation

- The combined market capitalization of the merged company will be 71.5 billion.

- This is calculated as follows:

- Pre-merger market cap of seller: 14.5 billion

- Pre-merger market cap of buyer: 39 billion

- Synergies: 35 billion

- Cash payment: -17 billion

- The post-merger share price will be 114,400 VND/share.

- This is calculated by dividing the post-merger market capitalization by the post-merger number of outstanding shares.

- Post-merger number of outstanding shares: 0.50 million + 0.125 million = 0.625 million

Gains for Seller and Buyer

- The seller will gain 16.8 billion from the merger.

- This is calculated as follows:

- Cash payment: 17 billion

- Post-merger value of seller shares: 114,400 * 0.25 million = 28.6 billion

- Pre-merger value of seller shares: 58,000 * 0.25 million = 14.5 billion

- The buyer will gain 18.2 billion from the merger.

- This is calculated as follows:

- Synergies: 35 billion

- Post-merger value of buyer shares: 114,400 * 0.50 million = 57.2 billion

- Pre-merger value of buyer shares: 78,000 * 0.50 million = 39 billion

Ownership Structure

- The buyer will own 80% of the merged company.

- This is calculated as follows:

- Buyer shares: 0.50 million

- Total shares: 0.625 million

- The seller will own 20% of the merged company.

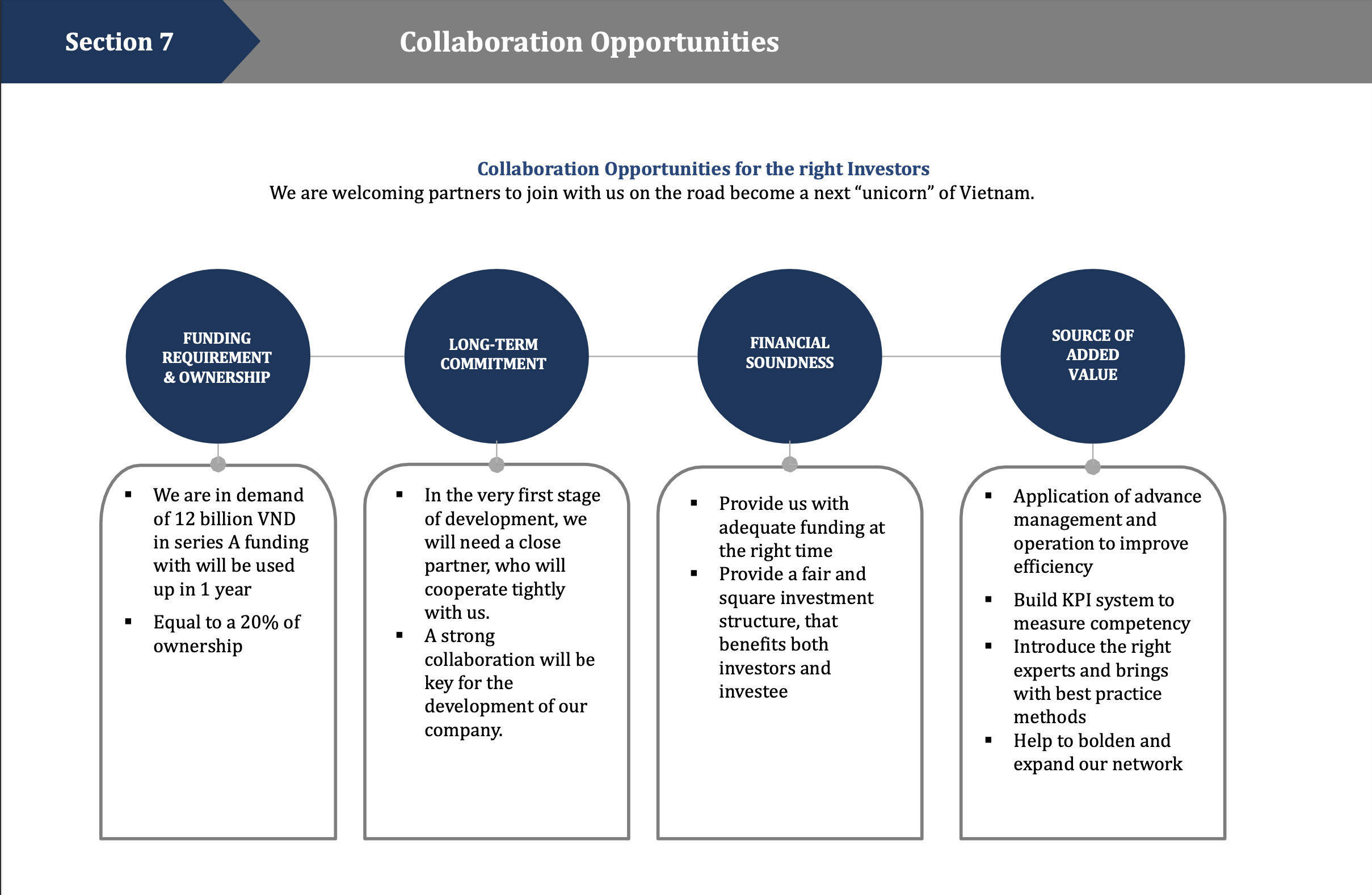

This is an example of an M&A deal presented by Equitix to help founders better understand the process of a company acquisition or merger.

In the financial world, we not only focus on business to generate cash flow, but we also focus on M&A to expand assets more quickly using financial and legal methods and techniques to expand the influence of the BOD.

Depending on the needs of businesses that want to switch to a different industry or want to buy/sell/merge businesses to supplement their competitive capacity and reduce the opportunity cost of self-deployment; We connect, build professional offering profiles, full of market information, opportunities & challenges of the project to offer the parties together appropriately.

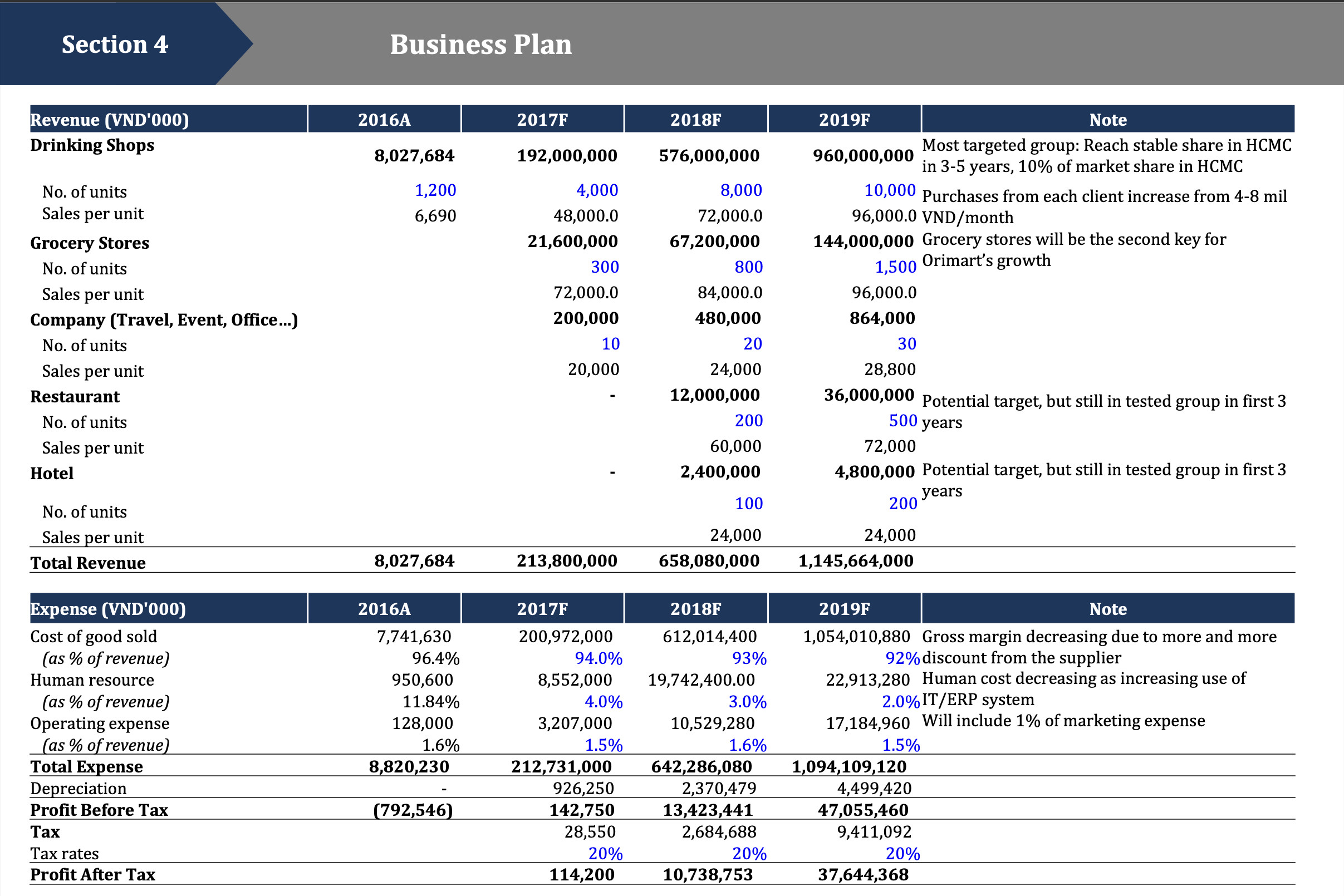

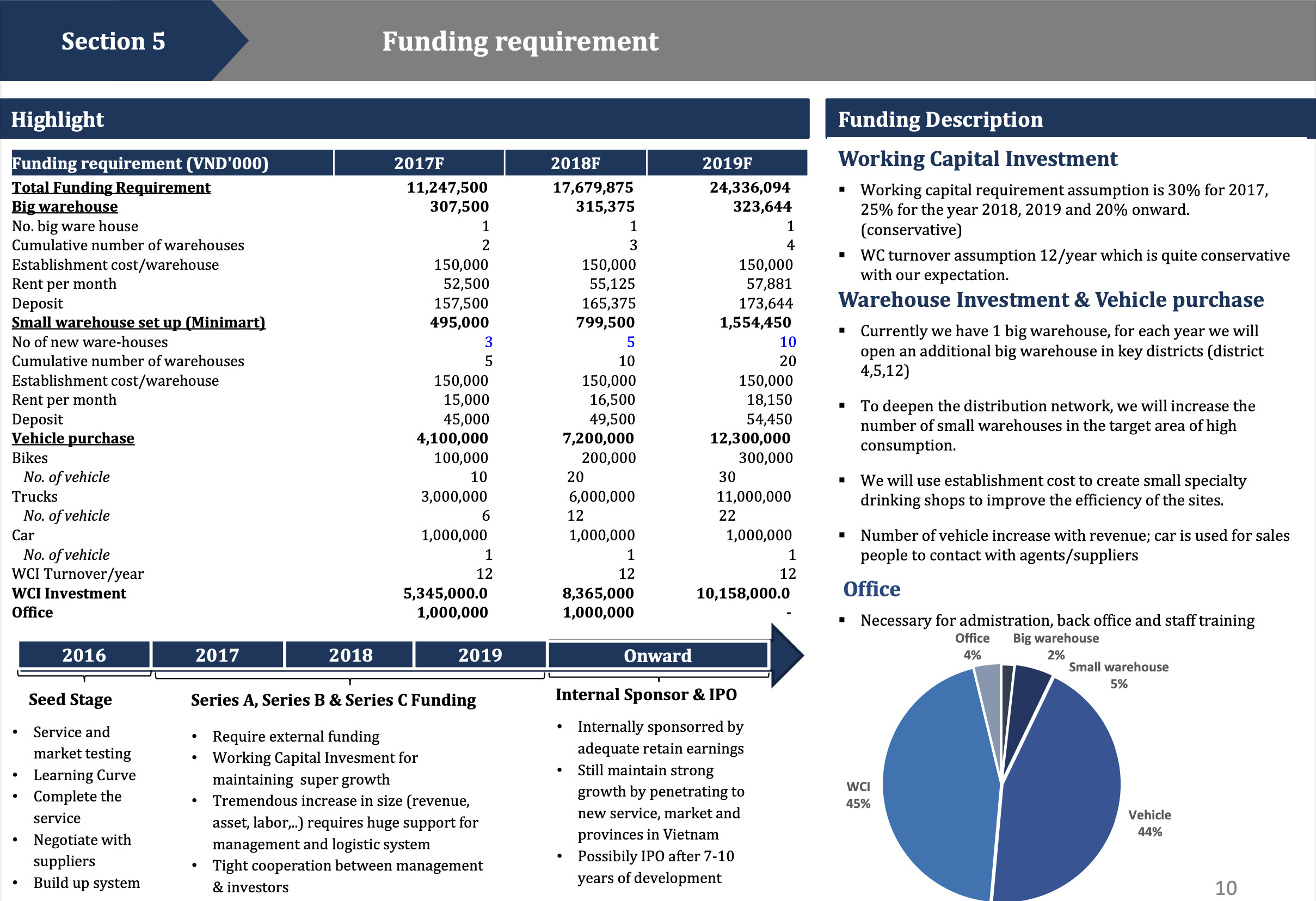

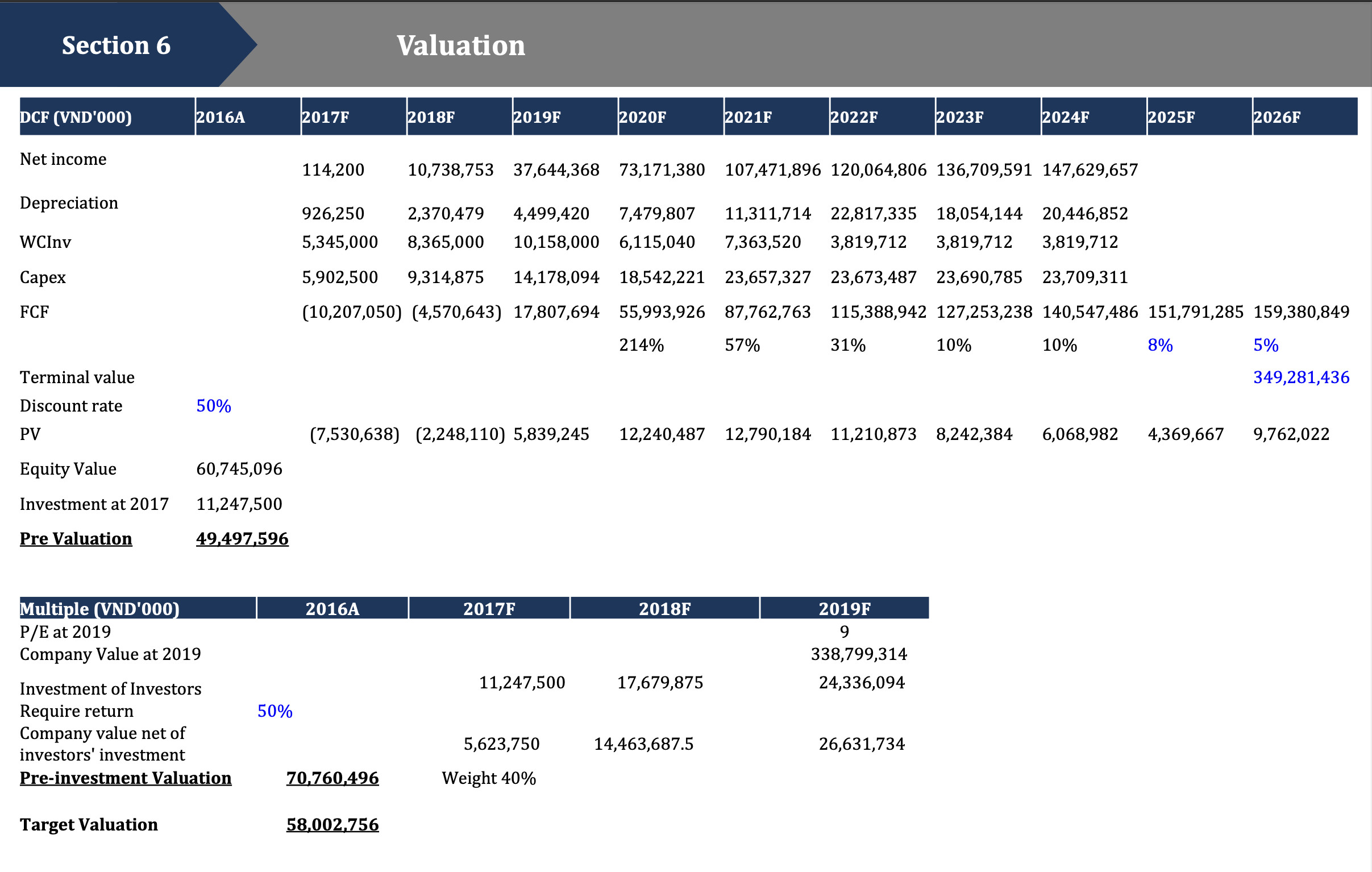

Case Study: FMCG – Logistics – $1 Million Investment in 2017

1. Market size analysis:

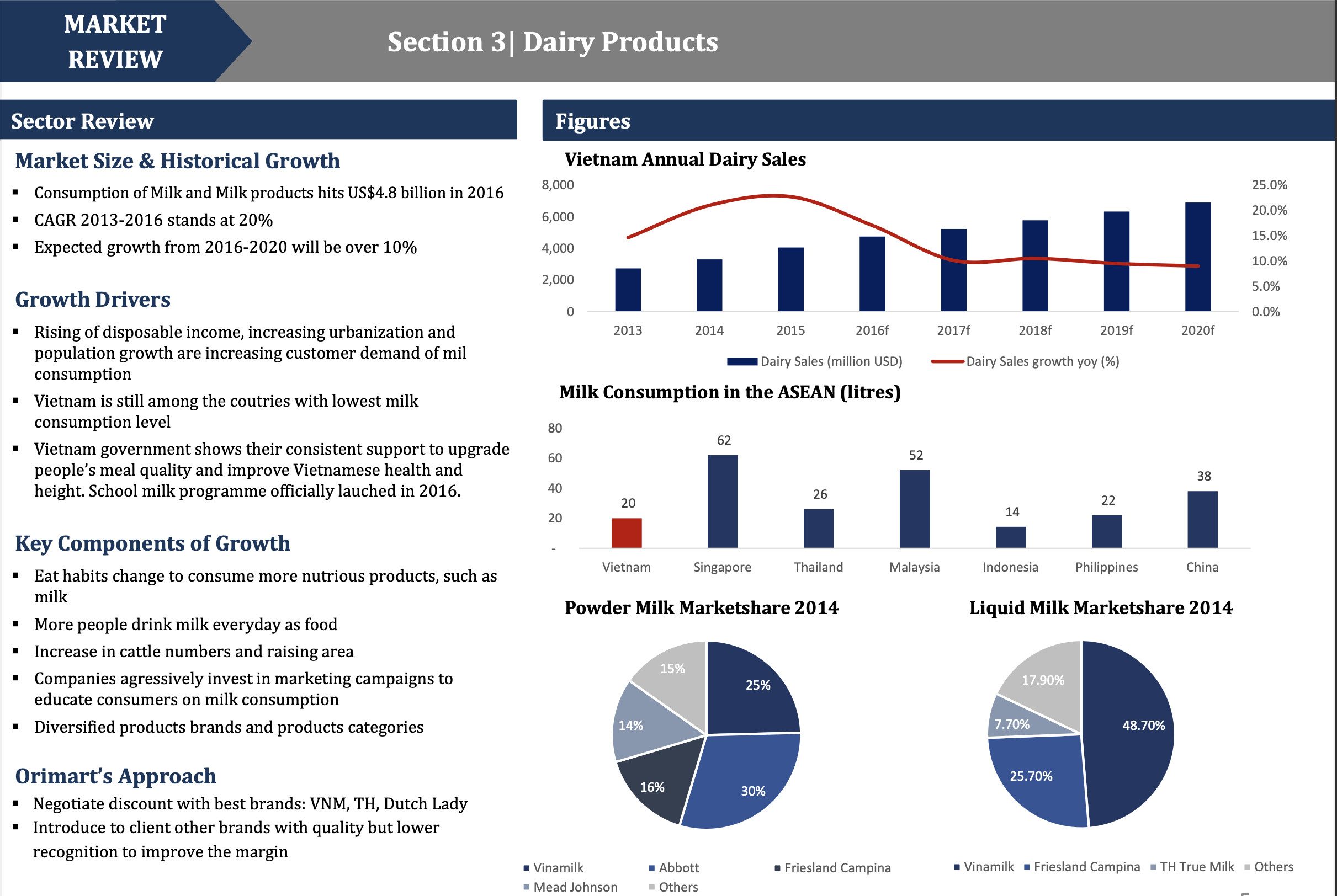

a) Dairy Product