Analysis of Liquidity and Operating Efficiency of Cash Flow.

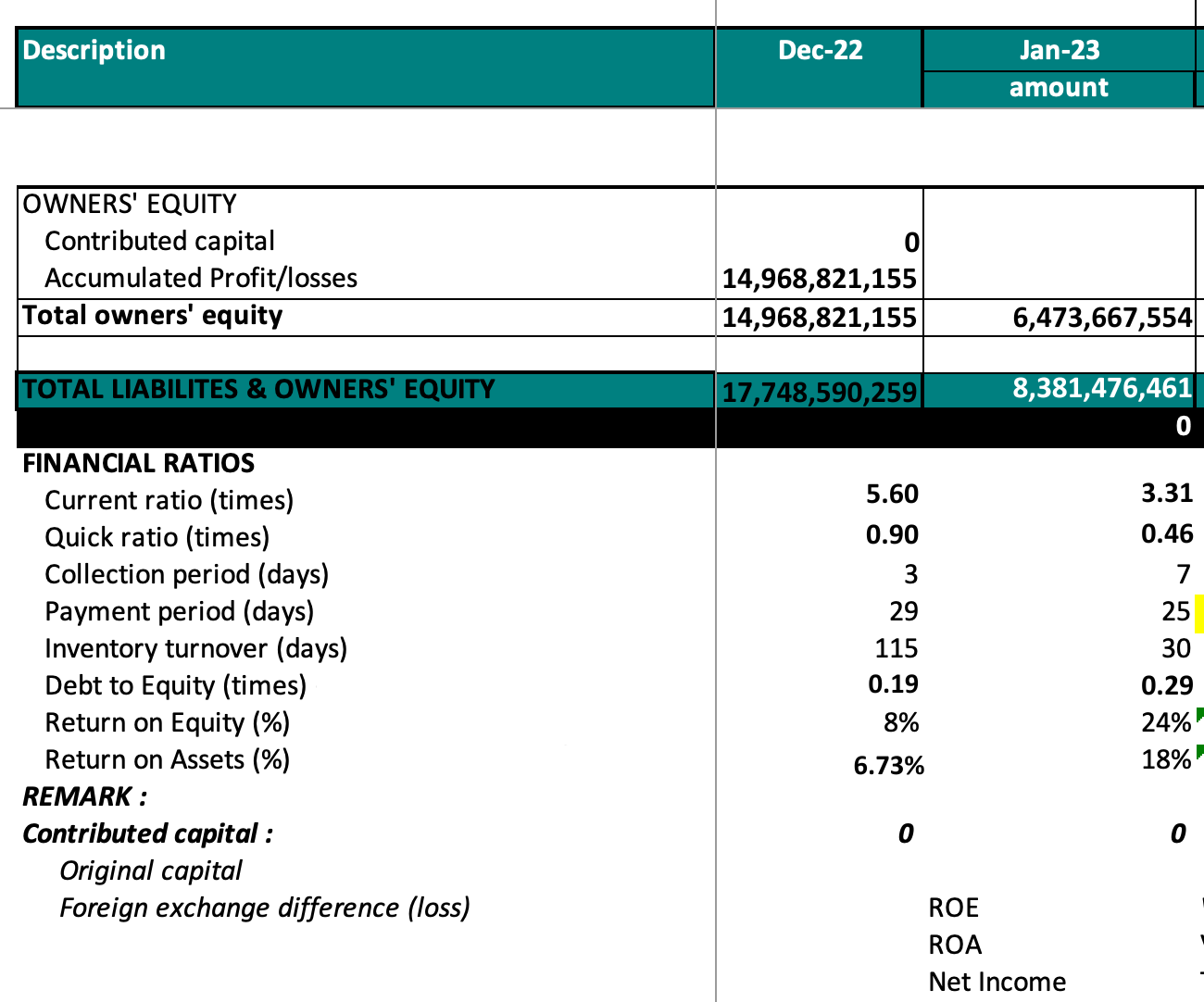

- Short-term debt paying ability: 5.6 times. Current assets are 5.6 times greater than current liabilities.

- Even if we deduct inventory and other less liquid assets, the quick ratio is still around 0.9, which is quite good.

- Initially thought that cash would be collected immediately after sales, but due to online sales, the average collection period is 7 days, increasing working capital.

- Accounts payable to suppliers: 25 days.

- Average inventory days: 30 days.

- Debt-to-equity ratio is only 0.19 times, which is stable.

Unfortunately:

- EBITDA = 28%, which is quite stable. Much higher than companies 10 times the size but with thin EBITDA.

- ROE is only 8% in 2022, the profit generated on equity is a bit low compared to other channels like real estate (11-13%), securities (15-18%), or even banks or gold (8%). Why?

- ROA is only 6.73%, this company does not borrow financial debt, total assets are essentially equity, the profit generated on total assets is 6.73%, the remaining debt is accounts payable. Why?

- The company operates efficiently and has excess cash.

- Buying land, cars, and personal assets.

- Undistributed profits are not reinvested in expanding production and business.

- Equity and assets are disproportionate to the profit generated; because not all assets and equity are invested in expanding production and business.

Meaning:

- This means that the business plan is too conservative.

- Generating 1 million USD but only spending 7 billion VND on the following year’s plan.

- The problem is not a lack of money, but a lack of familiarity with large-scale investment or operation and difficulties in expanding the business, which requires large-scale management and financial management capabilities.

- Without good financial management, inventory is wasted.

- Sometimes money is not the only thing needed, but it’s also about intellect and wisdom.

- Intellect is more expensive than money, intellect creates money.

- Excess money of 20 billion after 5 years of inflation loses quite a bit, around 3.6 billion in value.

- How to preserve money, replicate it, and create healthy future value?

- The company lacks people, not money.

- To get people, you need to transform yourself first.

If a company is not managed based on financial statements and data, all actions are emotional.All strategies without data are just temporary excitement.Finance and accounting will be the main departments for all founders when building their empires.Sometimes having a lot of money is not… a problem for startups, but the mindset of managing money is what… matters.

It’s hard to say. When you have nothing, you will spend freely, but when you have something, you will… save.

#equitix

#phunglelamhai

#Lucas

#ROE

#ROA