ACTIONS IN A CRISIS AND THE DIFFERENCE BETWEEN RUNNING A STARTUP AND A CORPORATION

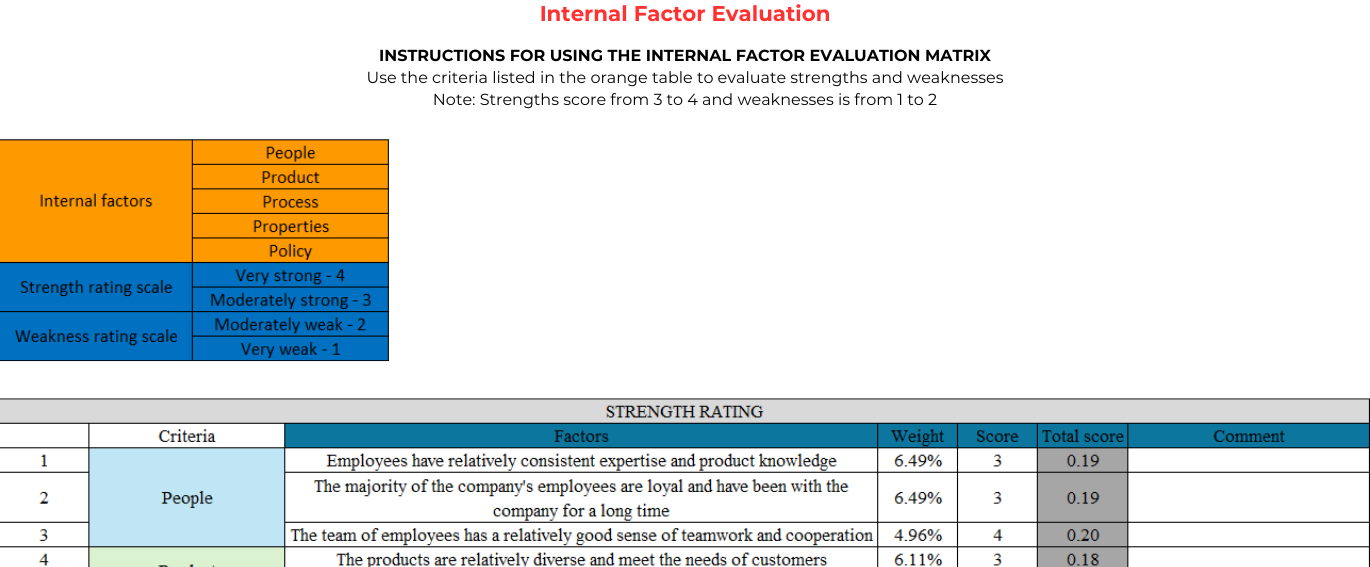

IFE Tools – Internal Factor Evaluation

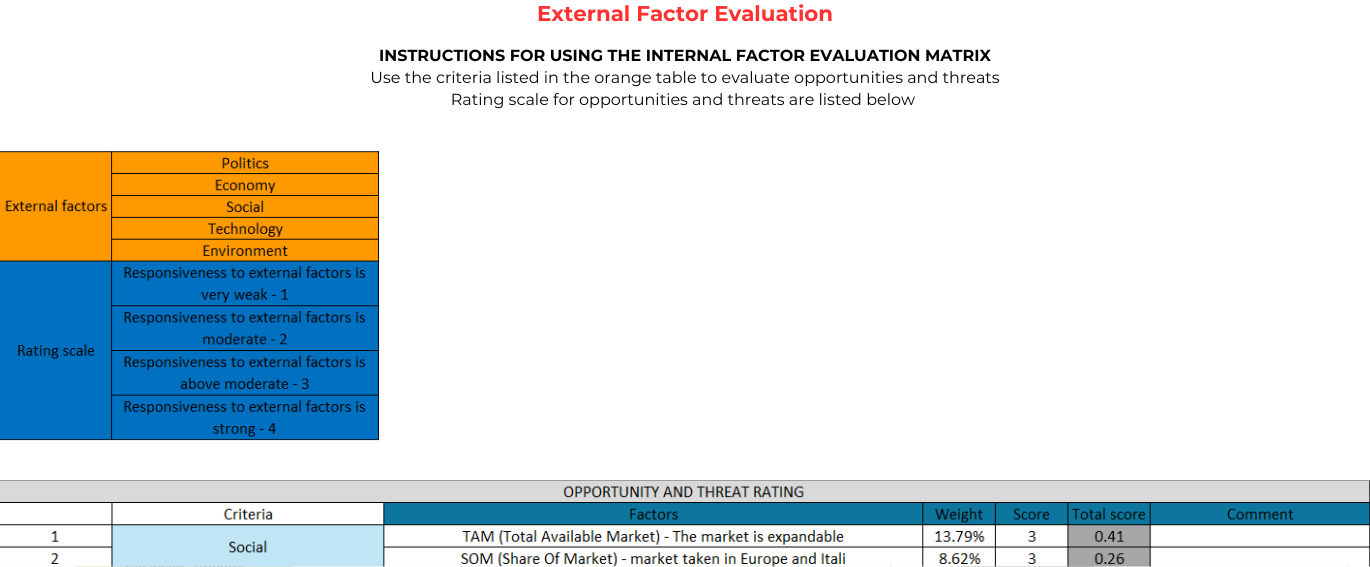

EFE Tools – External Factor Evaluation

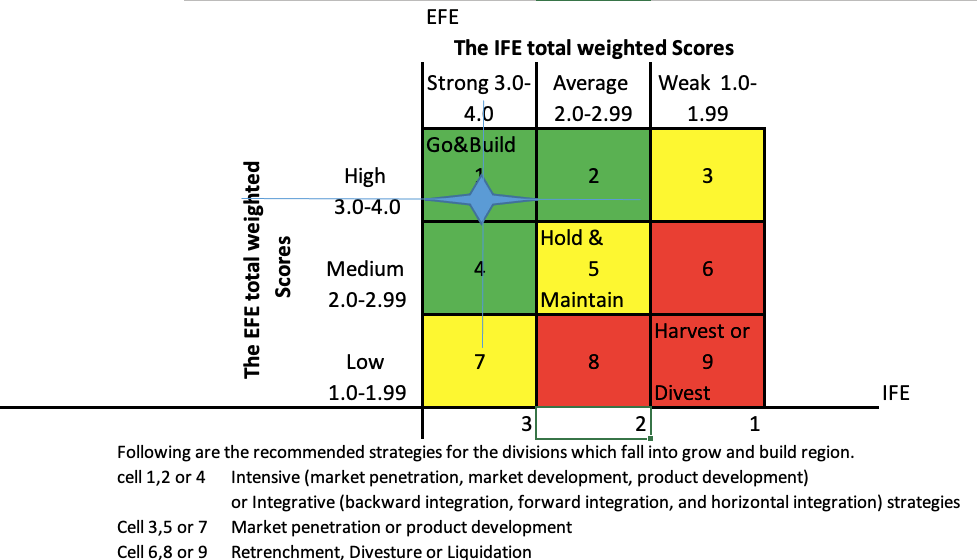

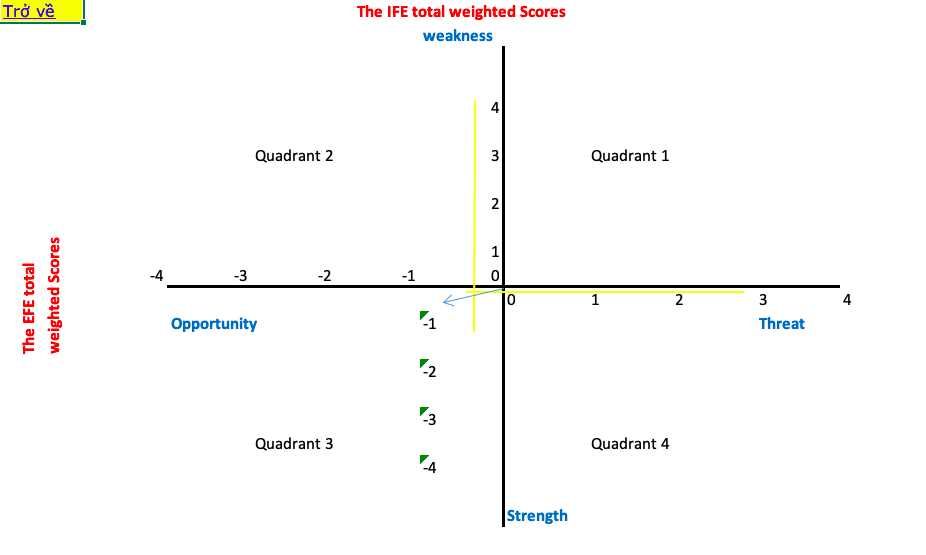

IEM – Strategic Planning

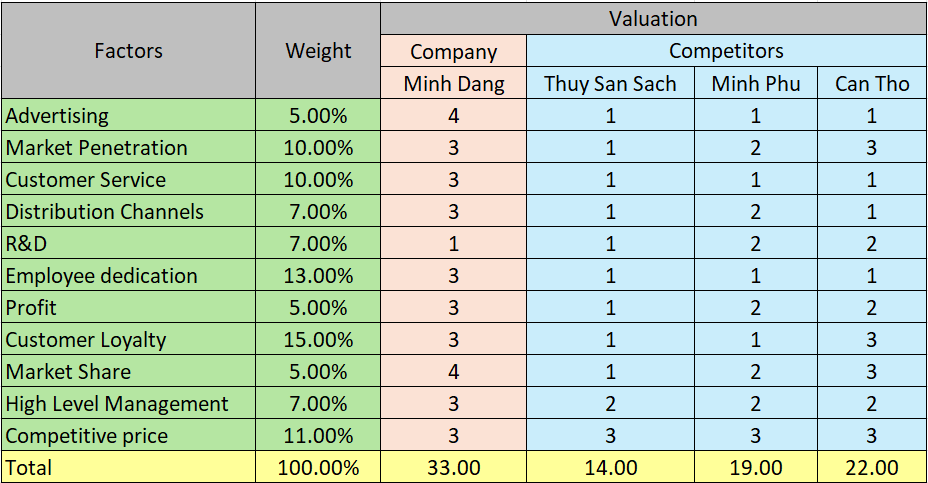

CPM – Competor Profile Matrix

Running a start-up company – when the founders take all profits and bear all risks:

- Freely do what they want

- Lack data

- The company is not fully structured

- Raw information, not needed to be processed through various steps before being helpful in decision making

- Information can be accessed immediately because the information organization structure is simple (only bosses and subordinates)

- There are not many managers and there is no hierarchy

- The number and level of management as well as their income is not yet high

- A wrong decision does not cause much loss of equity, which is acceptable

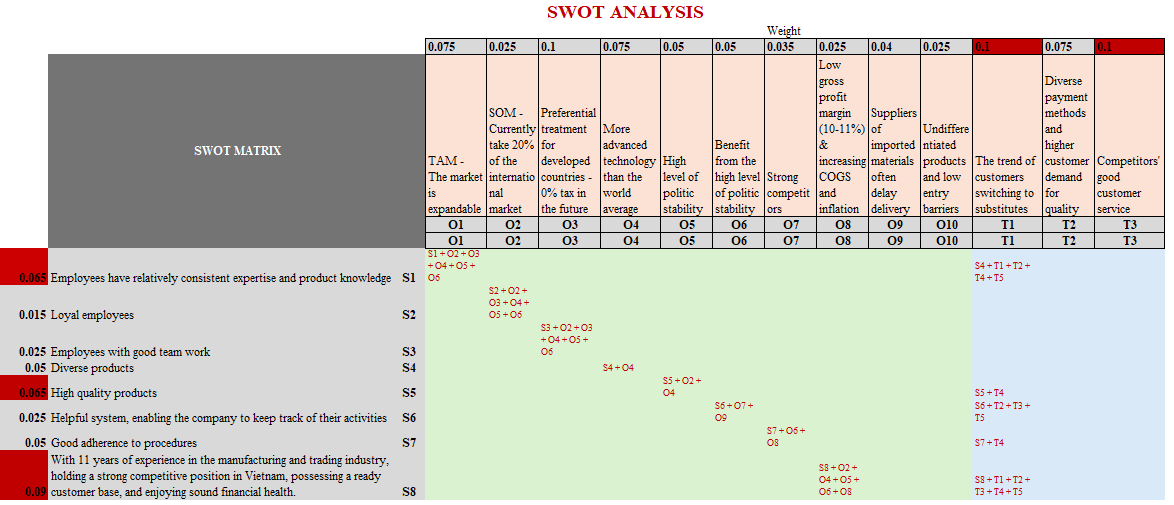

SWOT analysis

When it is a joint stock company

- Decisions are much more difficult: Responsible for your own money and other people’s money

- Mistakes can lead to significant losses of money, people, and opportunities

- Financial deficits can even result in the loss of previously established competitive advantages

- Information is highly dispersed and not centralized in one place

- Reliable information that accurately reflects market and macroeconomic trends is not easily accessible, often leading to reactive rather than proactive decision-making

- The processing of information is very complex

- The number of people and the flow of information involved in making decisions has increased significantly, stretching from the frontlines (customers/sales reps/delivery/accounting/technology…) to the top (CEO/BOD/BOM); and it takes time to navigate this entire process

- In the past, founders could do, think, and act on their own; now, they have to explain, communicate, and use tools to measure whether the entire organization is aligned with the goals you set at the beginning of the year for the Board of Directors

- And importantly, if the wrong actions are taken, it will lead to confusion, waste resources, and a decrease in the equity of founders and shareholders.

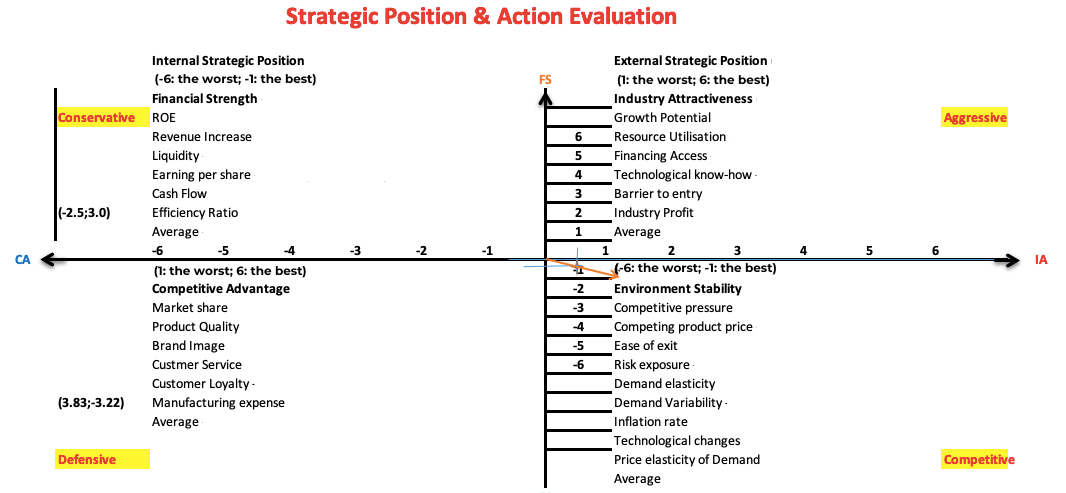

SPACE Matrix

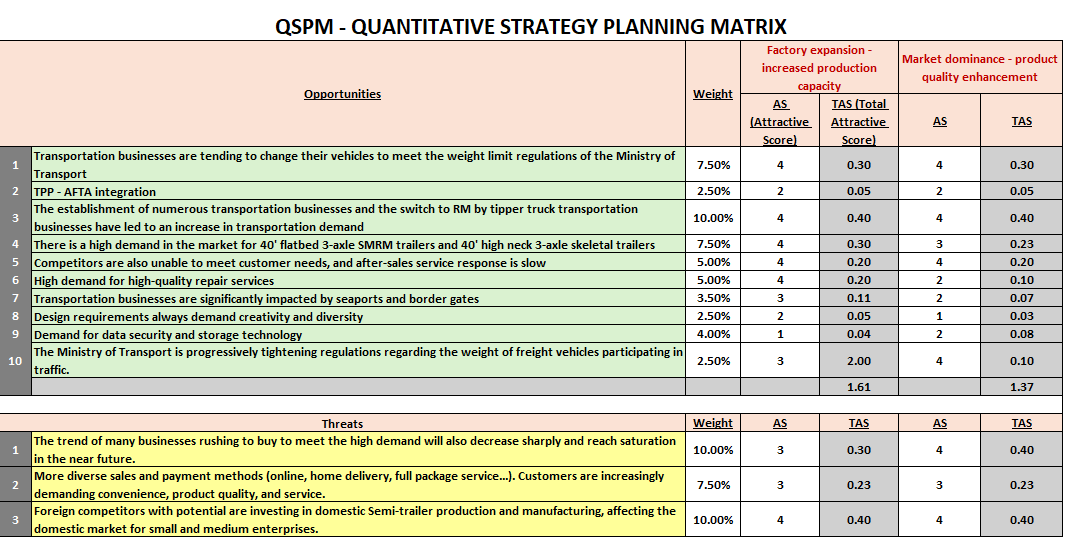

QSPM Matrix

In favorable economic conditions, even doing things haphazardly can lead to profits, as long as there is some effort and dedication. However, when the economy is not favorable, the risk of making wrong decisions that lead to a decrease in equity increases significantly. Irregular meetings are held more frequently to adjust to the changing times.

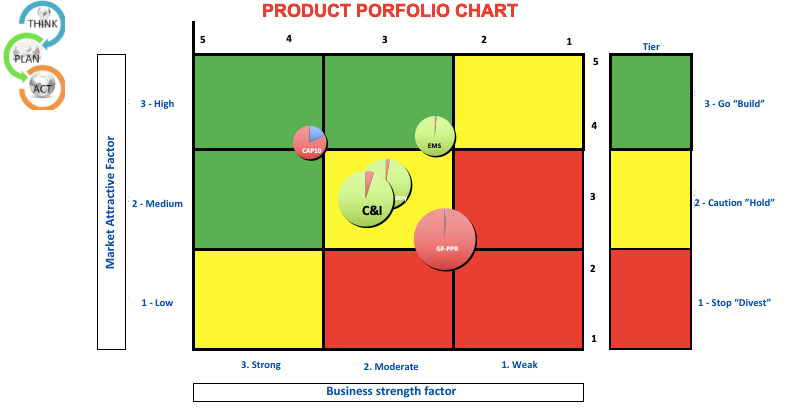

PPC Tools – Product Portfolio Chart

The advantages of breaking things down into smaller, more manageable tasks

Having experience as a sales employee, operations manager, marketer, and financial manager, handling multiple small projects, provides a solid foundation for understanding the company’s future actions. Engaging in various roles fosters a keen sense of action and prioritization, enabling one to discern which tasks should be tackled first and which can follow.

BSC – KPIs: Utilizing measurement tools to assess the performance of individual employees against the company’s annual action plan helps determine whether individual contributions align with the set objectives.

BSC – KPIs are only suitable for owners/founders/CEOs/CFOs and not for HR departments because they lack the ability to understand the business and business level.

So, if the owner does not step into leadership, BSC – KPIs will never be successful.

BSC is very difficult because it requires processing a lot of information and complexity to know what to do/choose/do to preserve or increase the efficiency of capital utilization for the group of owners in the company.

Here are some question-framing techniques to identify key actions based on four broad areas. Founders can refer to these as a guide:

- Company Status: Where are you currently at?

2. Goals: Do you have specific, budget-based annual targets (revenue, expenses, profits)?

3. Market Conditions: How are the surrounding market conditions (competitors, macro factors, financial markets, etc.)?

4. Investment Decisions: Are the investment decisions made to preserve or increase equity aligned with the goals? How can goal number 2 be achieved?

Grand Strategy Matrix

Currently, Equitix offers intensive founder-focused courses on management, governance, and in-depth business understanding from a financial perspective, as follows:

a) Course 01: Finance & Accounting for non-finance founders: learn to speak the same language as your finance and accounting team for business operations and asset management, and understand the language of shareholders and professional financial investors.

- 4-6 sessions

- Tuition fee: VND7.5mn /person

- Early bird registration: VND6.9mn/person

- Group registration: VND6.5mn/person

b) Course 05: Business Operations, Organization & Management According to Financial Plan (Revenue, Expenses, Profit)

- 4 – 5 sessions Tuition fee: VND6.5mn/person

- Early bird registration: VND5.9mn/person

- Group registration: VND5.5mn/person

c) Course 02: In-depth BSC Course – KPIs, From Strategy to Implementation in the Process of Receiving Capital from Investors 12 sessions

- Tuition fee: 35,000,000 VND/person

- Early bird registration fee: 32,500,000 VND/person

- Group registration fee:

- Group of 2: 32,000,000 VND/person

- Group of 3-4: 31,000,000 VND/person

- Group of 5 or more: 29,000,000 VND/person

d) Special Discount Course: 39,000,000 vnd (Original Price: 49,000,000 vnd). Students will have access to all of Equitix’s online and offline courses for 1 year.

e) 1:1 Finance Mentorship Program

- Evening sessions (6-10 sessions)

- Tuition fee will be quoted based on individual needs (after a 1:1 interview) and will vary depending on the business model, existing accounting data, the specific challenges faced by the founders, and the need for privacy and data security.

f) F1 Mentoring Program – Asset Management

- Tuition fee will be quoted based on individual needs (after a 1:1 interview) and will vary depending on the business model and your level of commitment.