ONE OF THE COMPANIES THAT EQUITIX IS DEEPLY COMMITTED TO, PROMISING TO MAKE HISTORY TOGETHER IN THE NEXT 10 YEARS

There are entrepreneurs who are overly theoretical but lack practicality, and there are entrepreneurs who rely heavily on experience. Currently, the knowledge of many Founders is fragmented and piecemeal, with methodologies that lack coherence and include many misconceptions, misaligned perspectives, and inaccurate views on Vietnam’s market context.

THE UNIQUE TRAIT OF F1, F2, F3; FUNDED COMPANIES AND SENIOR EXECUTIVES TURNING INTO FOUNDERS/CEOs

These future leaders must deeply understand finances. They need to grasp how much harder it is to manage money and bear ultimate responsibility compared to merely observing or benefiting from pre-existing resources.

2025 MARKET FORECAST – HOW SHOULD FOUNDERS RESPOND?

Weak businesses will collapse entirely in 2025. When Trump imposes tariffs and these companies’ asset values decrease, they will sell themselves to international “sharks.” Foreign Direct Investment (FDI) will bring USD to rebuild and restructure these businesses.

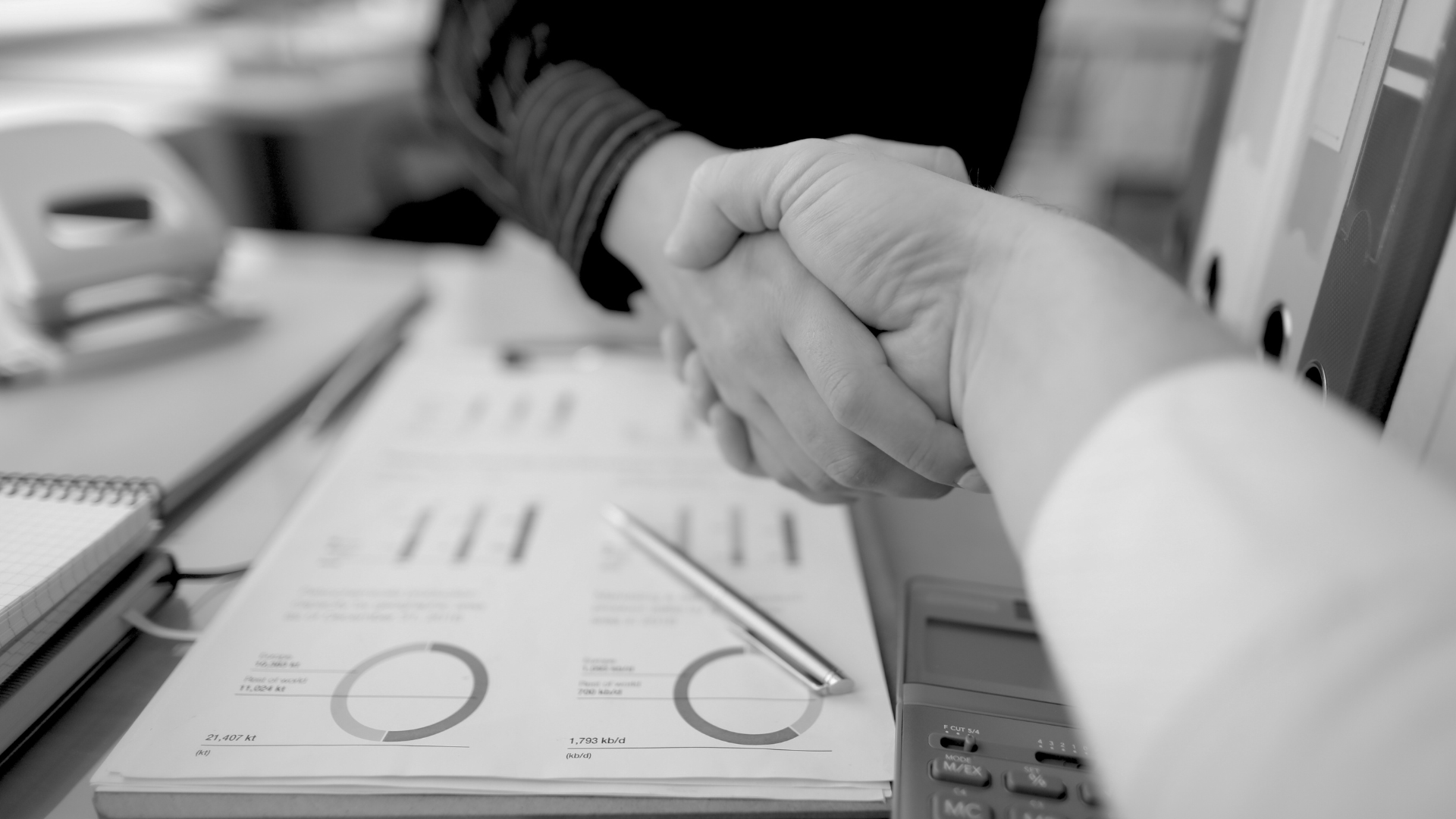

SYNERGY – THE COMBINED STRENGTH AFTER M&A

When negotiating your company’s valuation with investors or strategic partners, it’s crucial to thoroughly understand the added values (synergies) and the actual benefits derived from the proposed investment. Overlooking these factors can directly impact the price you agree upon—and ultimately the funds you secure.

A NEW LEADER/FOUNDER IS LIKELY TO EXHIBIT ONE OR MORE OF THESE LEADERSHIP STYLES

To attract talent, be a founder and CEO who avoids the following mistakes. It’s okay to ignore small mistakes, but you can’t do big things alone. It’s the effort and hard work of a whole team of suitable people with complementary abilities.

WHY IS THE FOUNDER LONELY (PART 1)

The majority of a founder’s solitude, isolation, and pressure stems from financial concerns. However, many founders, while skilled in management, often lack a deep understanding of finance and cost management. This gap in knowledge can lead to numerous challenges, particularly when it comes to managing teams and making strategic decisions.

WHY IS THE FOUNDER LONELY (PART 2) – HR DEPARTMENT

Global standards might sound intimidating, but they’re not as complex as they seem. It’s not about technology or open policies. The true global standard is ‘keeping money in your pocket is more important than how much you earn.’ Saving money is more critical than making it. It reduces the strain on society’s resources.

HOW A FOUNDER/CEO CAN CULTIVATE A CALM MIND TO MAKE CLEAR-HEADED DECISIONS

Having intelligence without emotional intelligence is like having a powerful engine but no steering wheel. It’s hard to navigate challenges and inspire others. On the other hand, having great emotional intelligence but lacking the skills to execute can limit your impact.

WHY SHOULD YOU INVEST IN A VALUABLE FOUNDER-ENTREPRENEUR?

- They work for good relationships.

- They work for a supportive network.

- They work for personal growth and the unique experiences gained from taking risks and doing difficult work.

- They work because they provide valuable products and services to the community.

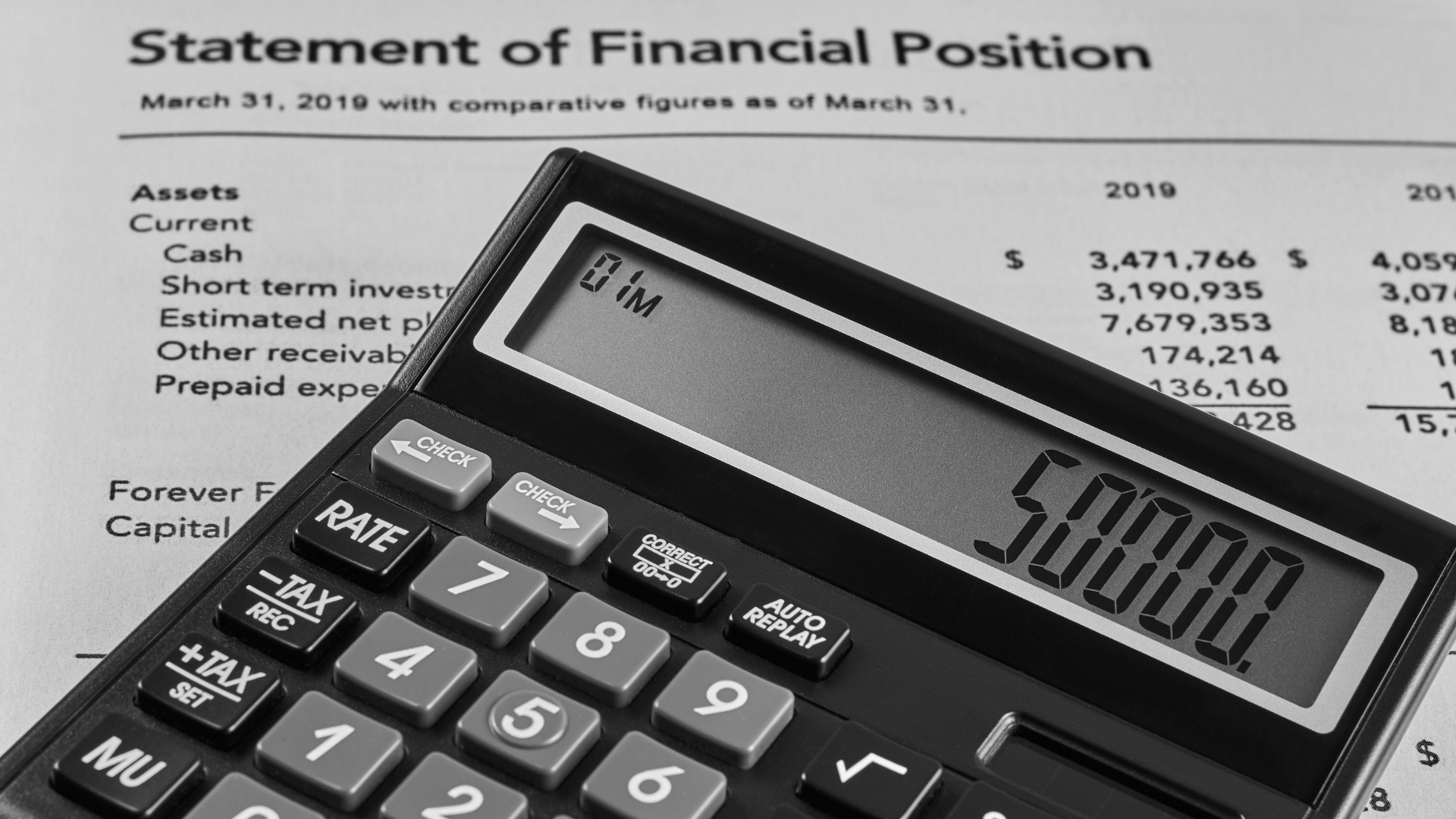

EBITDA AND THE ASSOCIATED RISKS

If we only focus on profits and not on cash flow, the company may easily miss all of its issues. EBITDA is not Cashflow. Experienced investors can see through this right away. Especially bosses who have risen from accounting and finance; they will definitely negotiate a lower price.

TEMU’S ATTACK ON THE VIETNAMESE MARKET

Essentially, Temu’s attack isn’t anything new. It merely highlights the existing lack of competitiveness among Vietnamese sellers. Those who have successfully built brands and established independent supply chains will continue to thrive. However, those who have been relying solely on platforms and have not diversified will face challenges as platforms adjust their strategies.

HOW CAN YOU INSPIRE MY COLLEAGUES TO BELIEVE THEY CAN ACHIEVE THEIR FINANCIAL GOALS

Of course, not everyone should be given ESOPs. Those whose worldview is still limited to basic necessities should not be brought into this picture. It should be for long-term members of the company or those who express a desire for long-term commitment.

THE HOUSE OF BUSINESS OPERATION FROM A FINANCIAL VIEW

Are you tired of seeing countless business plans that lack a solid financial foundation? As a CEO or Founder, you’re bombarded with information daily. But how do you know if it aligns with your business model, whether you’re in manufacturing, commerce, services, or technology?

HOW DO STRATEGIC INVESTORS COME UP WITH NUMBERS WITH THE BUSINESS OF THE ENTERPRISE?

The SWOT framework by Equitix suggests bullet points that startups/SMEs need to answer and explain thoroughly to professional institutional investors – investors who have zero knowledge like ourselves but have accumulated capital for 60-100 years.

WHAT DO F2 – F3 LEARN FROM SHARK TANK?

People who understand money will make money, while those who don’t will have lessons and experience. Money flows from those who don’t understand money to those who have experience with money.

[SHARK TANK] SEASON 7 – EPISODE 4 – DEAL 1

The founder may have pitched a bit early in their business journey, perhaps due to the challenges of finding co-founders in a rural area. However, the deal, while premature from an investment standpoint, provides valuable learning experiences for the founder.

[SHARK TANK] SEASON 7 – EPISODE 3 – DEAL 1

Basically, Riki and Shark Bình will be co-founders of a new business. I think Riki should completely separate themselves from the factory/distribution system, even sell 51-70% of it. Use that money to focus on the new business, not just 1/3 of their focus as Shark Bình suggested, but 100%.

[SHARK TANK] SEASON 7 – EPISODE 3 – DEAL 4

Realistic Valuation: A revenue of VND75bn seems more reasonable, which would lead to a pre-money valuation of around VND225.9bn with a 30% EBITDA.

Growth Opportunities: The company could attract more investors if it prioritizes sales, distribution network development, and brand building.

[SHARK TANK] SEASON 7 – EPISODE 3 – DEAL 3

Agriculture’s Potential: Vietnam’s agriculture sector has immense potential, capable of serving a population of 500 million. With a significant portion of the population engaged in agriculture, coupled with global food shortages, the industry is poised for substantial growth and exports.

[SHARK TANK] SEASON 7 – EPISODE 3 – DEAL 2

All 5 sharks are not FMCG experts or wholesalers, so their guidance is not aligned with IPP Group and IPP Sachi’s strengths. With a large fixed asset system, depreciation could reach 5%. D2C is a different skill set and requires a completely different company operation.

[SHARK TANK] SEASON 7 – EPISODE 2 – DEAL 2

However, the biggest challenge for social impact businesses is to maintain their social impact DNA, rather than just using social media messaging to carry out business activities. That’s the difficulty. Founders must possess both a kind and compassionate heart; but they must also be able to calculate, think logically, weigh the pros and cons for the business, and manage finances transparently and clearly.

[SHARK TANK] SEASON 7 – EPISODE 1 – DEAL 2

Fundamentally, the deal structure is highly risky, but it’s uncertain whether it can guarantee an xx times return on investment.

If we delve deeper into the accounting, the cost calculations are not entirely accurate, however, given the small size, it’s not necessary to delve too deep into the nature of the costs.

[SHARK TANK] SEASON 7 – EPISODE 1 – DEAL 1

This business model necessitates substantial investments in a central kitchen or large-scale manufacturing facility in the future, resulting in significant fixed costs. Consequently, the company will need to sell large quantities of products to reduce costs. This requires the establishment of a distribution network (wholesalers, distributors, retailers, etc.) or even export.

A MIDDLE MANAGER WITH QUALITIES THAT A FOUNDER MIGHT WANT TO PAY SPECIAL ATTENTION TO

From Equitix’s perspective, a great founder is someone who can identify the qualities in their middle managers that make them suitable for higher positions. By placing the right people in the right roles, founders can focus on more strategic, high-level tasks. So, what are the signs to look for when considering promoting someone to a higher position?

TO BE RESPONSIBLE WHEN GIVING ADVICE ABOUT BUSINESS DECISIONS TO SOMEONE

Analyze the current cost structure.

- Objective: To understand where the actual accounting data is allocating costs. Identify patterns and benchmark standards for cost usage.

- Target audience: Finance and accounting professionals with a strong focus on reading costs, accounting entries, and financial statement audits.

UPCOMING OPPORTUNITIES FOR VIETNAM

Japan is currently a very active group of investors, diving into a wide range of sectors including: Food and Beverage (F&B), healthcare, logistics, technology, and factory acquisitions across various industries. Of course, besides Japan, there are many other FDI groups.

Doing business with the Japanese requires a highly structured, precise, cautious approach, and strict adherence to procedures.

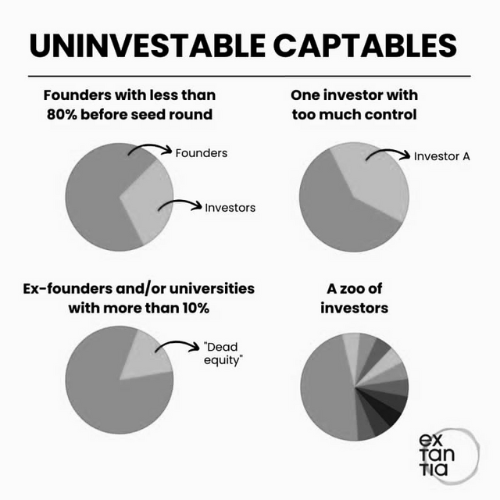

[CASE STUDY] A FOUNDER OWNING LESS THAN 36% OF SHARES AND OTHER SHAREHOLDERS

Case overview:

- 15 shareholders: The company is owned by 15 individuals, with the founder holding the largest share, 36%.

- 14 other investors are members of the BOD and specialized departments.

- Funding round: A new investor is planning to invest in the company through two methods: increasing the company’s capital (equity financing) and buying shares from existing shareholders.

HOW INFLATION AFFECTS BUSINESSES

The increase in USD/VND and the increase in input costs will increase the cost of goods, while selling prices cannot increase or businesses wait for each other to increase prices according to game theory. Inflation is a state of currency devaluation, manifested by:

- Increased prices of goods

- Decreased portions or quantities

Equitix Investing and Associates is seeking deals with a budget of 1 million to 100 million USD

Food and Beverage (F&B): This includes distribution, retail, food courts, entertainment, etc. Budget: 1-20 million USD.

Healthcare, Beauty, Wellness. Budget: 1-20 million USD.

Retail: This covers a wide range of retail sectors, including home appliances, baby products, fashion, education, lifestyle, and electronics. Budget: 1-50 million USD…

What should a founder prepare before seeking investment from an institutional investor?

Equity Offering Document – two versions (Teaser Version: 4-8 pages and Full Version: 50-70 pages), Due Diligence (Legal Review, Operational Review, Financial and Accounting Review), Valuation (Comparable Company Analysis, DCF Analysis, and EBITDA and Enterprise Value Multiples), and Transaction Structure (Capital Increase, Secondary Share Sale, Majority Stake Sale, and Investor Type).

ANTI – DILUTION AND LIQUIDATION PREFERENCE

Professional investors and founders always consider the possibility of the invested company’s dissolution, bankruptcy, or liquidation.

Every industry has a lifecycle. In a market with well-established brands, sticking to a business with little room for growth may not guarantee efficient capital utilization or a quick return on investment for the owners.

THE SECRET OF THE COMPANY BUYING 25 BILLION LAMBORGHINI RUNS ON THE ROAD WITH THE POSSIBILITY OF GOING TO JAIL FOR CRIMINAL CRIMES FOR NOT UNDERSTANDING…?

With profits made on average sales of 20 billion…

But when he opened the account, the president had a sum of money up to 145,961,691,086 VND (~146 billion). What will the president do when he opens the account and sees the amount of money?

THE VALUE OF A WOMAN WITH A FOUNDER/KING – SOMEONE WHO ONLY HAS BEAUTIFULNESS IS NOT SURE THE ONE TO MARRY

A person who understands finance will understand the value of a woman next to him.

If using the discounted cash flow method, evaluate the future value of a woman; Then bring it back to the present, to try to find a way to increase the value of a woman to the founder…

10 CHARACTERISTICS THAT MAKE BOSSES AND FOUNDERS LOSE POINTS IN THE WORK OF MANAGEMENT AND ATTRACTING TALENTED PEOPLE

“As a master, narrow-minded, shallow in perception, jealous, jealous, conservative and suspicious, scheming but not decisive, strong-mouthed but cowardly, many soldiers but inconsistent in command, arrogant, The orders were not clear; the father let his children use their troops arbitrarily, fighting for the throne, the monarch used relatives rather than talented people”…

WHEN WE AS MEN COMPARE VALUE, WE ARE BEHIND A … DOG

From the perspective of finance and economics, whoever spends a lot of money and brings a lot of credit (debt) to the economy is better off. … worth, we rank according to the above criteria as follows:

Women (mother, wife, lover…) – Children – Dogs – Men.

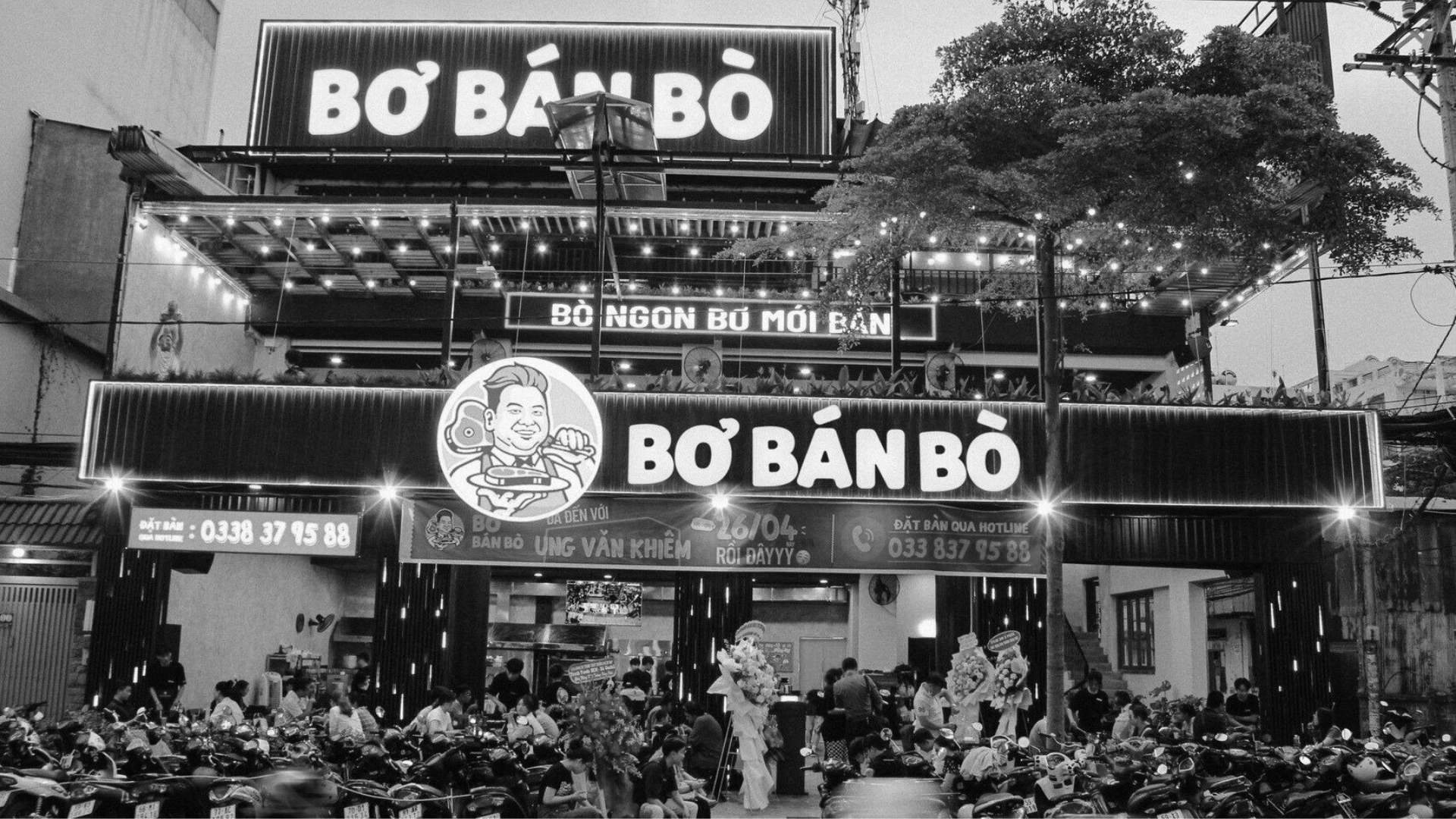

[…]SECRET GROWTH IN BƠ BÁN BÒ – 40% of XEMESIS RANGE 10 – 12 FAST PRICE RATIO

EBITDA 15%, BEP 16 days, 6 months capital recovery if done well, not an important core point of BBB.

Actually, CASH (Cash Flow) is the strong key of BBB.

Open quickly + replicate quickly in the FnB industry with a cash conversion cycle of (27) days. […]

HOW DOES LEARNING TO BE A BOSS, BE A KING, BE A OWNER DIFFERENT FROM BEING A CEO?

If a founder is good at holding generals, he doesn’t need to set up a battle. If someone is good at planning battles, there is no need to fight. If you have a champion who is good at fighting, you will not lose. If a founder is smart, he won’t die if he loses.

…

XEMESIS LEAVES BƠ BÁN BÒ – CASE FnB IS YOUTH’S IDOL – THE ARTIST’S BUSINESS … FEATURED?

In the first few months of opening, Bơ Bán Bò (BBB) did quite well in terms of Marketing, operations and customer experience from the perspective of a Secret Customer…

The problem is how long the brand will last.

BƠ BÁN BÒ WITH 16 DAYS BREAK-BOWN AND 6 MONTHS PAYBACK, IS IT FEASIBLE?

Team BBB knows the advantages of the Xemesis + Xoai Non effect and they grow fast and are capable of meeting this (ie operating capacity) from choosing the concept, area and investment cost, choosing the source structure human resources (40 – 50 people) and set up the customer experience journey from ordering to driving the car… It’s not something a dreamer can do.

THE RELATIONSHIP BETWEEN THE ABILITY TO MAKE RIGHT FINANCIAL DECISIONS AND THE FINANCIAL POSITION OF FOUNDERS (and F1)

The common point of F1 (you take over hundreds of billions of assets from your parents) and the founder is invested it is about financial comfort when making decisions, But the dead point also comes from here. […]

BEING PEOPLE IN THE INDUSTRY, DON’T COMMENT WRONGLY TO ACCOUNTANTS

A few years ago, as an undercover team in the e-commerce industry, Mr. Phung Le Lam Hai – Founder and General Director of Equitix Investing and his brothers His brother is associated with digital, platforms, websites and in 2017 introduced website products for customers to optimize web standards to push traffic up.

He thought everyone is like him…

PROTECT YOUR FINANCIAL POSITION OR REGRET LOSING YOUR POSITION?

If you understand how difficult it will be to regain a lost financial position; You will have a different way of spending money than you do now.

Entry point; Financial position is something that takes many years to build; Don’t knock it down easily just because of your passion, standards or unwillingness to take a step back to look at the market and customers.

TAX FINAL SEASON IS COMING, HERE ARE SOME TAX INSIGHTS FOR FOUNDERS

The trend is to purify the market so that you guys can do it properly, do it really… big. To move, founders want to do it in not 1 or 2 days.

This information and insights are the working information of the companies that Equitix discussed and shared with you guys. Try to comply with standards and fundamentals for sustainability!

IS CAPTABLE (STOCK DISTRIBUTION TABLE) BROKEN?

Many founders have very good businesses, but get stuck in the capital structure allocation table because of 4 basic mistakes.

To create financially healthy companies, manage money and develop sustainably through economic crisis cycles, top management members must be truly connected and shareholder relations must receive significant attention.

THE 5 GROUPS OF MEN THAT WOMEN FOUNDERS WILL MEET IN THEIR LIFE

The reason why female founders start a business mostly comes from family pain or depending on someone’s economy or the image of their mother’s dependence on dad’s economy, or the image of his family not being so well off in the past as the main driving force for growth and change.

[…] These girls were divided into 5 groups…BUSINESS OWNER’S WIFE/FOUNDER’S WIFE

In wealth management, it turns out that the relationship between founders and relatives is most related to the role of money, emotions, family & they are especially related to business.

In the big family (i.e. business), we also have to find a common destination for all officers and brothers. Then in the second small family, what we also need to do is establish a vision for this small but important family.

CRISIS IS COMING CLOSELY

What to say about businesses far away. Whenever she sells bread, she sells sugarcane juice, he sells sticky rice, she sells vermicelli, it’s understandable, that’s reality.

What is the profit and loss, how the assets are,… these people totally hold. And the business is so big that the accounting department is so weak that we don’t know what we’re really like…

WEALTHY PEOPLE DEFINITION

If you have faith… you are the one who changes the status of your family in the future, join the club of founders who learn to think. Think and think like a financier first.

If you don’t start, maybe in the next 10 years, you will only have to … reincarnate to change your position instead of working as a hired worker or suffering from crises at the age of 35-40.

Because Wealthy People often talk about…

ACCOUNTANTS NEED TO BE CORRECTLY AND REGARDLY RECOGNIZED

In investing, there is a saying like this, it doesn’t matter how much money you earn, what matters is how long you manage and keep them in your pocket.

That is the role of the accountant, the accountant will tell you how you use your money and whether it is really reasonable or not.

3 THINGS TO DO TO BE BETTER THAN PEOPLE

Learn to know the standard, vision and self-suggestion to work towards that standard; Act fast and learn from customers and the market, the market is our greatest teacher, they will tell us if the product and approach are right (not too early or too late); Sales, market research and adjusting what you have… to be close to reality, a product that is too good may not sell to customers who don’t need it right now.

TO PARENTS, AUNTS AND UNCLES, BROTHERS AND SISTERS!

There are so many leaders, who allow them to go deep into their hearts and inner worlds with openness, acceptance after a period of defense and sharing to come after that… feeling emotional breakdown.

There are moments, they are alone in their own business…

HOW MUCH IS YOUR COMPANY WORTH?

When a shareholder and investor wants to contribute capital to you, but you do not know how much to bid on your company… The value of your company consists of 3 categories:

a) The value you have made in the past (the last 3 years)

b) The current value of the company you are operating and reporting recently

c) Future value of the company

CEO KPIs

In the bank of KPIs (Several thousand KPIs) that Equitix Investing team synthesized during BSC – This KPI for about 20+ businesses, share some perspectives for you about KPIs of specialized CEO position.

Referring to the CEO’s KPIs helps you imagine what indicators the CEO should bear in operating & developing the company when it is large-scale.

PAYING THE RIGHT SALARY – FOUNDER’S PEAK IN USING HUMAN

In fact, the greatest art in employing people is the ability to pay them according to their qualifications, not ‘overpay’ or ‘underpay’. We can’t say he looks ‘competent’, all feelings will be at the expense of…feelings.

So it’s easy to overpay or underpay, IT’S HARD TO PAY THE RIGHT SALARY.

STORIES AND KEYS OF BUSINESS SEGMENTS (Startups + SMEs + Corporations) & SIGNS OF SUCCESS

Startups + SMEs + Corporations to avoid: Using money without feeling what it is used for and where it is… High EGO (Ego), awareness and understanding of money, finance – accounting, asset management; Don’t take the time to act, evaluate and find the right talent for the next decade…

WHERE IS THE MONEY GET IN THE LAST 6 MONTHS – PREDICT THE YEAR-END RATE WILL GROW

The sad news is that it is easy to see that some guys’ houses are forced to be taken because they no longer have enough money to pay interest and want to sell their house even though it is reduced, but they can’t sell it even though they really want liquidity. At the end of 2023, the State Bank will announce a sharp increase in interest rates, if left for a long time, society will be chaotic.

BRAND VIEWS IN FINANCIAL VIEW

In 2010, a new brand was formed and lasted and developed up to now.

When the market is more difficult, the method is on the throne, in the narrow door of the market there are many names and they are vying for the minds of customers every day, if you do not have a good enough and long-term competitive strategy, you will lose money.

FINANCIAL POSITION

The reason you refer to business models in the world that are difficult to apply is to create a financial position and create those competitive advantages; people need a lot of comfort, especially cash flow, cash, reserve fund, ability to generate profit or ability to mobilize resources (Capital, people, relationships).PROFIT RATE OF INVESTMENT CHANNEL AFTER 20 YEARS VIETNAM ACCEPTED TO WTO

This rate of return does not include inflation. on average from 3-5%/1 year depending on the time. We will be shocked to find that gold even loses to bank interest rates. Just a tool to keep assets, risky because there are costs to manage at home.HOW WILL HO CHI MINH AND HANOI BECOME FINANCIAL CENTERS?

Is it possible that after 2025, Ho Chi Minh and Hanoi will have fewer traffic jams, the population is not concentrated in big cities, and we will become two financial centers of Asia? The number of millionaires will increase rapidly by 2030 and appear people with a net worth of at least $30 million when compared to neighboring countries in Southeast Asia.WHY WOULD COMPANIES HAVING MONEY AND KNOWLEDGE START A BUSINESS DIFFERENTLY FROM THEIR FIRST TIME?

Companies with money and knowledge will start a business differently from their first time because … they have the ability to see gaps and market opportunities. Doing business with knowledge will be different, starting a business for the nth time (multi-disciplinary investment) will also be very different from the first time.SOME CEOs/FOUNDERs ASK ME WHAT SHOULD THEY HAVE MIND IN THE NEXT YEAR…

Matter generates consciousness. If we lack money, we will worry, even: small things tear up big; big things become huge things. So what to do next year: say something with a smile, understand everything. Exercise, and learn new skills. Cost savings. Whatever can be missed, let them go.YOUR GROWTH DEPENDS ON YOUR SPEED AND ABILITY TO RECRUIT ‘THE RIGHT PEOPLE’

If you consider the product we are selling as the above bullet points related to the employer brand, you will probably find that, if your company wants to be the one worth noting in the market… Take employer branding seriously, seriously and properly.IN THE OFFERING PROFILE, BEYOND THE ATTRACTION OF FINANCIAL STATEMENTS, WHAT ISSUES SHOULD INVESTORS BE AWARE OF?

In the offering documents, besides the attractiveness of financial statements, investors need to understand 4 issues: People, Processes and operational capabilities, Products, Assets: Tangible and invisible.Why do enterprises need to operate based on financial view…

I have read through a shared article on this topic by Mr Phung Le Lam Hai – Chairman, Investment Director of Equitix Investing, the reason is that… businesses need to clearly separate effectively their businesses and understand the basics nature of costs.“Definition” of good culture

Lack of people, folding people is compromising with standards, recruiting and rushing; meaning the pain and experience are not big enough to feel the different levels of importance of the culture. If understood deeply, culture is the most important for a large self-run organization – more important than your profit strategy…Don’t let your employees fight 2 battles at the same time in your business

Employees fight 2 battles at the same time: Competing for market disputes, gaining the trust of customers as well as fighting more toxic internal battles and mental fatigue. “For consensus and compliance, tools only take 40% and communication still accounts for 60% of your efforts.”The bottleneck of the Enterprises and their teammates…

When Mr. Lam Hai entered the Enterprise to apply his high-level knowledge and discovered that the Founders did not understand why to do and practice complicated things like so. He discovered that they did not yet understand professional management and happy leadership.5 levels of self-confidence of CEOs and employees

Confidence is a positive self-image, self-image is a must-have mental positive image for CEOs or their staff.

Two keywords to describe this capability are ‘the real person CEOs are’ and ‘the person CEOs aspire to be’. Many CEOs have a goal to bring ‘what they are now’ and they tend to build and become the person they ‘want to be’.

How important is market research?

Small and medium businesses or startups naturally want to do market research, want to get the right customer insights, really want to know what their consumer customers need and want. However, with Market Research, it is difficult to get really good resources, expertise and market experience.

The risk of not understanding finance when starting a business?

Have you ever wondered about the product that you put in effort, effort and investment with sweat and tears, but the result you get is… “Doing a lot but not having much?”. The result of a time series of investing effort and money, ultimately discovering ‘no profit’. Even many business owners make more and more losses without knowing why.

Is vision, mission and culture important?

How do you rate the importance of Vision, Mission and Culture in business? Do they sound abstract and have little to do with business? I don’t think so, vision, mission and culture are essential elements for your business. There are things that don’t generate sales right away, but are essential for building trust. If you have faith, you can sell…