SHIFTING THE OPERATIONAL FOCUS BASED ON FINANCE AND ASSET MANAGEMENT

What is ETA? ETA (Entrepreneur through Acquisition) is a philosophy of becoming a business owner and company operator through equity acquisition and enhancing the value of the invested company. This includes building and shaping a Core Competitive Business Model, developing Operational Excellence, and applying Technology Transformation to help the company achieve its Growth Strategy aligned with the stock price appreciation plan of shareholders/ownership groups.

ETA emphasizes the Synergy capability with various resource ecosystems and stakeholders from different contributing shareholders, rather than solely operating within a family-run ecosystem where only family members manage and govern the company. Of course, we do not deny the necessity of certain key positions being held by family members with sufficient competence, assessed through a standardized Talents Management & Individual Performance Review system within our company.

ETA faces the challenge of harmonizing (Combination) culture, innovation, and Leadership & Management Style with companies that have been in the market for an average of 8 to 10 years. This is different from founders who have built the company from scratch, as the founding leadership team often plays a crucial role in providing Soft Power and Core Belief, which fosters trust among long-term company members.

ETA synthesizes knowledge, processes, methods, insights, and know-how from global practices and the local Vietnamese environment through Restructuring, equity transactions, Mergers and Acquisitions (M&A). From there, we innovate and tailor the approach to suit Vietnamese local enterprises. This enables us to inherit the strengths built by startups in past years while simultaneously creating and customizing elements to transform these startups into professional companies with an Internal Control System based on standards to uncover specific competitive advantages, Key Success Factors for replication, and the highest standards in Governance and Business Management to serve the interest of Asset Growth for Equity Holders.

ETA typically undergoes three stages:

-

Opening training on methodologies and case studies we have implemented from 2019 to the present.

-

Restructuring according to new operational standards after the company leadership has thoroughly understood stage 1.

-

Investment, fundraising, and accelerating asset growth for the company we engage with.

Challenges during the restructuring/investment phase: Business activities in this stage are understood as a collection of processes that not only generate profit but operate continuously in a cycle (Procurement of raw materials – Production – Accounts payable – Sales – Accounts receivable – Depreciation – Continuous procurement). These involve ongoing reinvestment.

If we cease operations, divest, pivot industries, or discontinue production processes, the company and the ownership group may not achieve profits or returns that meet financial and economic criteria compared to other market investment or business options. Therefore, industry benchmarks (Financial Benchmark) are needed to compare and evaluate:

-

Return on Assets (ROA): Evaluating whether the company is efficiently using all its assets.

-

Return on Equity (ROE): Assessing if shareholders are gaining better investment returns compared to other financial opportunities.

-

Financial Leverage: Determining if the leverage ratio for business operations is within a safe threshold.

-

Weighted Average Cost of Capital (WACC): Evaluating whether the cost of various types of capital (Debt, Loans, Bonds, Venture Capital) aligns with the company’s long-term profit-generating capacity. Otherwise, the rate of return may be insufficient to cover interest expenses/capital costs.

This is considered after accounting for all costs in a competitive market environment while excluding unfair competition practices (e.g., pricing) or when the company lacks specific Competitive Advantage.

When a company lacks specific competitive advantages, its asset value becomes non-sustainable, non-accumulative, and non-replicable from an asset management perspective for the ownership group. They may opt for more suitable alternatives in the market.

Therefore, the company’s EBITDA is only considered valuable profit if it generates surplus to distribute to shareholders, known as Free Cash Flow to Equity Holders (FCFE) – the free cash flow available to shareholders after deducting working capital and reinvestment for the next business cycle.

These accumulated profits (Accumulated Profit) grow over time through business operations, increasing the company’s assets and influencing share prices during each valuation and equity transaction round in the context of private equity before listing.

Under normal supply-demand conditions, when the number of issued shares increases insignificantly, but the company attracts investors interested in acquiring its equity, the company’s asset scale and valuation increase.

As a result, all Business Decisions are not only aimed at generating profit or maintaining positive cash flow but also at proving to shareholders that their assets are growing through investment in the founders’ company.

Consequently, Asset Management emerged as the company’s asset scale surpassed the threshold where only a few exceptional individuals or groups could manage it. A system of financial-accounting rules and standards became necessary to prevent loss, fraud, or false profit/loss reporting, while also enhancing Transparency in management and post-Audit information disclosure.

ORGANIZING THE COMPANY OR CREATING A STATE OF READINESS FOR EFFECTIVE ASSET MANAGEMENT VISION AND INCREASING ASSET/EQUITY LIQUIDITY FOR SHAREHOLDERS BECOME MORE IMPORTANT OBJECTIVES FOR FOUNDERS/CHAIRPERSONS.

Therefore, when companies reach a sufficiently large asset scale (multiple business models, subsidiaries, and core business branches that create a differentiated competitive advantage), the operational focus shifts from profitability (EBITDA) to effective Cashflow Management and Asset Management through sound financial decisions.

At this stage, finance – accounting and international financial standards become the main drivers of company operations and development.

Equitix helps founders restructure their companies according to investor due diligence standards under the ETA (Entrepreneur through Acquisition) philosophy as well as financial-accounting norms and standards to facilitate fundraising or equity conversion.

This means that companies must prepare to operate as professional joint-stock companies, considering that most companies in Vietnam are family-run businesses or limited liability companies (LLCs) with simpler operational regulations.

The question is: how can operations align with buyer requirements and professional institutional investor insights?

And if governance activities do not ultimately produce an outcome in financial reports that reflect data recognition, asset growth rate, or asset growth forecasts, then transitioning or restructuring the company becomes meaningless.

Equitix Investing Will Help You – Equitix Investing’s Approach:

-

Discussion to clarify asset management and restructuring goals

-

Ensuring alignment with professional investor due diligence criteria before capital injection.

-

After discussions and an initial assessment of the company, Equitix will outline key opportunities, challenges, and goals the company aims to achieve in optimizing asset management.

-

-

Example/Objectives Illustration:

-

Building an efficient management and governance system for distribution chains or networks.

-

Developing market expansion and talent strategies for international expansion by 2025.

-

Structuring financial and investment strategies: Board of Directors, internal control, and subsidiary asset efficiency.

-

Establishing a competitive strategy and structured capital approach for market entry and expansion.

-

Developing a talent strategy.

-

Equitix’s Engagement Process:

a) Internal Survey and In-Depth Interviews (ETA Approach):

-

Interviews with the leadership team, functional directors, and department heads (1-on-1 in-depth interviews).

-

Group interviews with 5-6 employees per session across various departments.

-

Delivering a readiness assessment report covering:

-

Work environment and culture

-

Team and personnel

-

Processes

-

Detailed functional reports

-

Technology

-

Finance & Accounting

-

-

From this assessment, financial insights will cover:

-

Strengths

-

Weaknesses

-

Opportunities

-

Challenges

-

-

Evaluating how internal strategic factors can respond effectively to external opportunities.

-

A 50-70 page detailed report will be provided, outlining the company’s current state and prioritized actions for founders/CEOs to focus on.

b) Business Strategy – Corporate-Level Strategy under ETA

-

Based on the internal assessment in (a),

-

Equitix collaborates with founders to define a clear business strategy and specific actions for both short-term (financial year) and long-term growth (split into three phases with specific goals).

-

Tools used: SWOT, IFE (Internal Factor Evaluation), EFE (External Factor Evaluation), IEM Matrix (Strategic Positioning), CPM (Competitive Assessment), and action selection over multiple years; and short-term actions within 6 months – 1 year.

c) Functional Strategy – Financial Alignment:

-

Aligning company business strategy with financial planning and ensuring BOD/key leaders have consensus.

-

Creating a financial budget plan for the fiscal year to understand the big picture and required resources.

-

Long-term financial planning (5-8 years), including working capital, capital usage, and company valuation projections.

d) Board of Directors Formation:

-

Establishing organizational and capital structure for a professional joint-stock company: Chairman, Board Members, Shareholders, stock issuance, options, ESOP.

e) Internal Governance System Development:

-

Detailed operational budgeting with CFO:

-

Product strategy using the GE Matrix to assess product lines concerning cash flow goals and inventory turnover.

-

Workforce planning, budgeting, and international-standard talent development strategy.

-

Business, sales, and marketing plans.

-

Supply chain, R&D, and production plans.

-

Technology, ERP development plans.

-

Capital mobilization, working capital management, banking, investor, and shareholder relations plans.

-

Competitive positioning strategy development.

-

Company profile preparation for stock issuance rounds.

-

f) Compensation and Performance Management under ETA:

-

Defining processes for all departments.

-

Compensation and performance management using the 3P approach: Position, Person, and BSC-KPI.

-

Developing a competency dictionary and structured seven-level career progression path.

-

Training and coaching for middle/senior management.

-

Optimizing job performance at all levels and improving overall company productivity.

g) Building the Company Investment Memorandum:

-

Objective: Continuous fundraising across multiple investment rounds based on future cash flow projections supported by historical growth data.

-

Describing company products/services, past investment deals, and achievements.

-

Defining customer pain points and product/service solutions.

-

Value proposition for customers.

-

Timing: Why now?

-

Market size and potential (TAM, SAM, SOM).

-

Direct competitors.

-

Product/Functionality.

-

Business model.

-

Team.

-

Financials: Financial statements and capital structure.

CASE STUDY: FMCG – LOGISTICS – DISBURSED 1MIL USD IN 2017

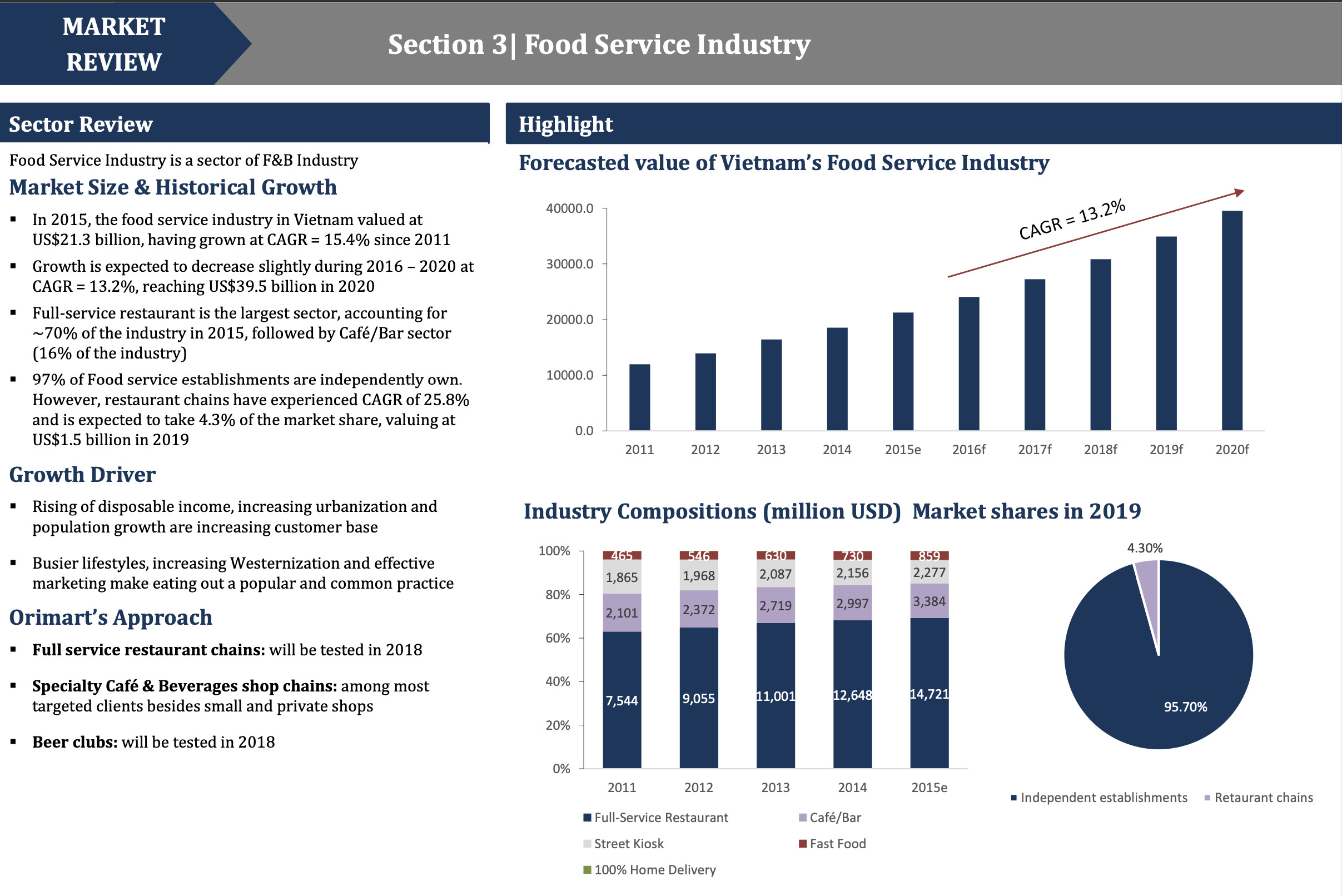

1. MARKET SIZE ANALYSIS

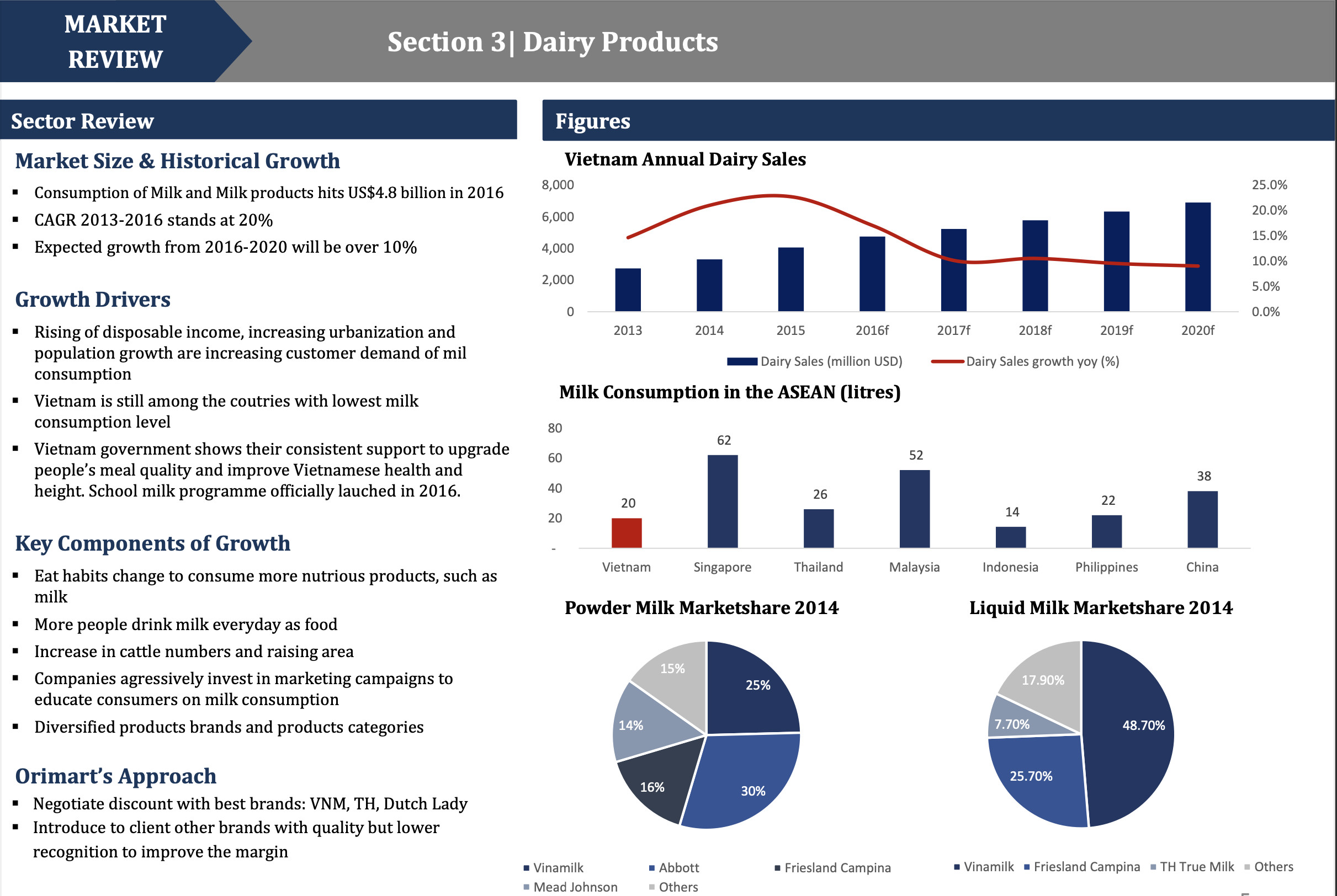

a) Dairy product

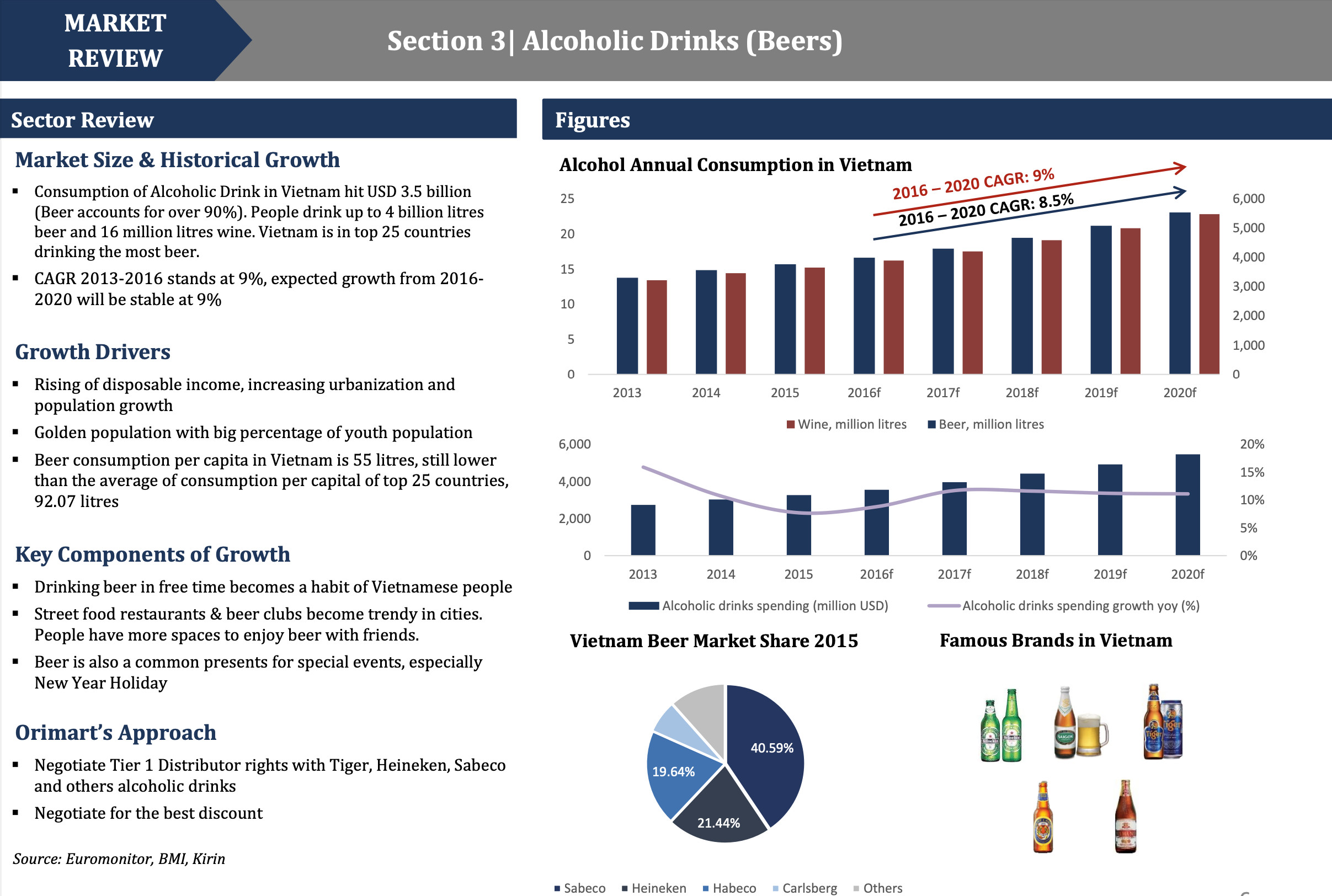

b) Alcoholic drinks

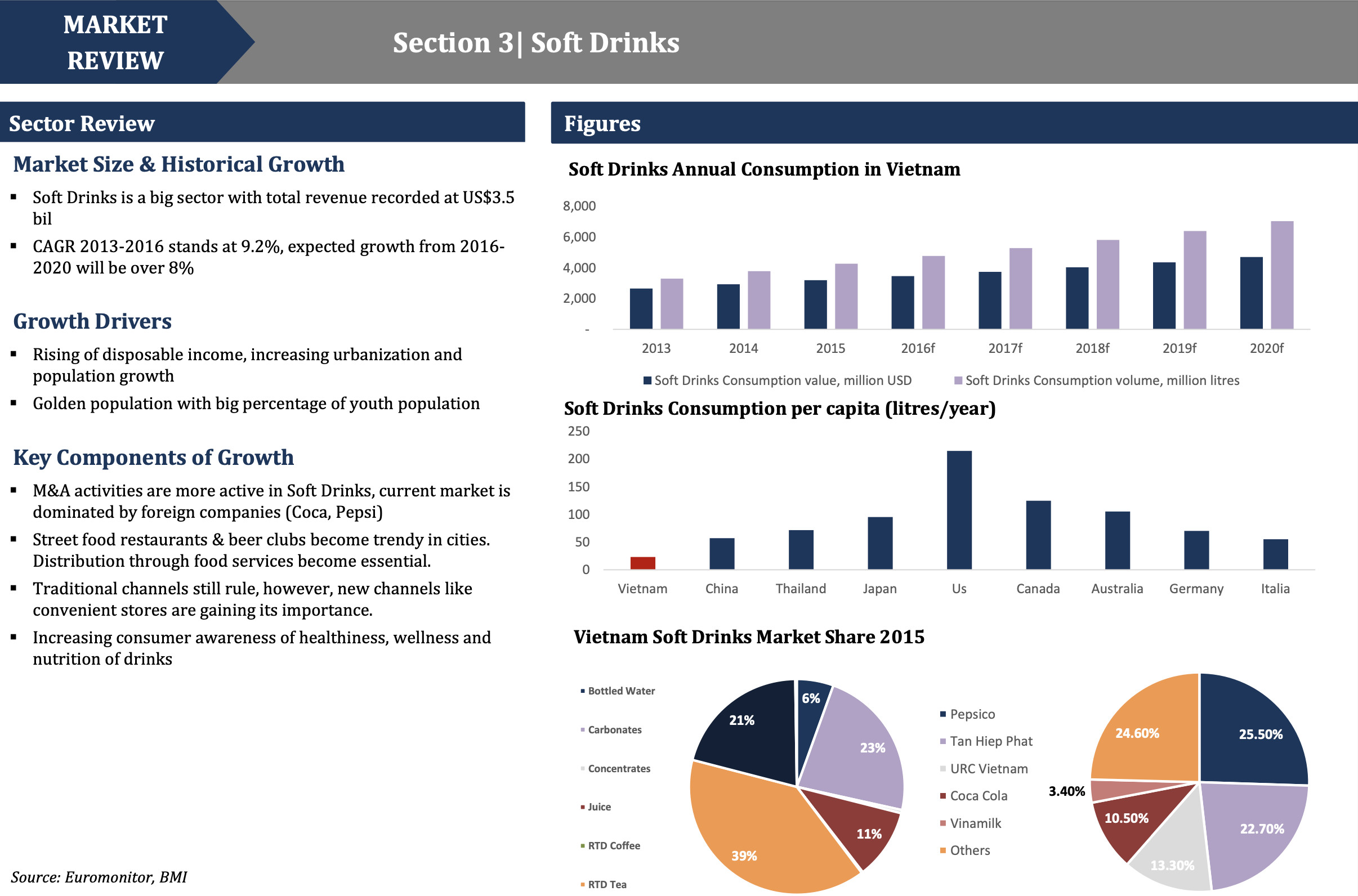

c) Soft drinks

c) Soft drinks

d) Food service

d) Food service

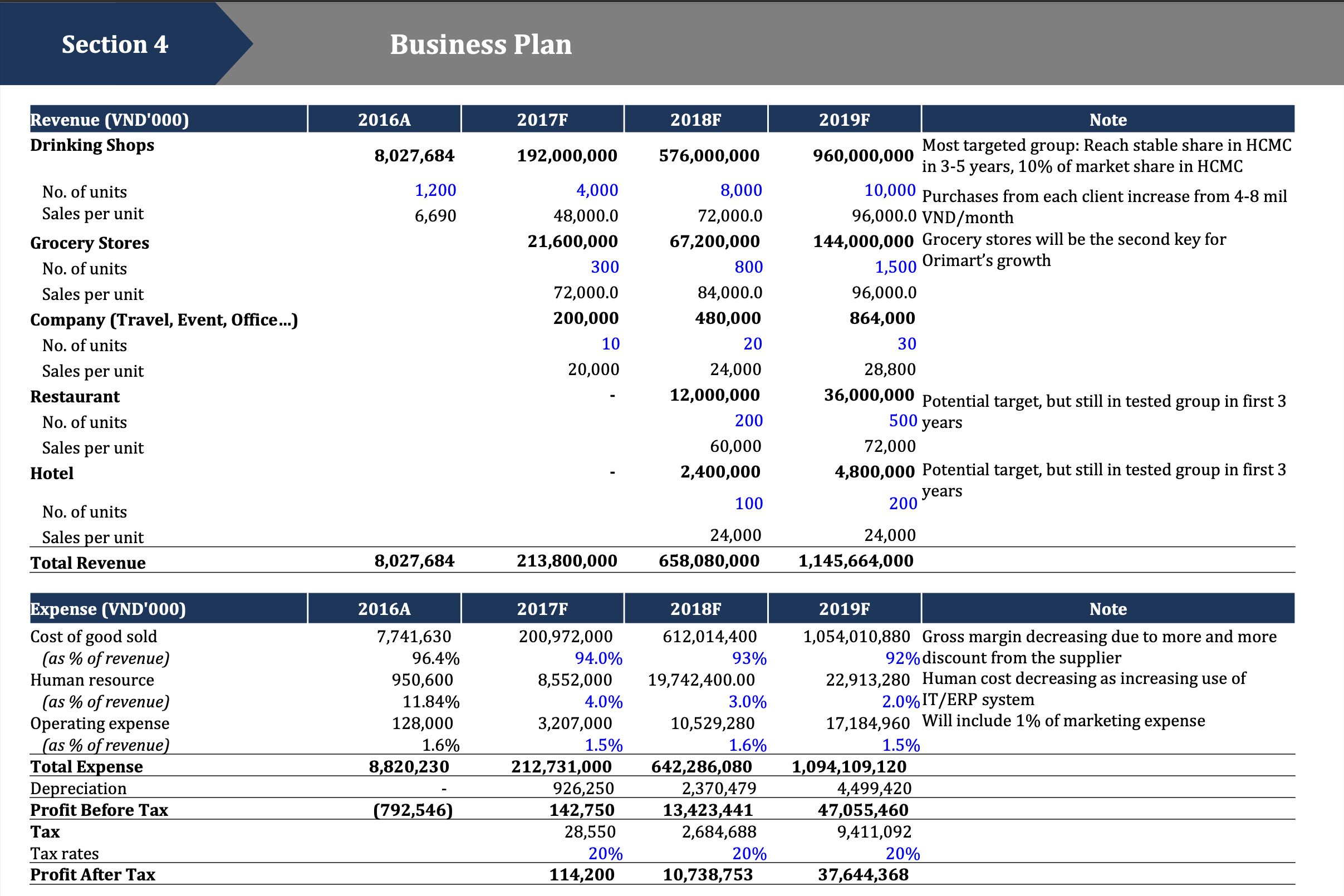

2. Business plan for the next 4 years

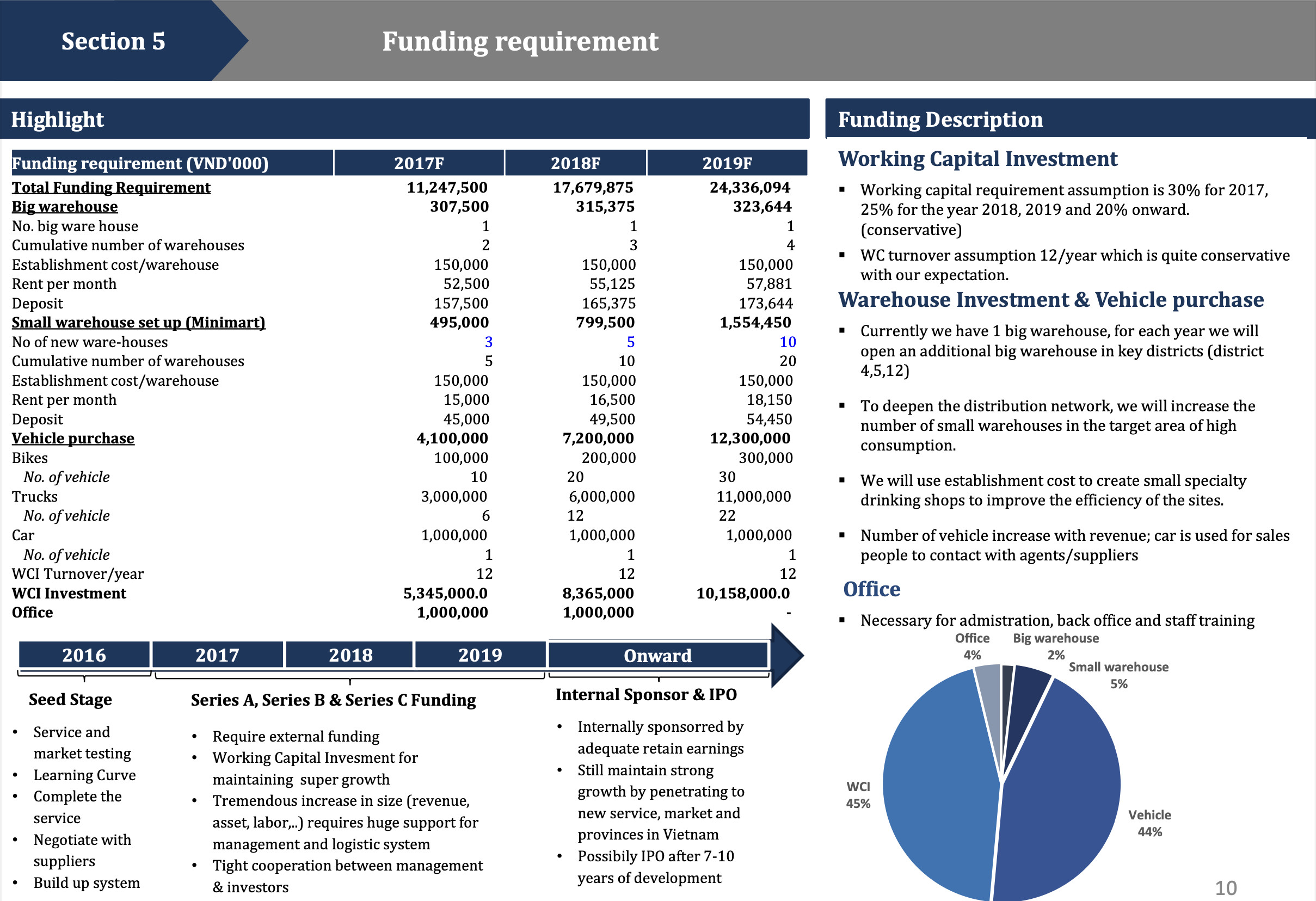

3. Capital requirements and utilization plan

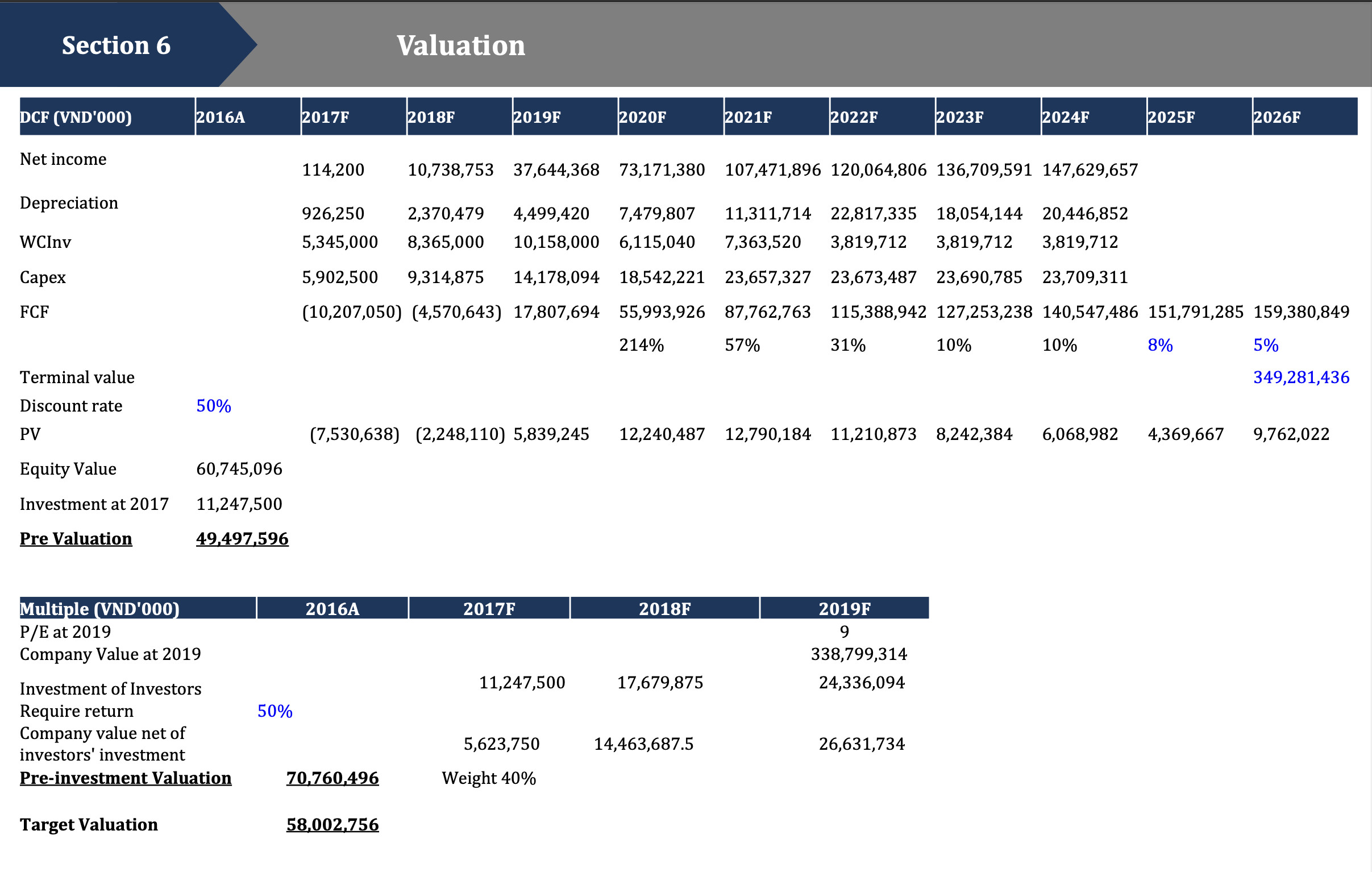

4. Valuation

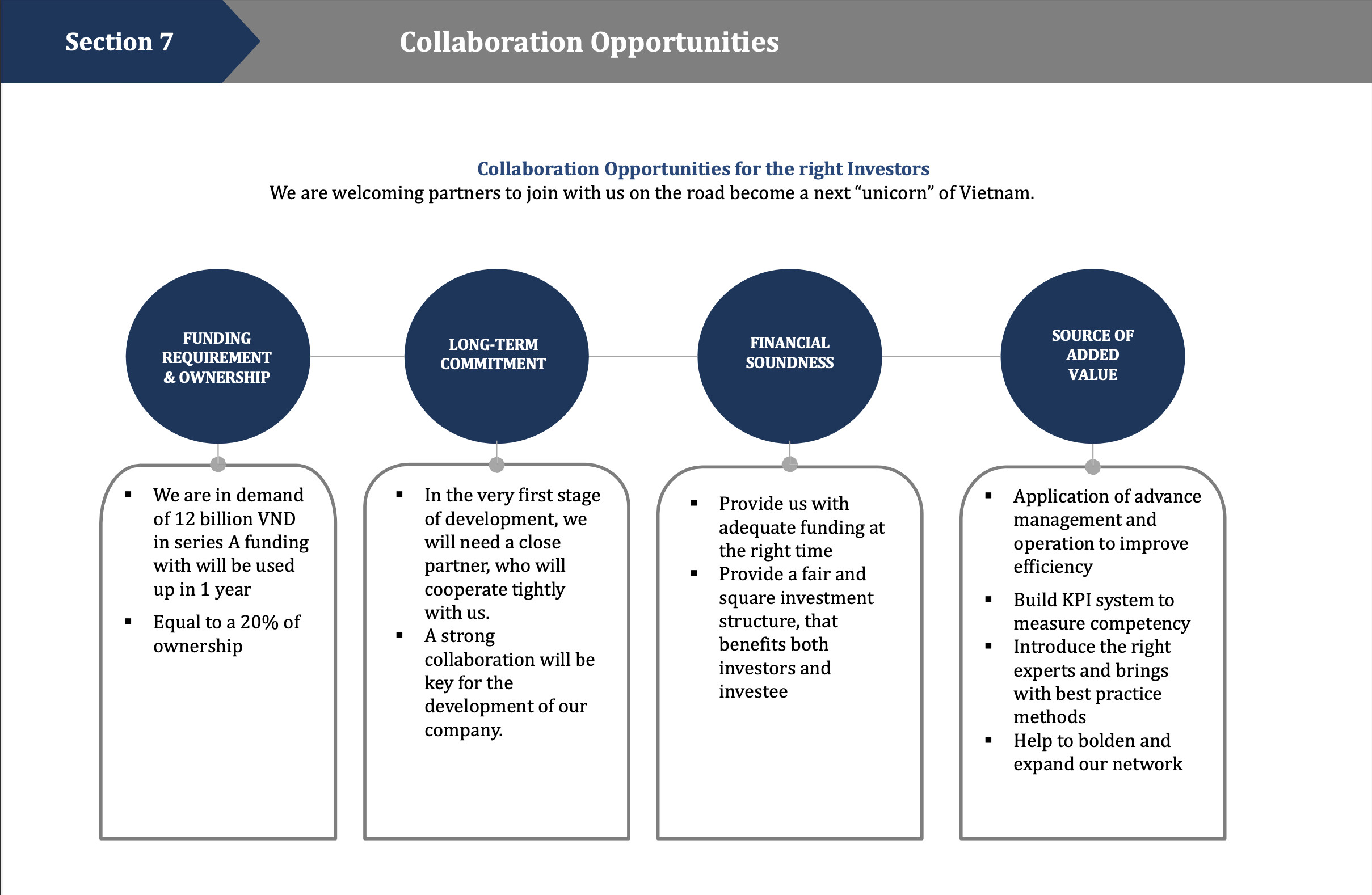

5. cooperation opportunities and investment proposals with institutional investors

5. cooperation opportunities and investment proposals with institutional investors

Deal – Size: 1 million – 50 million USD depending on specific requirements:

Within 6 – 9 months, Equitix & Partners will introduce 6 – 20 potential investors with pre-existing demands for share acquisition and equity purchase from founders, based on the following criteria: Industry, investment ticket size, budget, acquisition ratio, investment criteria, and investor information. Equitix will also prepare all legal and financial documents to execute the investment transaction, including fundraising or full company sale if founders desire.

The demand will depend on the proposal and preferences of the seller, as well as the current status of the company.

Restructuring, maximizing company value, and finding suitable investors with large budgets and professional investment expertise are the strengths of Equitix.

h) Tax settlement and building sustainable relationships with government agencies. These are the tasks that Equitix can support founders with, under the capacity of: Board Member, Supervisory Board, optimizing most departments, reporting directly to the Chairman/CEO/BOD.

If Equitix and the founder reach an agreement, Equitix will carry out specific meetings and tasks as follows:

-

Task list with detailed timeline.

-

Non-disclosure Agreement/Confidentiality Agreement.

-

Investment Agreement and Memorandum of Understanding (MOU) between both parties.

Need support today? Contact Equitix.