If you prefer stability, that’s fine, just grasp these 5 rules and live comfortably. If you aspire to leave a legacy, then you should learn from us.

We, founders, encourage our management team to learn about money in great detail as we’re afraid they’ll fall into financial traps and… distance themselves from us or lose focus on the company’s core business.

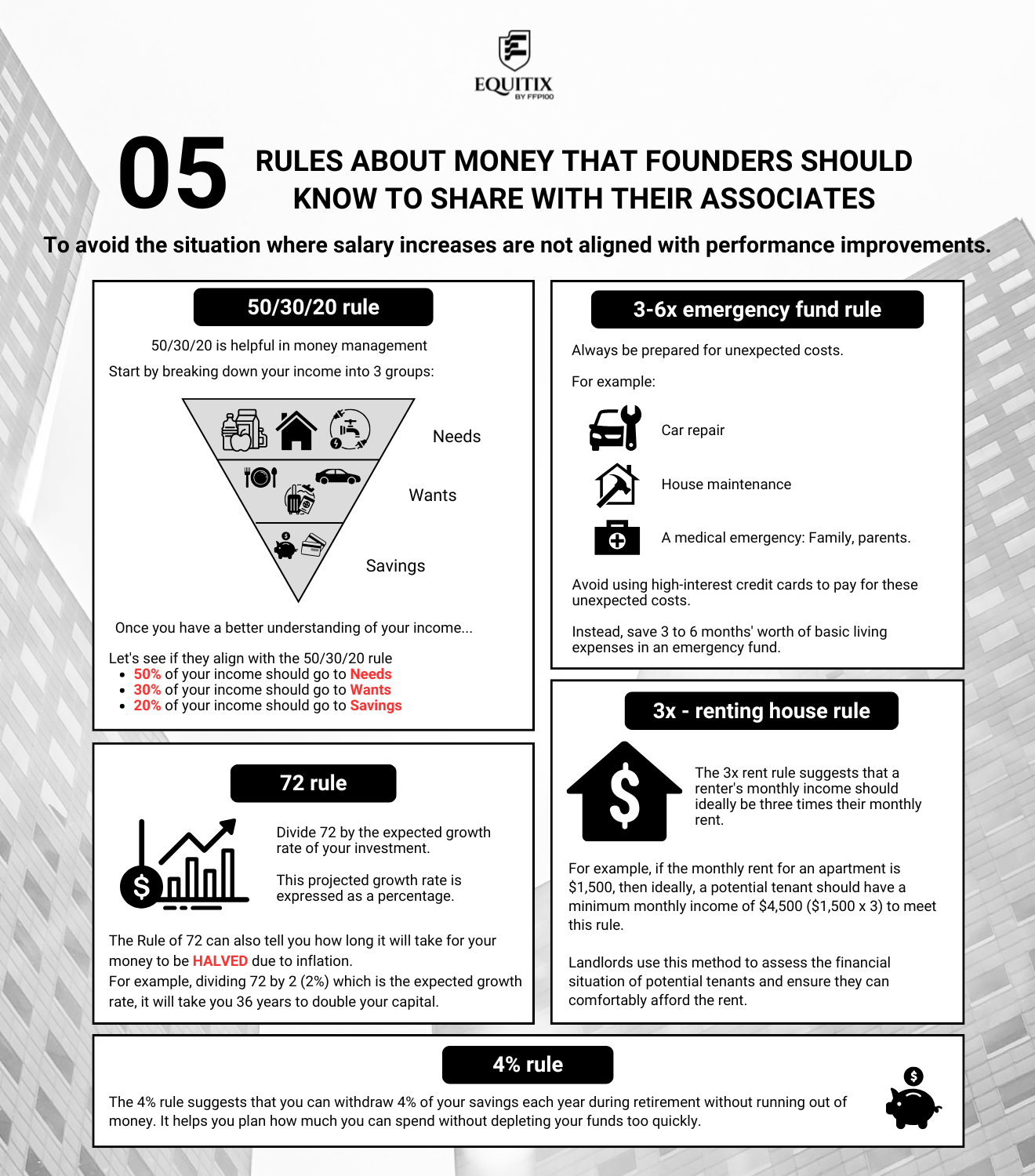

If they don’t understand money, they’ll be controlled by it. Here’s what they need to know:

- What is money?

- The history of currency.

- Medium of exchange/community trust.

- Goods and money.

- The gold standard.

- The US dollar and the role of the Fed.

- The role of central banks in issuing currency.

- The nature of money and labor.

- How to make money/Comparing the value of people to convert it into money.

- How inflation affects income, especially Gen Z.

For those at the executive level who have purchased company shares, the learning is more complex, tailored to their level:

- The money cycle involving the central bank, commercial banks, lending, payments, money management, and debt repayment.

- Financial crises and lessons learned from historical crises.

- The nature of the financial market – The Zero Sum Game.

- The difference between wealth management and asset management.

- Travel trends: The Middle East, US, Europe, Japan, are shifting assets and money to Southeast Asia.

- What are BRICS and G7?

- Petrodollars, indirectly indicating the power of the Fed – Independent operation.

Calculating the value of your money:

- How to calculate inflation for different cash flows and the depreciation of currency each year.

- Rate of return/interest rate/lending rate.

- Present value of money/Future value of money.

- Risks for money and business managers.

If a manager of yours exhibits a tendency to bargain and demand while their abilities don’t match, assume they haven’t truly understood the nature of the money they hold. If they don’t understand the fundamentals but are indirectly pressured by the waste caused by real estate, leading to an inability to live, spend, and buy a house, believe that they will… continue to demand.

For your close managers, bring them closer to your zone of understanding and your areas of expertise so that you can progress together.

Financial language is the language of business owners – Founders/Entrepreneurs.