I’ve shared a lot of case studies, and people have learned from the style, data, and presentation. Some founders have started to realize the need to be extremely confident in what they plan to share with potential investors.

They’ve reached out to learn systematically and to solidify their practical experiences with solid theoretical knowledge. This is to have a more comprehensive, systematic, and investor-centric approach.

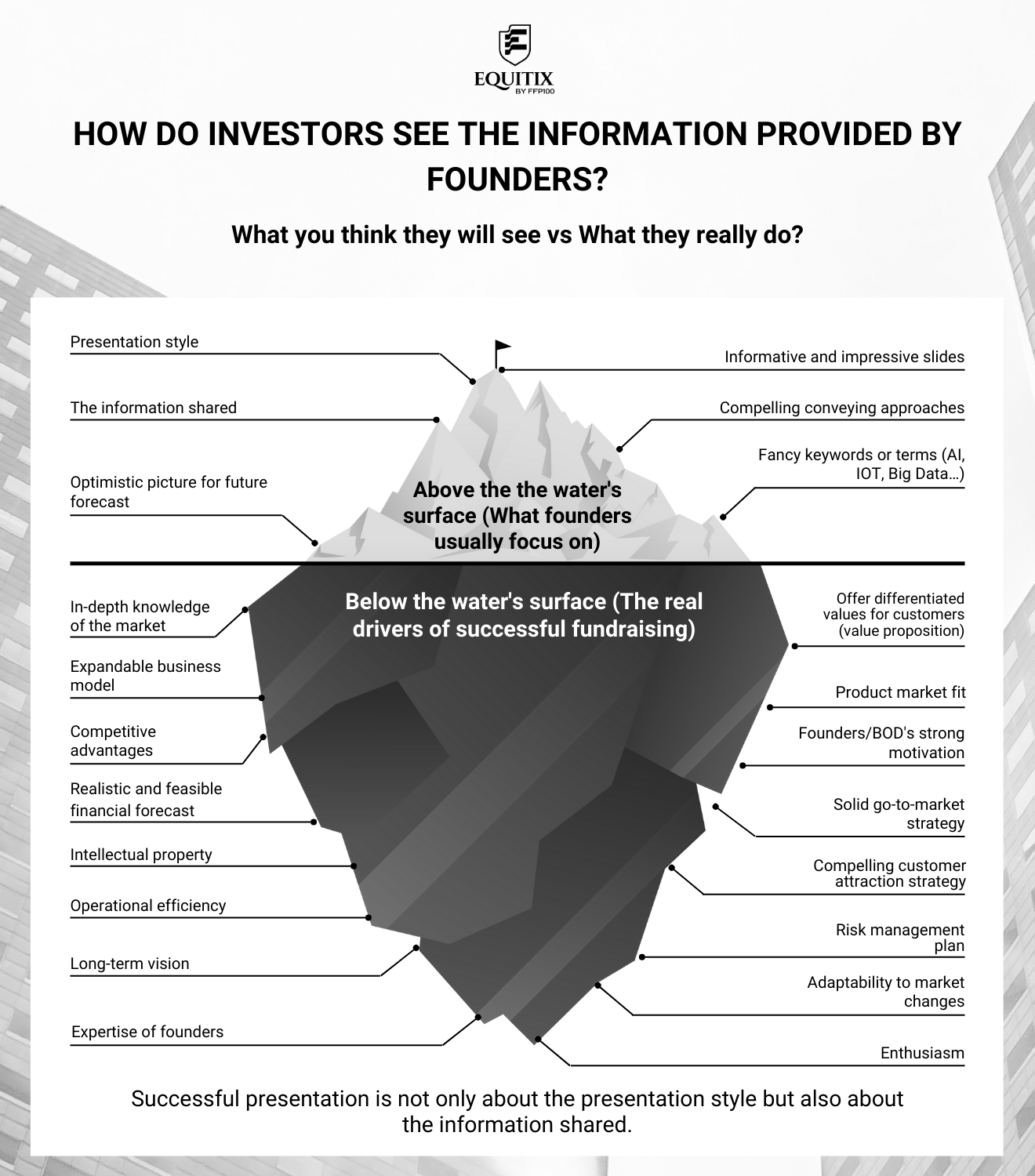

Indeed, the tip of the iceberg is always the easiest to see. The hard-to-see part requires us to dive deep into the company’s internal workings to discover and illuminate everything.

I’ve met more than 90% of founders who are great at execution but lack a strong foundation in theoretical knowledge. They struggle and their journey to scale is still far away.

To scale up, one must have a very good grasp of theoretical knowledge and apply it to practical situations to deeply understand all issues before engaging with investors.

“Practice leads to understanding. Understanding creates theory. Theory guides practice.” – Ho Chi Minh.

Founders must master both the theoretical and the practical to go far and go right.

Example: FPT.

A founder who only masters one of the two will struggle in the upcoming competitive phase, despite many opportunities.

Whether it’s easy or difficult depends on our approach and mindset.