A founder making USD25mn/year (VND627bn/year) asked me:

When building an empire focused solely on personal and family assets, your associates will gradually mature and they have 2 choices:

- They choose to leave when they’re fully capable to become their own bosses. Regardless of whether they can succeed or not, one thing is for sure… they will still try. They might also… return to the company in the future when they find themselves unsuitable for business, as long as they still have talent (a) and the business still needs them (b) and the relationship between the two parties is still good from when they left (c), then this can happen. Otherwise, if they succeed, then congratulations to them.

- They choose to stay, and most of those who stay tend to be stable and don’t like to develop professionally or take on more responsibilities in their work, or they don’t tend to improve their management skills as the company’s scale grows.

In addition, Digital transformation and AI will gradually change the workforce with weak skills, weak desire to develop, with the pressure of employers having to reduce operating costs, and production costs in the context of the average salary and living standards of Vietnam increasingly demanding and requiring higher due to inflation pressure and deep-rooted real estate waste. Therefore, most business owners at this stage are quite tired and stressed with personnel because most of this group number 2, leading to the company finding it difficult to grow, because the most headache is… people.

The difficulty is: Not willing to develop but still demanding… a raise.

But going back, if the group of people that the owner wants to retain are those in group 1, then the vision of the chairman/group of owners at the upper level must be long enough to last for generations, so that they don’t have to pack their bags and go to another environment, or be forced to devote all their intelligence to serving another empire that is not their old boss.

The solution is to corporatize the company.

Improving the company’s governance to enable the company to expand further

- To expand further, we need more people, shareholders, and board members with real capabilities and a team to support us.

- Share this vision with employees so they can become a part of the company through an Employee Stock Ownership Plan (ESOP).

- As well as expanding the company’s governance structure when the company’s scale is large enough, there will also be successors to continue the founders’ vision.

- The group to which we issue ESOPs, we should also have entry criteria and they must be a group that has made many contributions and has been with the company for many years.

- The company has enough room in the market and the vision for the strategy to be feasible.

- How to do it? There will be many ways as long as the founder/chairman has the vision and the desire to do it first.

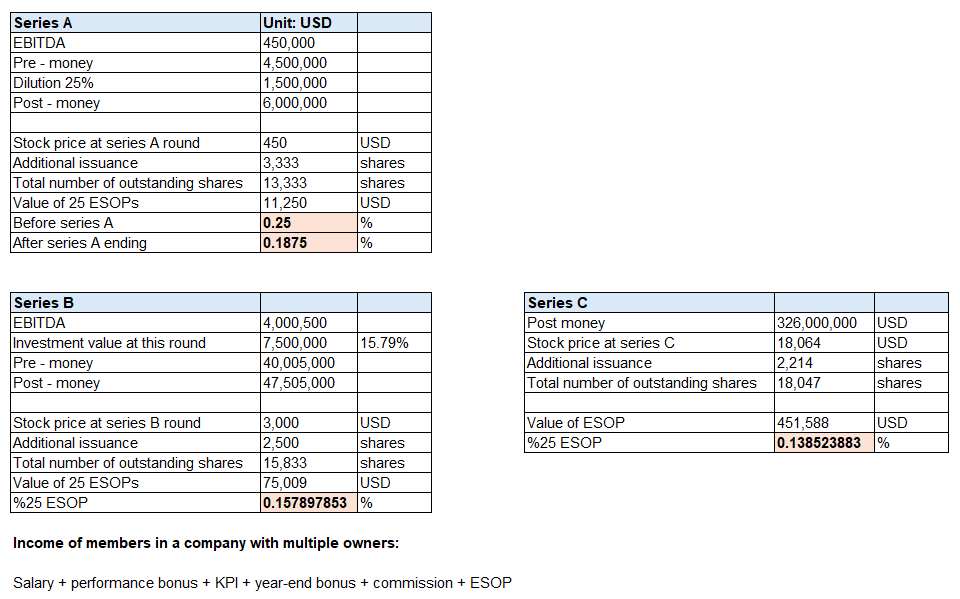

Example of an employee having received ESOP

- An employee received a preferential purchase price and a gift, totaling 25 ESOP shares with a total outstanding share count of 10,000.

- These 25 ESOPs have gone through 3 funding rounds.

- From owning 0.25% which was diluted to 0.1875% in Series A, 0.15789% in Series B, and 0.1385% in Series C.

- However, the value increased from 450 USD, 3000 USD, and to 451,588 USD.

- After Series C, the company’s valuation was recorded at USD326mn ~ VND8,182bn upon completion of the investment.

As long as this person believes in the leadership, the company’s vision, and observes that the company is expanding, developing, and fulfilling what the owners have promised, it’s because the company has the ability to manage shareholder interests (financial and legal benefits) through rounds of fundraising.

So will be able to buy a house and own a car, at the very least a Mercedes E-Class or better.

Of course, not everyone should be given ESOPs. Those whose worldview is still limited to basic necessities should not be brought into this picture. It should be for long-term members of the company or those who express a desire for long-term commitment.

If we focus solely on our family’s assets, there is nothing wrong with that, but the challenges of succession planning and governance will be much more difficult due to the human factor.

When the company has multiple owners – F1, F2, F3 – they also have a better opportunity to learn and grow through the company’s journey of development and expansion with other pieces and resources.

For young founders, early planning will make the future restructuring of their family/clan much easier and more pleasant.

Equitix is currently offering intensive courses on management, administration, and a deep understanding of business through a financial lens specifically designed for Founders. Here are the details for September’s online courses:

a) Course 01: Finance & Accounting for Non-Finance Founders

-

- Objective: Learn to communicate effectively with the accounting and finance departments and understand the language of investors.

- Duration: 10-12 sessions

- Fee: VND9.9mn. A 500,000 VND coupon is available for early bird registrations (before 2.9) when registering for 2 or more people.

b) Course 05: Operations, Organization, and Business Management Based on Financial Planning

-

- Focus: Managing business based on sales, costs, and profits

- Duration: 8-10 sessions

c) 1:1 Finance Consulting with Case Studies and Company Data

-

- Customized: Tailored to the specific needs of each founder based on their business model, accounting data, and challenges.

- Duration: Evenings (15-18 sessions)

- Fee: Determined after a one-on-one interview based on the complexity of the case.

d) Mentoring for F1, F2, F3 – Asset Management

-

- Customized: Tailored to the specific needs of each founder based on their business model and commitment level.

- Duration: Minimum 12 months, 48-52 sessions

- Fee: Determined after a one-on-one interview.

#equitix

#phunglelamhai

#Lucas

#ESOP

#founders