Case overview:

- 15 shareholders: The company is owned by 15 individuals, with the founder holding the largest share, 36%.

- 14 other investors are members of the BOD and specialized departments.

- Funding round: A new investor is planning to invest in the company through two methods: increasing the company’s capital (equity financing) and buying shares from existing shareholders.

Capital increase:

The company’s pre-money valuation is 3.6 million USD (approximately 91 billion VND).

With a 25% capital increase valued at 1.2 million USD, the post-money valuation becomes 4.8 million USD (3.6 + 1.2).

The new investor will own 25% of the company (1.2/4.8). Therefore, after this capital increase, the total ownership of the 15 existing shareholders will be diluted from 100% to 75%.

The founder may lose motivation if their ownership stake becomes too small, especially if they have to make decisions that benefit the company but may not much benefit them personally.

Secondary Share Sale.

The institutional investor is buying existing shares from other shareholders.

Existing shareholders are valued at book value, which is 20 billion VND.

The institutional investor is valuing the company at 10 times its last year’s EBITDA, which is 9.1 billion VND, resulting in a valuation of 91 billion VND.

For example, if a shareholder owns 5% of the company based on the 20 billion VND book value, they would have invested 1 billion VND.

When the institutional investor buys this 5% stake, this shareholder’s percentage ownership will be diluted (less than 5%), meaning the number of shares remains the same but the percentage ownership decreases.

With the same number of shares, the value of this shareholder’s holding has increased to 6.096 billion VND after the institutional investor’s purchase.

Compared to the initial investment of 1 billion VND, the value of this shareholder’s shares has increased by 6.091 billion VND.

The individual investor has a 6x return on investment, however, the company does not receive any additional capital from this transaction.

Future Potential

Currently, the company has a revenue of approximately 90-95 billion [Vietnamese Dong]. It is expected to experience high year-over-year growth in the coming years. With a large untapped market and many competitors exiting the market post-pandemic, the company has the potential to become a 1 trillion [Vietnamese Dong] company in the industry.

- If you were the Founder/CEO, what would you do to retain enough equity for 2-3 more funding rounds?

- How would you convince your current shareholders (who have been with you since the beginning) to continue their journey with the company as it grows from 91 billion to potentially 1 trillion? Who will they be when the company reaches 1 trillion?

- If you need more than 15 million USD for the next 3 funding rounds, how would you explain to investors how you plan to use this money?

- How would you allocate funding across the rounds? Raising too much too soon could dilute your ownership excessively and dampen your motivation.

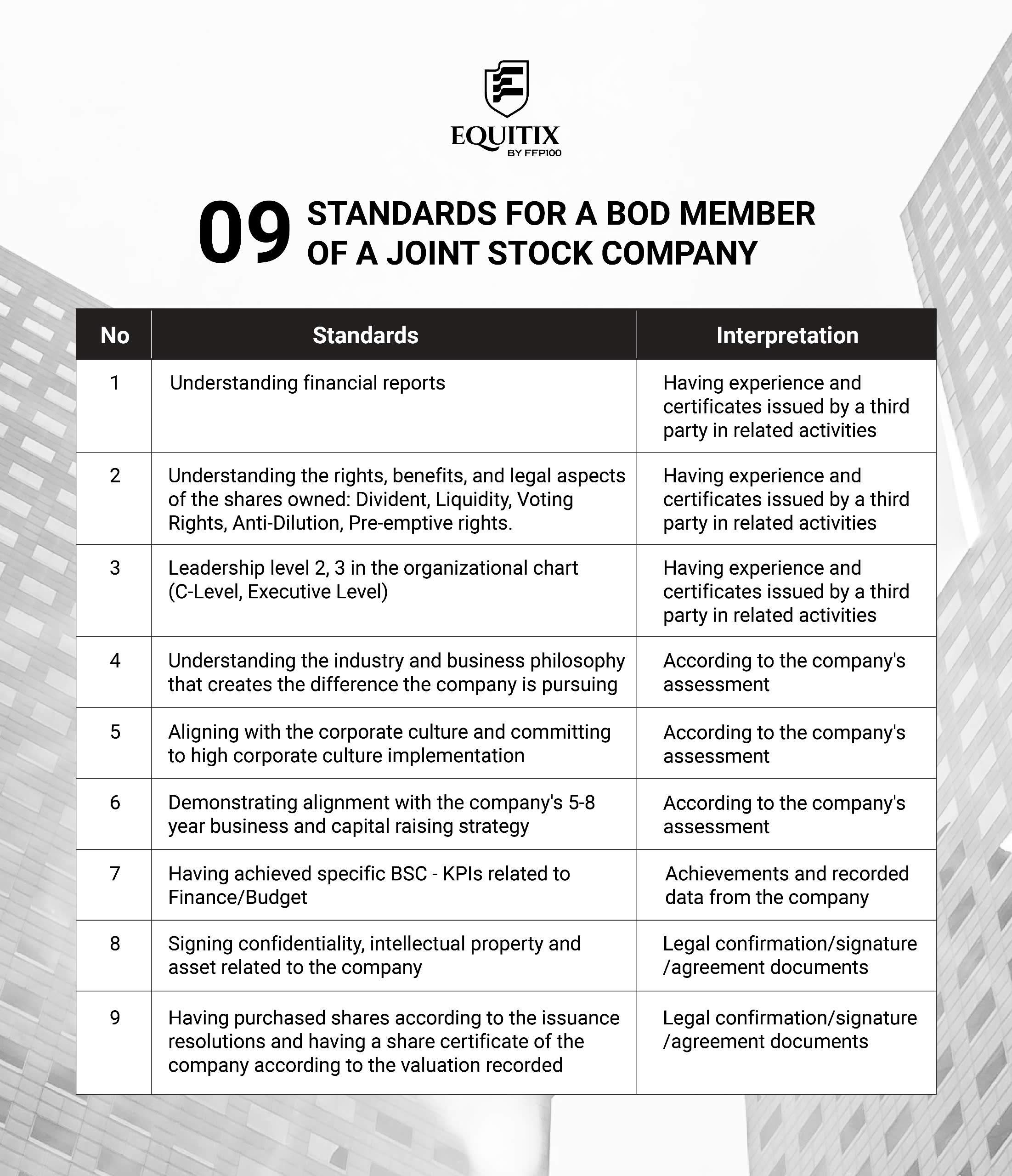

- How would you restructure the board of directors and set operating standards to accommodate professional investors who will join the company in the next 1-2 years?

When inviting someone to join the board, establish clear criteria for board membership. For all other individual stakeholders, ensure they actively contribute to the company’s operations and bring value beyond just capital. Also, set a fixed percentage ownership to reserve space for future institutional investors. There are practices that are standard for institutional investors but require communication with individual investors. Be cautious when inviting or appointing someone to the board and consider the value they can bring to the company.

#equitix

#phunglelamhai

#Lucas

#MnA

#Raising_Fund

#HDQT