SaaS (Software as a Service)

Technology, software, app, Game, non-Game, SaaS are the types of business models that offer super valuations with P/E that can be many times better than the traditional model.

The cradle that produced many dollar millionaires.

But most of the older generation didn’t understand much about it before they… invaded the world.

The old generation, not everyone knows and cares about the younger generation, apart from the useless and unreal trends.

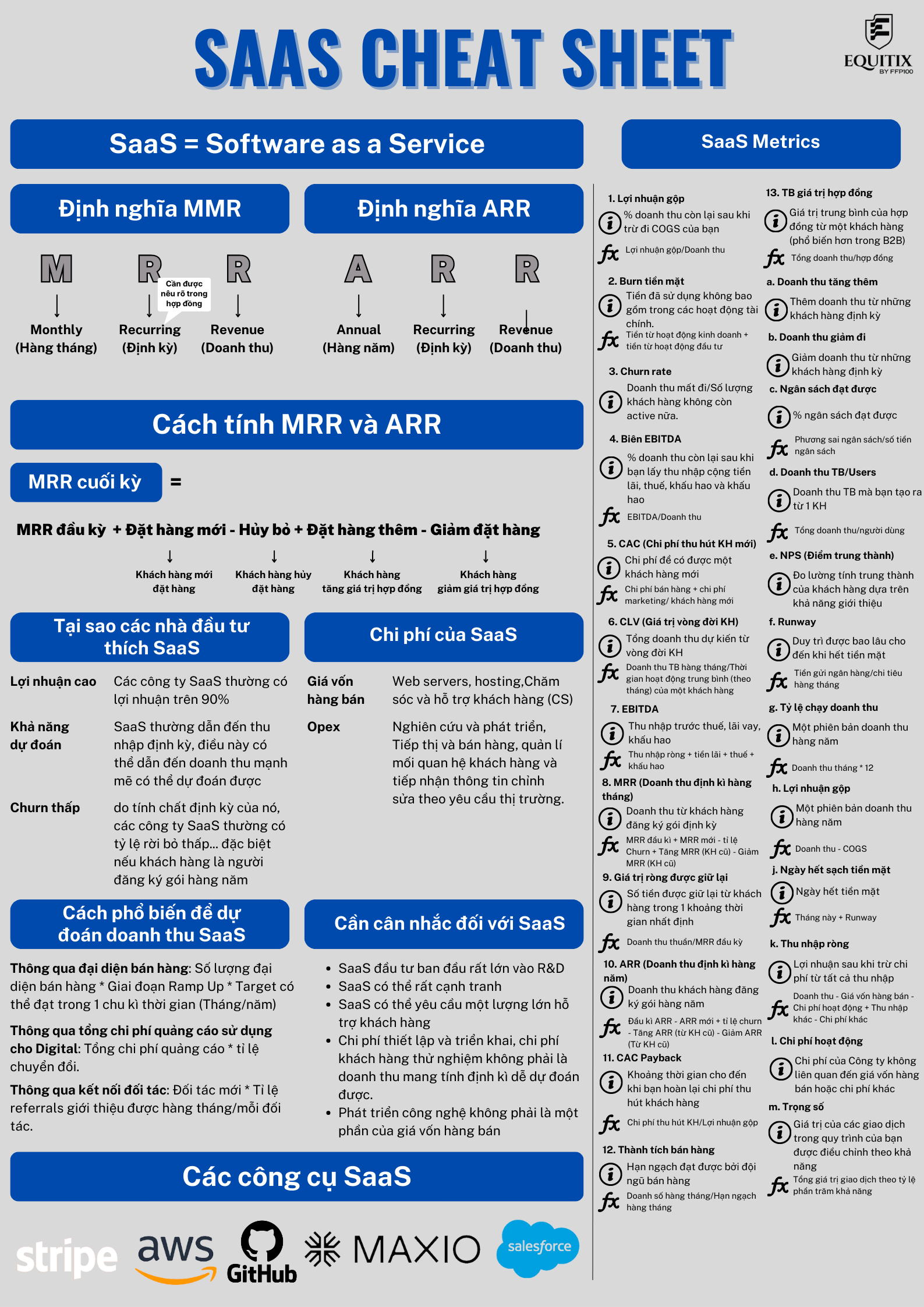

The 25 key metrics of SaaS are also very different from the traditional model.

If the tradition is heavy on accounting and auditing of book value or assets.

Tech companies are very simple in terms of cost structure, get tax incentives (some places) and can xxx many times the assets.

However, the company’s core competence is … raising capital because the initial RnD cost can be 1-2 million dollars.

And very few technology companies after their IPO in the US keep their capitalization or stock value increases after going public.

Almost in Vietnam, there are no priority policies for the technology industry, so tech companies are only headquartered in Singapore because the technology industry is not priced according to charter capital, land or real estate.

The rate of return and IRR can reach 20-35%.

ROI can reach 3x – 10x within 1-3 years.

Appendix:

– SaaS: Software as a Service

– IRR: Internal Rate of Return

– P/E: How much capital RMB are willing to spend to own a dollar of your equity

– Very little hold on to meaningful capitalization minority, not none.